- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

Is L3Harris's $500M Rocket Motor Investment Changing Its Outlook for Investors (LHX)?

Reviewed by Simply Wall St

- In July 2025, L3Harris Technologies announced a US$500 million investment in a new large solid rocket motor production campus, unveiled advanced munitions vehicles for U.S. defense, and appointed Rob Mitrevski to lead missile defense initiatives.

- These actions highlight L3Harris Technologies' commitment to expanding its manufacturing capabilities and innovating in multi-domain defense solutions, which could strengthen its competitive position in key national security programs.

- We’ll explore how the scale of L3Harris’s new production campus may influence its growth outlook and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

L3Harris Technologies Investment Narrative Recap

To be a shareholder in L3Harris Technologies, you need to believe in the company's sustained role as a leading provider of mission-critical defense solutions, especially its ability to secure and deliver on high-priority government and international contracts. The company’s US$500 million investment in a large solid rocket motor campus may help address concerns about production capacity, a potential short-term catalyst, though ongoing reliance on government budgets remains a material risk.

Among the latest news, the announcement of the new LSRM production campus is the most relevant. This major expansion could directly impact L3Harris’s capacity to fulfill large-scale missile defense projects, potentially strengthening its position as new contracts emerge, though delays or budgetary pressures could still affect the pace and scale of this opportunity.

But investors should be aware, in contrast, that even with this growth investment, ongoing U.S. defense budget constraints could...

Read the full narrative on L3Harris Technologies (it's free!)

L3Harris Technologies' forecast calls for $24.1 billion in revenue and $2.6 billion in earnings by 2028. Achieving this outlook requires 4.4% annual revenue growth and an increase in earnings of $1.0 billion from the current $1.6 billion.

Exploring Other Perspectives

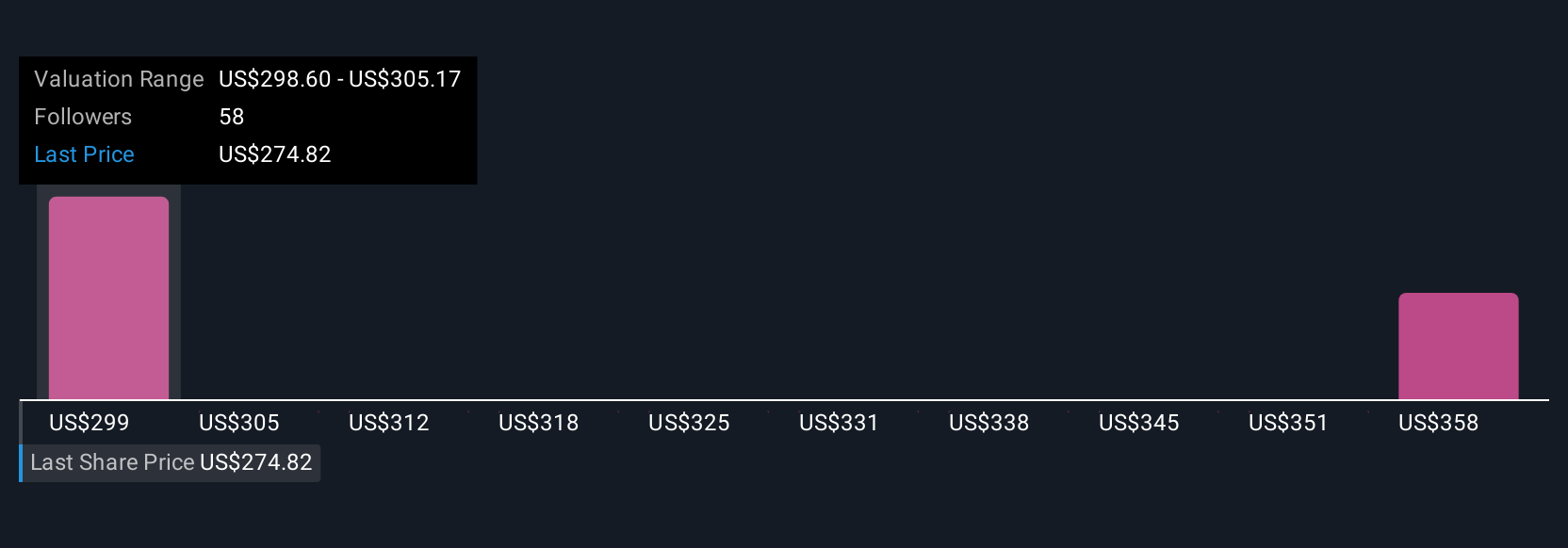

Simply Wall St Community members submitted 3 fair value estimates for L3Harris Technologies, spanning from US$255.50 to US$300.88. With government contract timing and budgets influencing the outlook, you can explore the full range of views and see how opinions differ.

Build Your Own L3Harris Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free L3Harris Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L3Harris Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives