- United States

- /

- Aerospace & Defense

- /

- NYSE:KRMN

Has Karman Holdings Run Too Far After Its 116.1% Year To Date Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Karman Holdings is still a smart buy after its big run up, or if most of the upside is already priced in, you are not alone.

- The stock has pulled back about 3.5% over the last week, but it is still up 11.4% in the past month and an eye catching 116.1% year to date. That indicates the market has rapidly rewritten its expectations.

- Much of this momentum has been driven by growing investor attention on Karman's role in the broader capital goods space, with traders increasingly treating it as a way to gain exposure to infrastructure and industrial investment themes. At the same time, coverage from niche industry publications has highlighted management's strategic moves and deal making, adding fuel to the narrative that the business could be entering a more scalable phase.

- Despite that excitement, Karman scores just 1/6 on our valuation checks, which suggests the stock only looks clearly undervalued on one of the six signals we track. Next, we will unpack what different valuation approaches say about the current price, and then finish with an even more intuitive way to judge whether Karman is truly good value or just a momentum story in disguise.

Karman Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Karman Holdings Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it could generate in the future and then discounting those cash flows back to their value in the present.

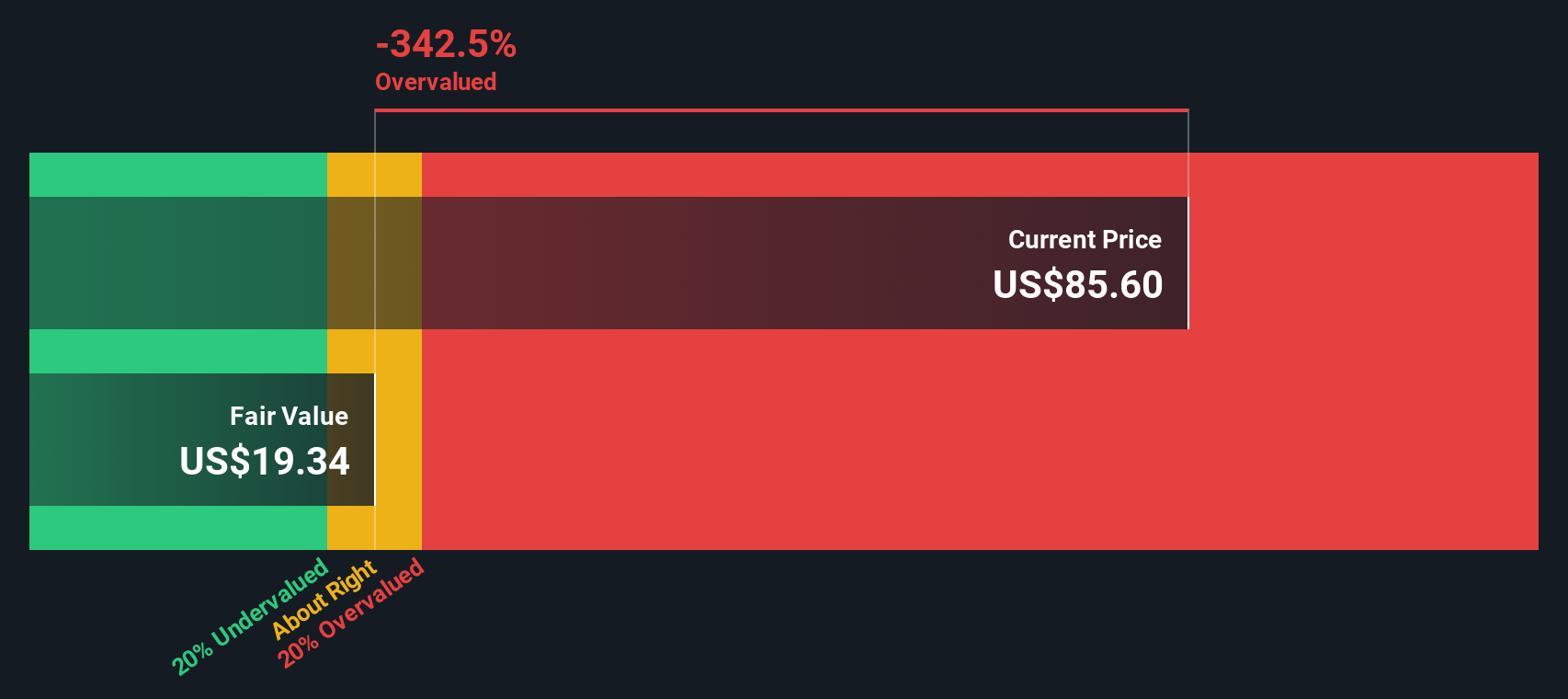

For Karman Holdings, the latest twelve month Free Cash Flow is about $48.7 Million in the red, which means the company is still burning cash rather than generating it. Analysts and internal estimates, however, expect this to flip, with Free Cash Flow projected to reach roughly $229.8 Million by 2035. This is based on a 2 Stage Free Cash Flow to Equity model that blends near term analyst forecasts with longer term extrapolations.

When all these projected cash flows are discounted back to today in dollars, the model arrives at an intrinsic value of about $27.30 per share. That is 137.9% below the current market price, implying the stock is trading at more than double what the cash flow outlook appears to justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Karman Holdings may be overvalued by 137.9%. Discover 912 undervalued stocks or create your own screener to find better value opportunities.

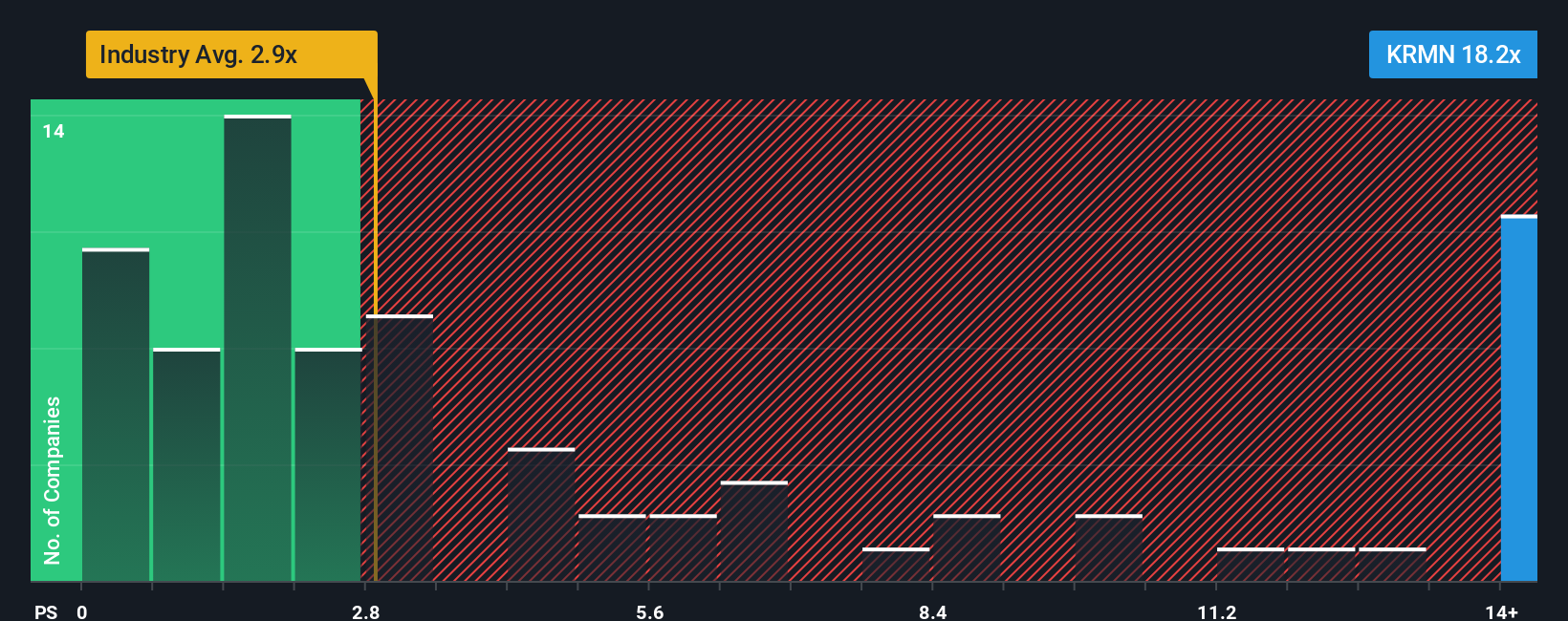

Approach 2: Karman Holdings Price vs Sales

For companies that are still scaling and reinvesting heavily, the Price to Sales ratio is often a more reliable yardstick than earnings based metrics, because it focuses on the revenue engine before accounting quirks and one off items in profit. In general, investors are willing to pay a higher sales multiple for businesses with faster, more predictable growth and lower perceived risk, while slower or shakier stories tend to settle at a lower, more conservative multiple.

Karman currently trades on a rich Price to Sales ratio of about 20.07x, far above the Aerospace and Defense industry average of roughly 2.99x and meaningfully higher than its peer group average of about 4.84x. To cut through those blunt comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what a reasonable Price to Sales multiple should be after accounting for Karman's growth outlook, profit margins, risk profile, industry characteristics and market cap. For Karman, that Fair Ratio is approximately 5.08x, suggesting that, even after adjusting for its strengths and prospects, the market is valuing each dollar of sales at nearly four times what would typically look justified.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Karman Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect the story you believe about Karman Holdings with the numbers behind it. A Narrative is your own explanation of what the business is, where it is heading and how it will get there, translated into a financial forecast for revenue, earnings and margins, and ultimately into a fair value estimate. On Simply Wall St, millions of investors build and share these Narratives on each company’s Community page, making it easy and accessible to see how different stories lead to different valuations. Narratives then compare your Fair Value to the current share price to help you decide whether Karman looks like a buy, a hold or a sell, and they update dynamically as new information, such as earnings reports or major news, is released. For example, one Karman Narrative might assume long term defense contract growth and assign a higher fair value, while another could assume slower order intake and tighter margins, resulting in a lower fair value and a more cautious stance.

Do you think there's more to the story for Karman Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Karman Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRMN

Karman Holdings

Through its subsidiary, engages in designing, testing, manufacturing, and sale of mission-critical systems in the United States.

Exceptional growth potential with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)