- United States

- /

- Machinery

- /

- NYSE:KMT

Does Consecutive Caterpillar Awards Signal a Competitive Edge for Kennametal (KMT) in Industrial Markets?

Reviewed by Sasha Jovanovic

- In October 2025, Kennametal Inc. was recognized for the second consecutive year as one of Caterpillar's top indirect suppliers, highlighting its strength in metal cutting solutions, productivity, and technical support.

- This recognition underscores Kennametal’s role in supporting major infrastructure and electrification projects worldwide, showing strong alignment with Caterpillar’s long-term priorities.

- We'll now explore how Kennametal's back-to-back supplier recognition from Caterpillar may reinforce its position in key industrial markets.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kennametal Investment Narrative Recap

For those considering Kennametal as an investment, belief in the company’s long-term relevance in global infrastructure and electrification projects is key, especially as these sectors remain core growth drivers. While the recent supplier recognition from Caterpillar signals strong operational alignment and may foster incremental opportunity, there is little indication it will shift the primary near-term catalyst: the push for sustainable revenue growth in the face of soft end-market demand. The biggest ongoing risk is continued volume decline across critical segments like Transportation and Oil & Gas; this remains unmitigated by the Caterpillar news.

Among recent announcements, Kennametal’s August 2025 quarterly sales update stands out, as full-year revenues and earnings have both contracted year-over-year despite efficiency efforts. This persistent stagnation remains a headwind, even as enterprise accolades may help reinforce customer relationships and underpin future bidding activity. Ultimately, attention stays fixed on whether management’s cost-saving initiatives can outpace the structural demand challenges.

Yet in contrast to the optimism of supplier awards, there are persistent concerns around unresolved cost structures and what this means for margins if volumes remain subdued that investors should be aware of...

Read the full narrative on Kennametal (it's free!)

Kennametal's outlook anticipates $2.1 billion in revenue and $120.7 million in earnings by 2028. This scenario is based on a 2.3% annual revenue growth rate and a $27.6 million increase in earnings from the current $93.1 million.

Uncover how Kennametal's forecasts yield a $21.06 fair value, in line with its current price.

Exploring Other Perspectives

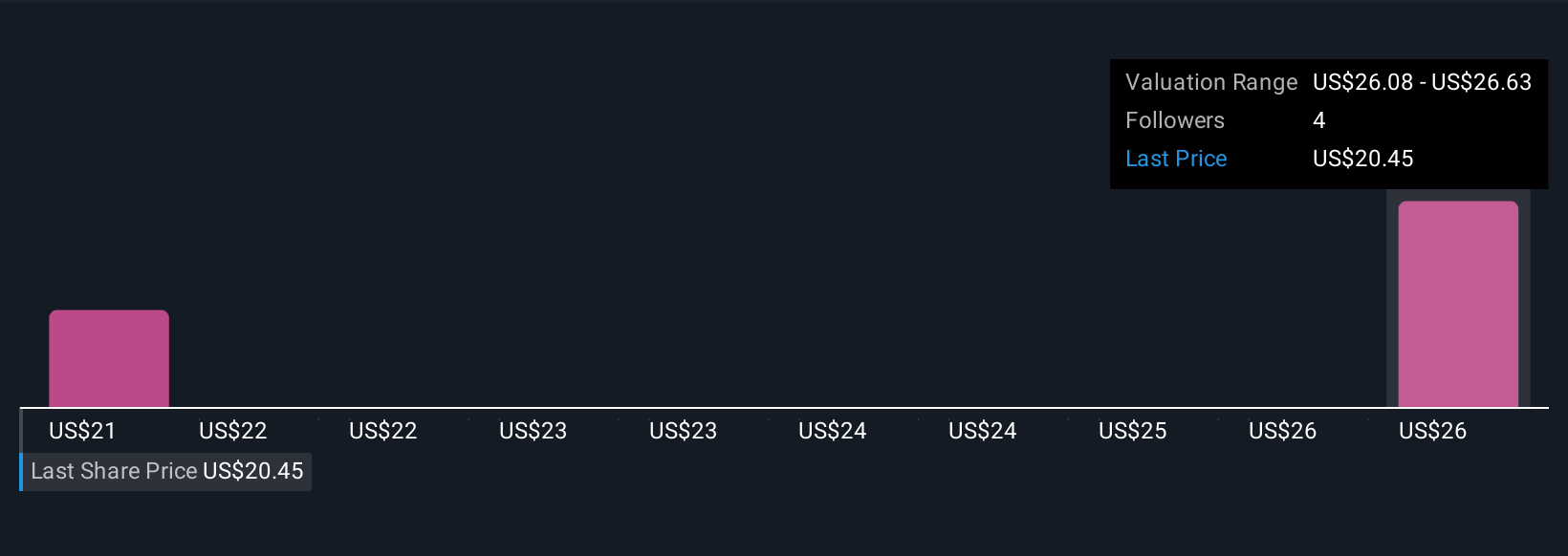

Simply Wall St Community members estimate fair value for Kennametal shares between US$21.06 and US$26.81, with two individual perspectives contributing unique forecasts. While many see potential upside, ongoing volume weakness and cost challenges continue to weigh on broader earnings expectations.

Explore 2 other fair value estimates on Kennametal - why the stock might be worth as much as 25% more than the current price!

Build Your Own Kennametal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kennametal research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kennametal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kennametal's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives