- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

Evaluating L3Harris Technologies After Major Defense Contract Wins and Robust 39% YTD Return

Reviewed by Bailey Pemberton

- Thinking about whether L3Harris Technologies might be a bargain or overpriced? You are not alone, as plenty of investors are looking at the recent data to judge its true value.

- The stock is up 1.2% over the past week but down 3.9% over the past month. Its year-to-date return sits at a robust 39.1%, with a 5-year climb of 62.4% catching many eyes.

- Recent headlines have focused on L3Harris Technologies' major defense contract wins, reflecting increased government spending and geopolitical shifts. News of its innovation in aerospace and successful merger integrations may also help explain the recent price moves and mounting investor interest.

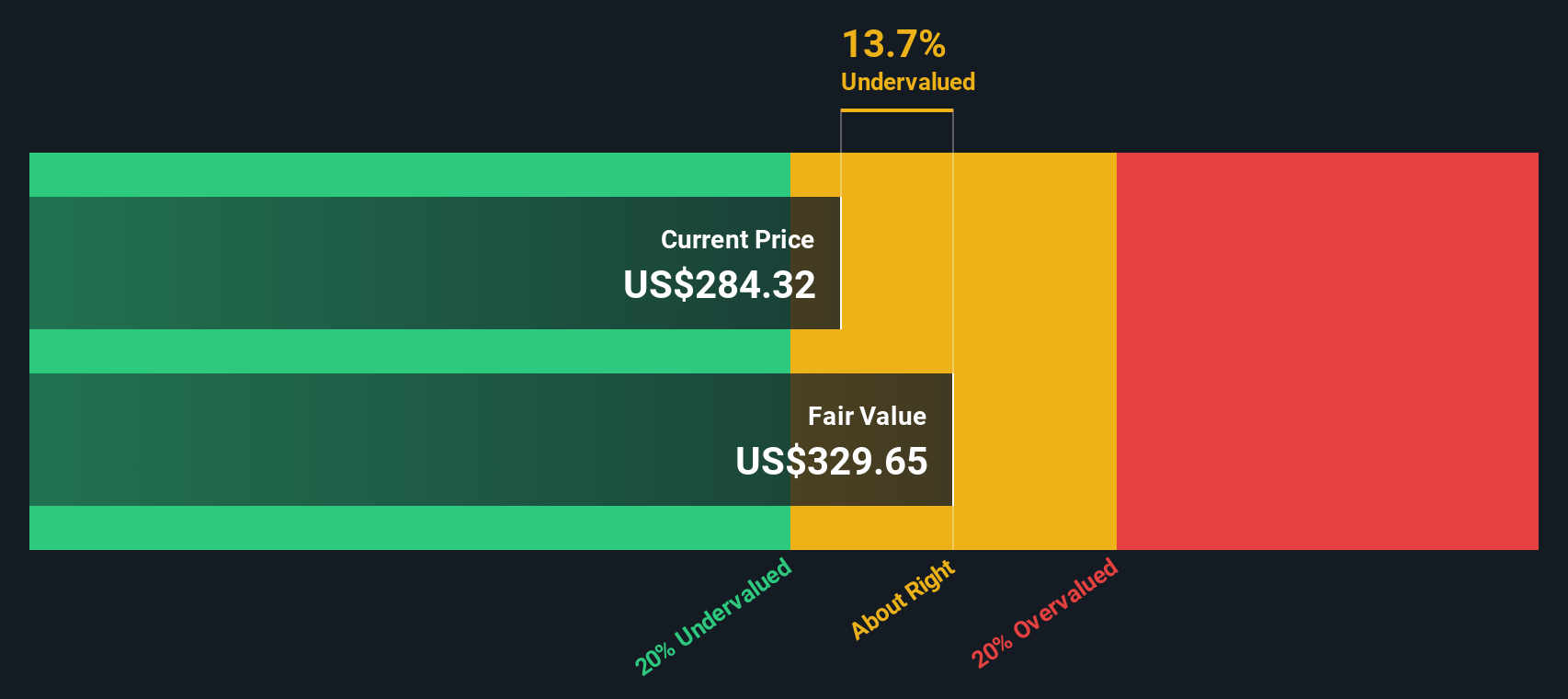

- Currently, L3Harris Technologies scores a 4 out of 6 on our valuation check, indicating it looks undervalued in several key areas. We will break down what this means through different valuation techniques in a moment. There is an even more insightful way to get a handle on value that we will share at the end of the article.

Find out why L3Harris Technologies's 18.5% return over the last year is lagging behind its peers.

Approach 1: L3Harris Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them to reflect their value today. For L3Harris Technologies, this approach uses a two-stage model to forecast future Free Cash Flow based on both analyst expectations and longer-term growth estimates.

