- United States

- /

- Building

- /

- NYSE:JCI

Is Now the Right Moment for Johnson Controls After Its Double Digit 2024 Rally?

Reviewed by Bailey Pemberton

If you are looking at Johnson Controls International and wondering whether now is the right time to get in, you are not alone. This stock has been grabbing the attention of both seasoned investors and those just stepping into industrials. With a closing price of $108.79, it seems to be riding high, up 1.7% over the last week and 2.4% in the last month. What also stands out is the impressive 37.8% jump year-to-date, with the past year bringing in a total return of 46.1%. If you have held on even longer, the gains look even bigger, with three- and five-year returns of 129.8% and 181.2%, respectively.

What has been fueling this run? Much of it comes down to renewed optimism in infrastructure investments and increasing demand for advanced building technologies, both areas where Johnson Controls is a well-known leader. As economic priorities shift globally toward sustainability and automation, the company appears to be well-positioned. This could be why risk perception is shifting and more investors are attracted to the stock.

This brings us to a trickier question. How do you know if the current price reflects true value, or if you are arriving a bit late to the party? Here is where valuation becomes critical. Johnson Controls International has a current valuation score of just 0 out of 6, meaning it does not screen as undervalued by any of the six checks commonly used to gauge bargain opportunities.

So, are traditional valuation checks the best way to judge this company at today’s price, or could there be a smarter approach? In the next section, we will dig into the most widely used valuation methods, and later on, I will show you a more insightful perspective that might change how you look at Johnson Controls entirely.

Johnson Controls International scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Johnson Controls International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. It essentially asks: What are all of Johnson Controls International's expected future cash flows worth in today’s dollars?

For Johnson Controls International, the latest reported Free Cash Flow stands at $2.89 billion, and analyst forecasts suggest growth to $3.34 billion by 2029. Beyond 2029, further estimates are extrapolated, reflecting a gradual climb through 2035. These projections are based on both analyst opinions (for the first five years) and methodical long-term growth assumptions provided by Simply Wall St.

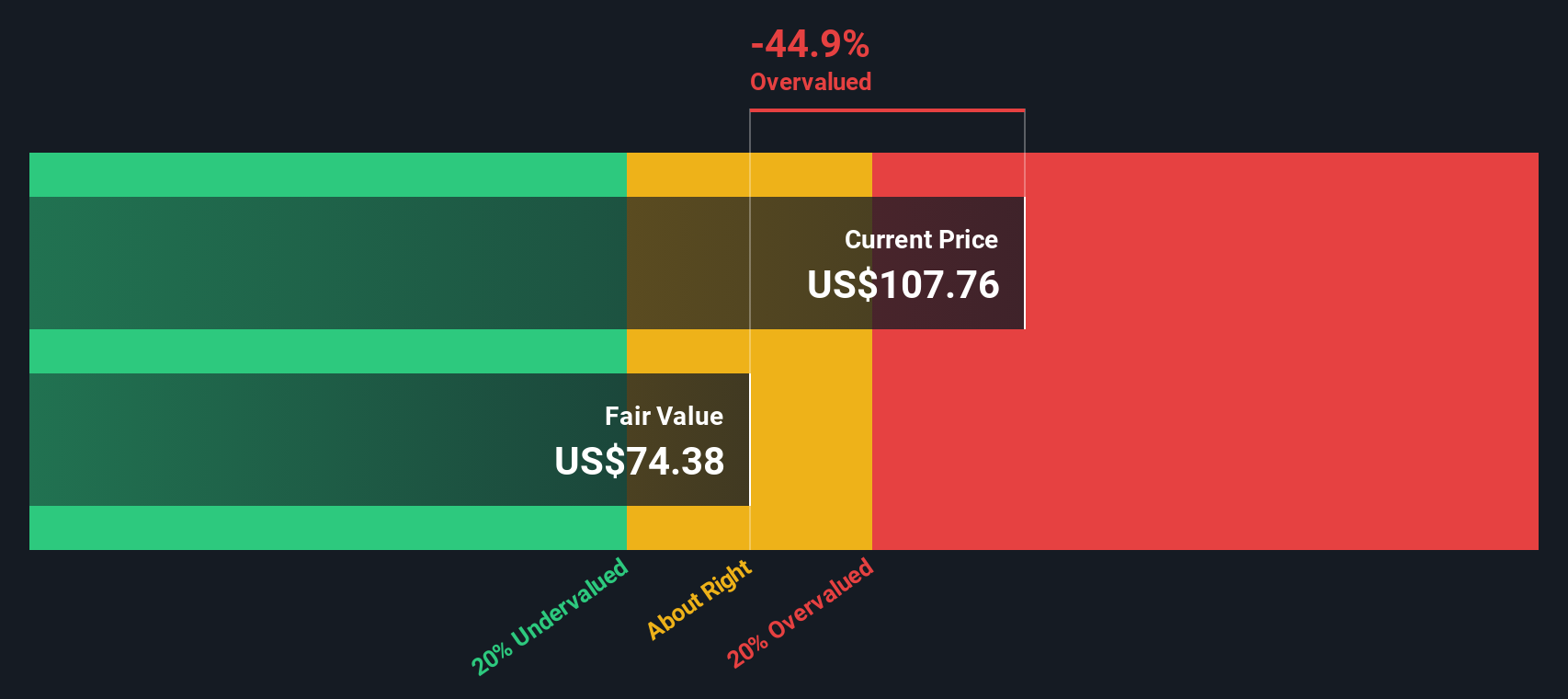

Despite these healthy projections, the DCF model calculates a fair value of $74.40 per share. This is considerably below the current share price of $108.79, implying the stock is priced 46.2% above what this cash flow-based analysis supports.

Based solely on a DCF perspective, Johnson Controls International stock looks overvalued at present. The market price runs well ahead of the value suggested by future cash flows discounted to today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Johnson Controls International may be overvalued by 46.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Johnson Controls International Price vs Earnings

The Price-to-Earnings (PE) ratio is a preferred valuation metric for profitable companies like Johnson Controls International because it directly connects the share price to the company’s actual earnings. This provides a straightforward measure of how much investors are willing to pay for each dollar of profit.

The "normal" or fair PE ratio for a company is influenced by several factors, including its projected earnings growth and the risks it faces. Companies with higher expected growth and lower risk typically command higher PE ratios. Conversely, slower growth or higher risk tend to justify a discount.

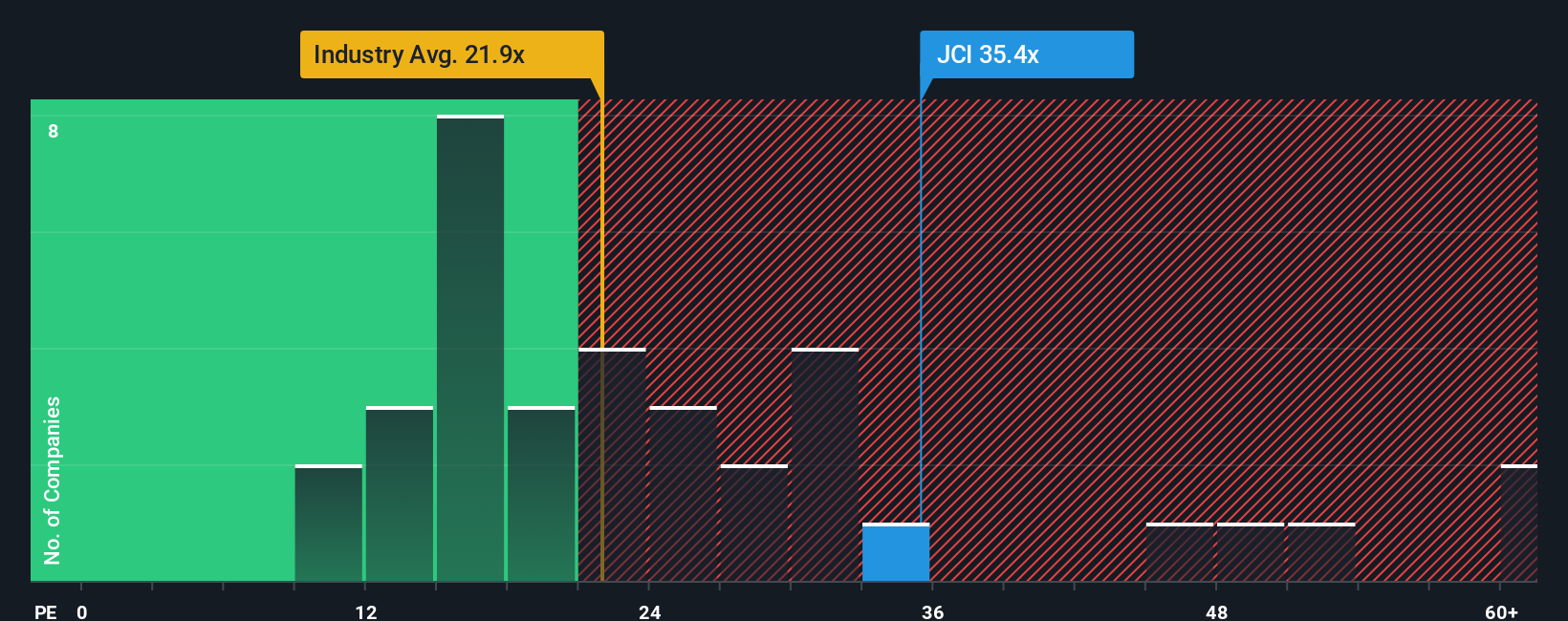

Currently, Johnson Controls International trades at a PE ratio of 35.8x. This is notably above both the industry average of 22.4x and the peer average of 26.8x. At first glance, this suggests the stock is on the expensive side relative to its sector and direct competitors.

However, Simply Wall St’s proprietary "Fair Ratio" refines this assessment. The Fair Ratio, calculated at 32.7x for Johnson Controls, goes beyond simple averages by considering key specifics such as the company’s earnings growth prospects, profit margins, market cap, industry sector, and risk profile. This approach aims to pinpoint a more accurate and tailored valuation level for the stock, recognizing nuances that a straight peer or industry comparison can miss.

With Johnson Controls’ actual PE ratio only slightly above its Fair Ratio, the share price appears to be about right based on earnings-driven valuation.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Johnson Controls International Narrative

Earlier, we suggested that there is an even better way to understand valuation, so let’s introduce Narratives. A Narrative is your personalized story and perspective behind a company’s numbers. It is where you connect your assumptions about Johnson Controls International's future earnings, margins, and risks to a financial forecast that produces your own fair value for the stock.

Rather than relying solely on static metrics like DCF or PE, Narratives allow you to define what you believe is probable for the company, link those beliefs to revenue and earnings forecasts, and instantly see how your thesis translates into a fair value, all accessible on Simply Wall St's Community page used by millions of investors.

Narratives empower you to decide if current prices offer attractive buying opportunities or signal it is time to wait by automatically comparing your fair value to today’s market price. Because Narratives are updated dynamically when new earnings, news, or business updates are released, your view stays current without extra work.

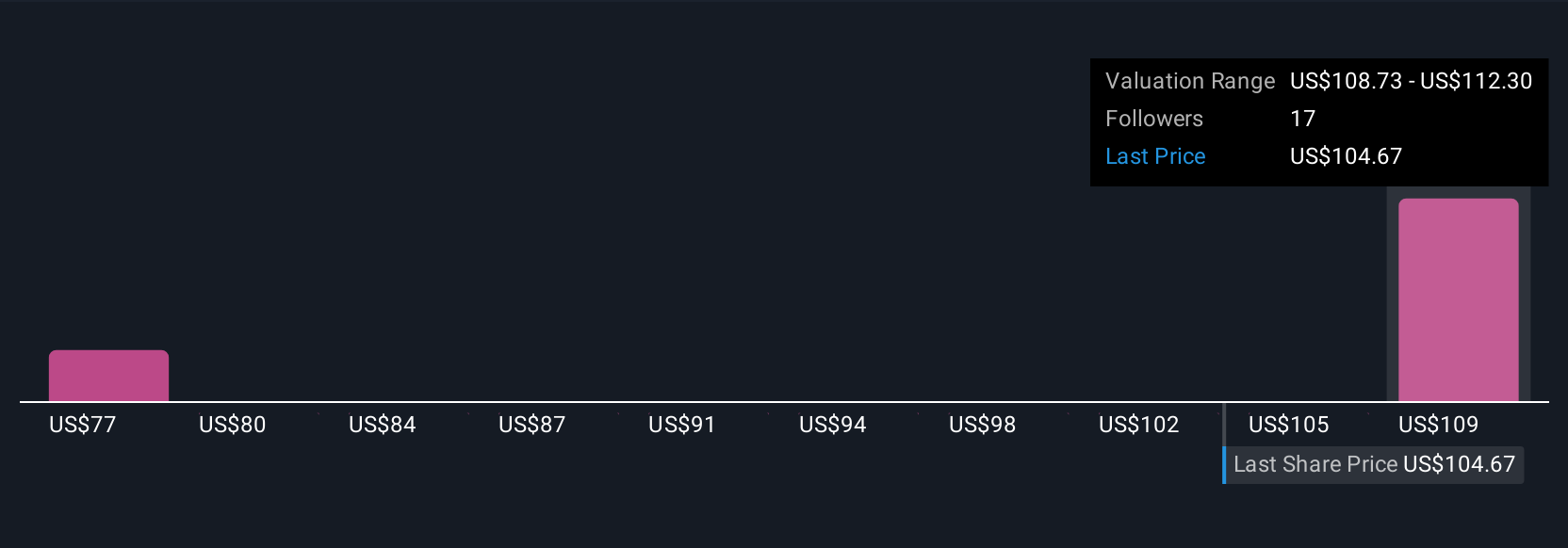

For example, with Johnson Controls International, one investor may have a bullish Narrative believing Lean manufacturing and York HVAC platforms will drive revenue and margin expansion, resulting in a fair value as high as $132.0. Another may see execution risks and industry pressure, justifying a fair value as low as $79.0. Both perspectives are instantly compared against the current price.

Do you think there's more to the story for Johnson Controls International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives