- United States

- /

- Machinery

- /

- NYSE:KMT

How Kennametal’s New $650 Million Credit Facility Could Reshape Flexibility for KMT Investors

Reviewed by Sasha Jovanovic

- Earlier this month, Kennametal Inc. and its Swiss subsidiary entered into a new unsecured US$650 million five-year credit agreement, enhancing their financial flexibility with leading global lenders and amending the previous 2022 arrangement.

- A key feature of the agreement includes capacity for multicurrency borrowing and the option to increase total commitments by up to US$300 million, supporting Kennametal's international operations and strategic initiatives.

- With Kennametal recently reporting disappointing earnings and issuing cautious 2026 guidance, we'll examine how the new credit facility affects the investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Kennametal Investment Narrative Recap

To be a shareholder in Kennametal, you need to have confidence in the company’s ability to capture growth from global infrastructure spending, automation, and manufacturing recovery, despite ongoing end-market demand weakness. The new US$650 million credit facility improves near-term financial flexibility, but its impact on Kennametal’s most important catalyst, sustainable volume recovery, appears limited, while substantial end-market risk still overshadows short-term optimism. Of the recent company announcements, the increase in full-year revenue guidance to US$2.100 billion–US$2.170 billion stands out. This move signals management’s view that certain industrial conditions are strengthening, though its significance may be moderated if core market headwinds persist or intensify. In contrast, investors need to be especially mindful of the risk that ongoing structural demand declines in key end markets could mean...

Read the full narrative on Kennametal (it's free!)

Kennametal's narrative projects $2.1 billion in revenue and $120.7 million in earnings by 2028. This requires 2.3% yearly revenue growth and a $27.6 million increase in earnings from $93.1 million today.

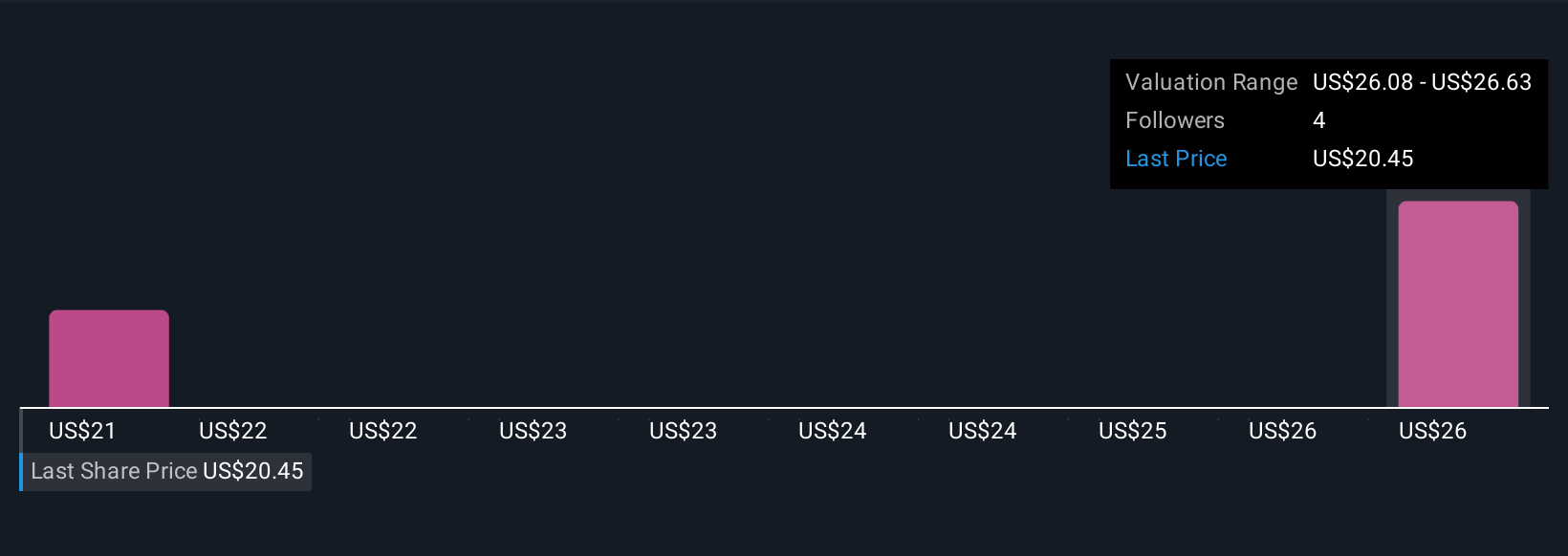

Uncover how Kennametal's forecasts yield a $25.25 fair value, a 9% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has supplied two fair value estimates for Kennametal stock, which range widely from US$25.25 to US$75.80. While perspectives vary, many remain focused on the persistent risk of long-term revenue stagnation and demand challenges across core sectors, inviting you to consider which scenario you view as most probable.

Explore 2 other fair value estimates on Kennametal - why the stock might be worth over 2x more than the current price!

Build Your Own Kennametal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kennametal research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kennametal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kennametal's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.