Currently, L3Harris Technologies generates Free Cash Flow of $1.85 Billion. Analyst estimates indicate steady growth, with projections rising to $3.68 Billion by 2029. Simply Wall St further extrapolates these forecasts, showing Free Cash Flow reaching nearly $4.6 Billion by 2035. This outlook assumes ongoing innovation and operational performance supporting robust cash generation well into the next decade.

Applying the DCF model, the intrinsic value per share stands at $386.08, representing a 25.3% discount compared to the current stock price. This gap suggests the market may be underestimating L3Harris Technologies' cash flow generation and long-term prospects.

The DCF model points to significant undervaluation, signalling an attractive entry point for investors looking for growth and value combined.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L3Harris Technologies is undervalued by 25.3%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: L3Harris Technologies Price vs Earnings

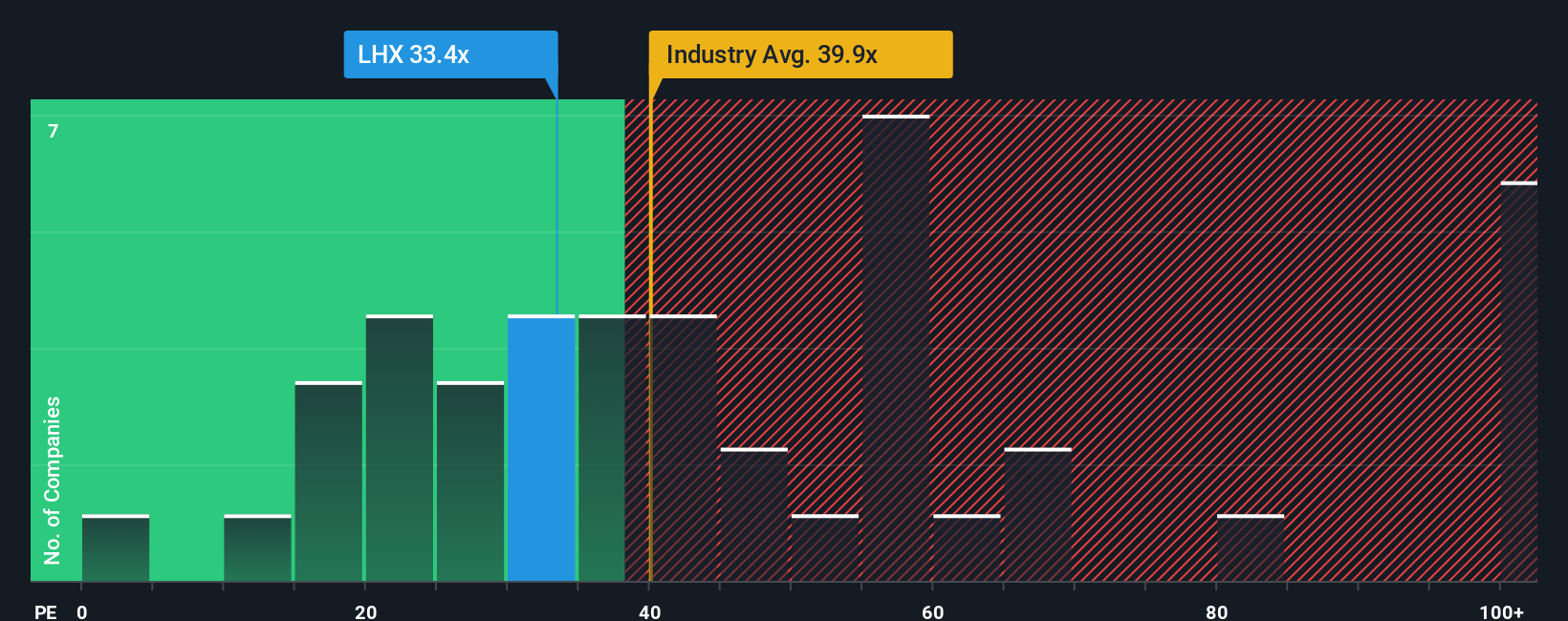

The Price-to-Earnings (PE) ratio is a favored tool for valuing profitable companies like L3Harris Technologies because it directly compares a company’s share price to its earnings per share. This metric is intuitive for investors seeking to assess how much they are paying for every dollar of profit, making it especially relevant for established, consistently earning businesses.

Determining what counts as a “normal” or “fair” PE ratio often depends on expectations for growth and company-specific risks. Higher growth rates or lower risks typically justify a higher PE, while slower growth or greater uncertainty might warrant a lower figure. Understanding these nuances is essential before drawing conclusions from raw PE numbers.

L3Harris Technologies currently trades at a PE ratio of 30.67x. For context, this is lower than the Aerospace & Defense industry average of 38.73x and slightly below the peer average of 34.95x. However, a deeper layer of insight is provided by Simply Wall St’s proprietary "Fair Ratio." This incorporates factors such as the company’s forecast earnings growth, risk profile, market cap, profit margins, and overall industry conditions. The Fair Ratio projects a more individualized benchmark. For L3Harris Technologies, the Fair Ratio is 29.20x, a figure carefully calibrated rather than based solely on sector data or immediate competitor comparisons.

The Fair Ratio goes beyond industry or peer averages and offers a tailored yardstick that captures both upside potential and specific risk. Since L3Harris Technologies’ current PE ratio is just mildly above the Fair Ratio, the stock’s valuation sits in line with what can reasonably be expected given its unique financial and business profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

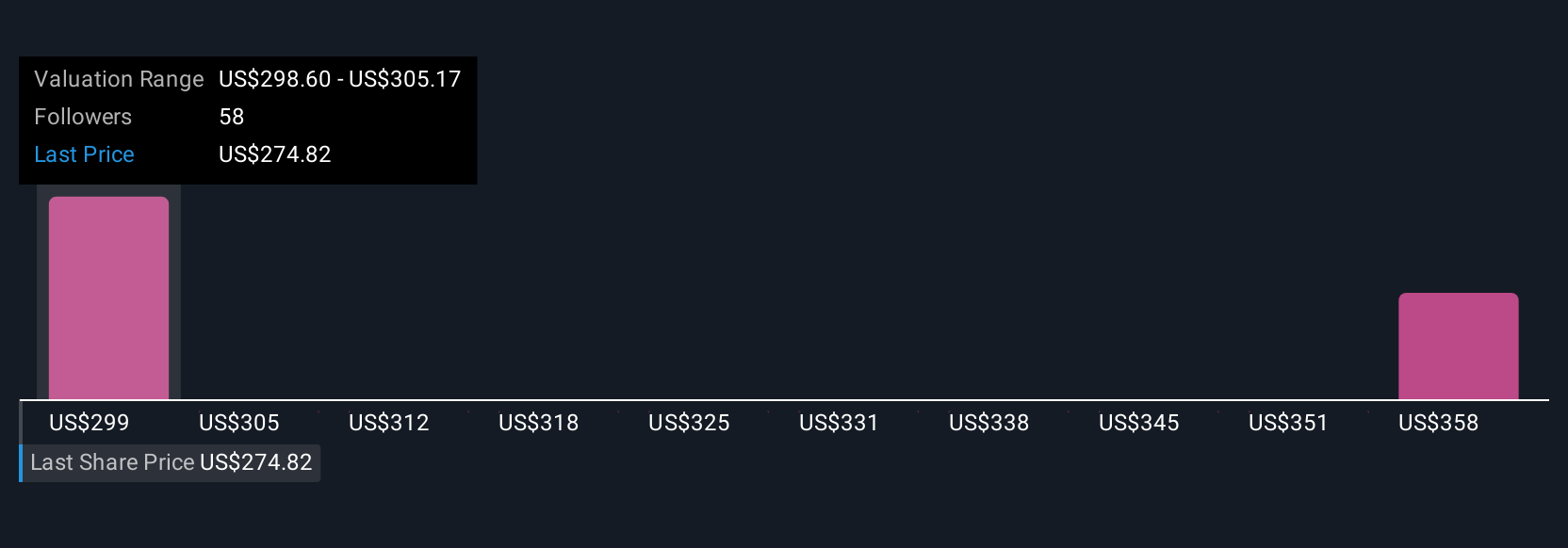

Upgrade Your Decision Making: Choose your L3Harris Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is your opportunity to connect the story you believe about a company, such as your own assumptions about its future revenue, margins, or market position, directly to a numbers-driven financial forecast and, ultimately, to a fair value estimate.

This means, rather than just relying on ratios or analyst consensus, you can map your investment perspective to concrete forecasts inside Simply Wall St’s user-friendly Community page, which is used by millions of investors. Narratives allow you to compare your Fair Value with the current market price, helping you decide precisely when to buy or sell. These valuations are automatically updated as new news or earnings reports come out.

For example, some investors might build a bullish Narrative for L3Harris Technologies, believing that its AI partnerships and strong contract wins will drive earnings to $2.7 billion by 2028 and justify a price target as high as $327. A more cautious investor could focus on budget constraints and industry risks, projecting a fair value closer to $250. Narratives let you see how diverse viewpoints are directly linked to tangible numbers, empowering you to invest with confidence based on your own informed convictions.

Do you think there's more to the story for L3Harris Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives