- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

L3Harris Technologies (LHX): Assessing Valuation as Shares Climb on Defense Sector Momentum

Reviewed by Simply Wall St

L3Harris Technologies (LHX) shares have edged higher this week, gaining around 2% over the past month and up about 6% in the past 3 months. Investors may be weighing ongoing momentum in defense sector earnings alongside solid annual growth rates.

See our latest analysis for L3Harris Technologies.

L3Harris Technologies’ share price has gained traction this year, with steady buying pushing it up nearly 40% year-to-date. Momentum appears to be building, underpinned by recent wins in the defense sector and robust total shareholder returns over multiple years.

If defense remains on your radar, you might want to see which other aerospace and security players are making moves. Check out See the full list for free.

With shares climbing and annual growth rates looking strong, the key question now is whether L3Harris Technologies still offers value at current levels or if future gains are already reflected in the price. Is there still a buying opportunity, or has the market fully accounted for its growth potential?

Most Popular Narrative: 13.4% Undervalued

L3Harris Technologies’ last close of $289.39 is notably below the most popular narrative fair value estimate of $334.28. This creates a compelling value gap that investors are watching closely. As market attention intensifies, the assumptions driving this narrative come under the spotlight.

L3Harris is well-positioned in several key growth areas, such as missile warning and tracking, due to recent investments and capability alignment. This is likely to increase future revenue. International demand, especially from NATO allies for advanced communication solutions, is expected to remain strong and support revenue growth.

This narrative suggests a valuation shaped by multi-year growth ambitions and a sector-wide race for new contract wins. Want to discover which forward-looking profitability metrics and ambitious revenue forecasts justify this valuation? Dive into the full story to see the surprising financial assumptions at the heart of this price target.

Result: Fair Value of $334.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain challenges and shifts in federal spending patterns could still disrupt L3Harris Technologies' robust growth outlook in the coming quarters.

Find out about the key risks to this L3Harris Technologies narrative.

Another View: The Multiple Perspective

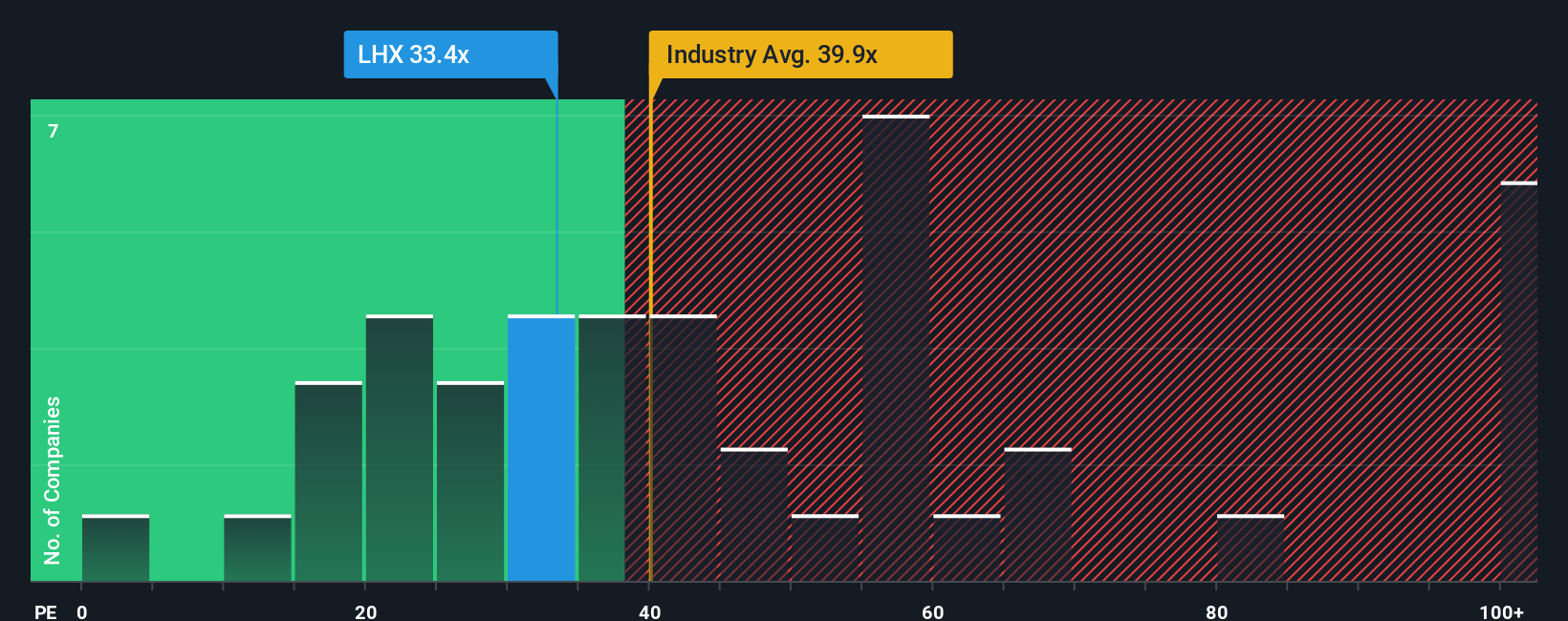

While one method points to L3Harris Technologies being undervalued, looking at its price-to-earnings ratio tells a more nuanced story. The company's ratio of 30.8x sits below the industry average of 38.5x and peer average of 34.7x, but still slightly above the fair ratio of 29.2x. This is a level the market could migrate toward. This creates both opportunity and risk: is the current market discount justified, or could sentiment adjust rapidly if earnings growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own L3Harris Technologies Narrative

If you'd rather craft your own insights or want to dig deeper into the numbers, you can build a personalized narrative in just a few minutes. Do it your way

A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your research stop here. There are plenty more opportunities waiting. Unlock your next potential win with these handpicked stock ideas from Simply Wall Street’s powerful screener:

- Snap up value by comparing companies trading below their fair value through these 886 undervalued stocks based on cash flows and see which stocks may be primed for a re-rate.

- Uncover growth potential in tomorrow’s technology by tapping into these 25 AI penny stocks, where promising artificial intelligence innovators are reshaping entire industries.

- Build a stable income stream with these 16 dividend stocks with yields > 3%, highlighting stocks with attractive yields above 3% and reliable dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives