- United States

- /

- Building

- /

- NYSE:JCI

Johnson Controls (JCI): Assessing Valuation as Analyst Optimism Grows on AI Infrastructure and Data Center Strength

Reviewed by Kshitija Bhandaru

Johnson Controls International (NYSE:JCI) is capturing investor attention as new research underscores its leadership in commercial HVAC for data centers. The company’s connection to long-term growth drivers, such as artificial intelligence infrastructure and electrification, is fueling market optimism.

See our latest analysis for Johnson Controls International.

Strong momentum around Johnson Controls International is easy to spot, with the stock’s year-to-date share price return climbing nearly 38% and a stellar 1-year total shareholder return of 43%. Positive recognition from industry analysts and recurring headlines about its pivotal role in data center and AI infrastructure have kept sentiment upbeat even as the broader market cycles through episodes of caution and optimism.

If you’re watching how industrial leaders ride emerging tech trends, now is a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares near all-time highs and Wall Street raising their targets, the big question is whether Johnson Controls is still trading at a bargain or if the market has already priced in all the promising growth ahead.

Most Popular Narrative: 5.3% Undervalued

With a fair value estimate of $114.95 and the last close at $108.83, the most widely followed narrative points to modest upside for Johnson Controls International, as analysts weigh recent momentum against future growth assumptions.

The company has significant opportunities for cost reductions and process improvements through the implementation of Lean practices. This is likely to positively impact net margins and overall earnings. Johnson Controls’ strong record backlog and sustained demand in key areas, such as its York HVAC and Metasys building automation platforms, provide a solid foundation for future revenue growth.

Curious which key assumptions are behind this valuation? Analysts are betting on improving profit margins, a substantial jump in earnings, and stronger efficiency. Much hinges on execution. Want the inside story on which precise financial shifts will make or break that fair value? See which bold projections support these numbers.

Result: Fair Value of $114.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational complexity or disruption from ongoing restructuring could limit Johnson Controls’ ability to fully realize projected margin and revenue gains.

Find out about the key risks to this Johnson Controls International narrative.

Another View: Market Comparisons Signal a Cautious Tone

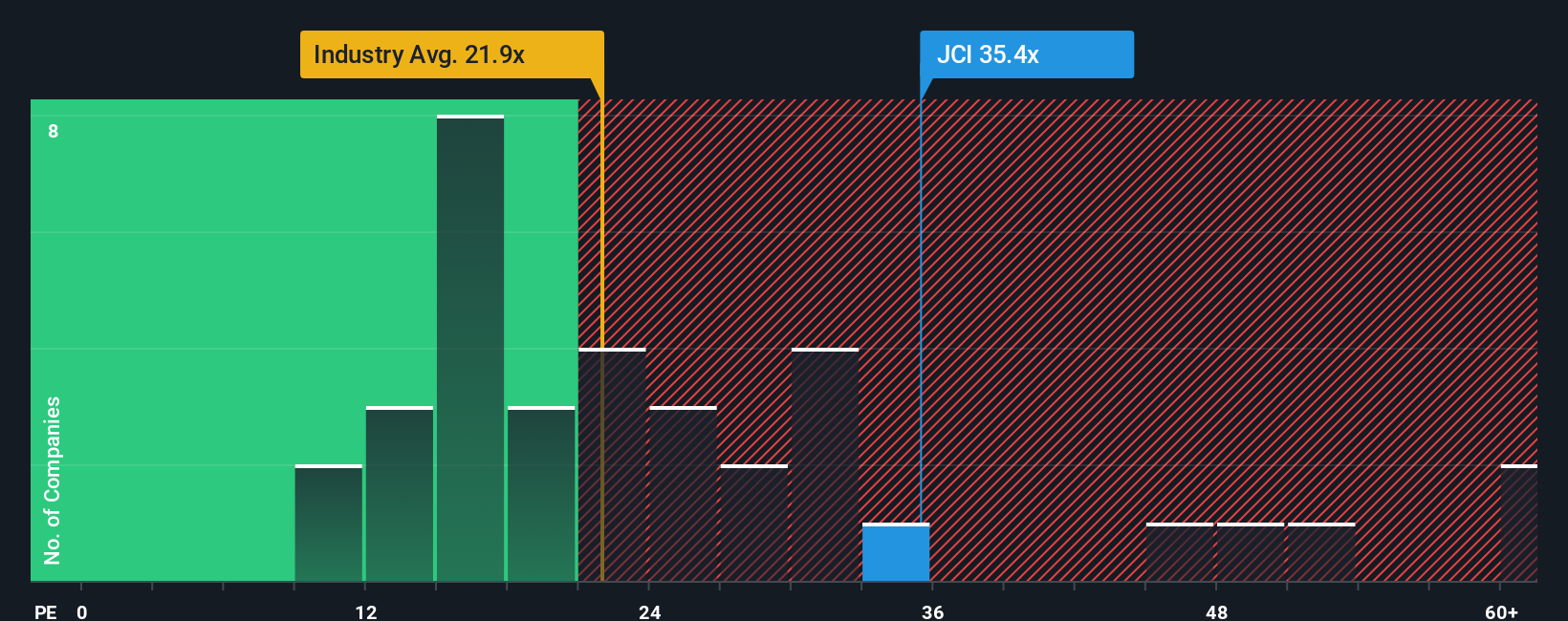

When comparing Johnson Controls International to its sector peers, the stock currently trades at a price-to-earnings ratio of 35.8x. This is notably higher than both the US Building industry average of 20.4x and the peer average of 25.6x. Even against its fair ratio of 32.6x, JCI appears elevated. This suggests premium pricing could limit future upside if market sentiment cools. Will the story of outperformance keep the premium, or could expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson Controls International Narrative

If you want to dive deeper or see the story through your own lens, you can easily piece together a personal view from the available data in just a few minutes, and Do it your way.

A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take charge of your portfolio’s growth by tapping into curated stock ideas you won’t want to overlook. These smart screens put powerful opportunities within your grasp.

- Secure your future income by targeting attractive yields using these 18 dividend stocks with yields > 3%, with a history of strong payouts and reliable business models.

- Ride the momentum of groundbreaking artificial intelligence with these 24 AI penny stocks, identifying companies at the forefront of automation and machine learning.

- Unlock potential upside with these 878 undervalued stocks based on cash flows, pinpointing stocks the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives