- United States

- /

- Machinery

- /

- NYSE:ITW

Illinois Tool Works (ITW) Margin Expansion Reinforces Quality Narrative Despite Tepid Growth Outlook

Reviewed by Simply Wall St

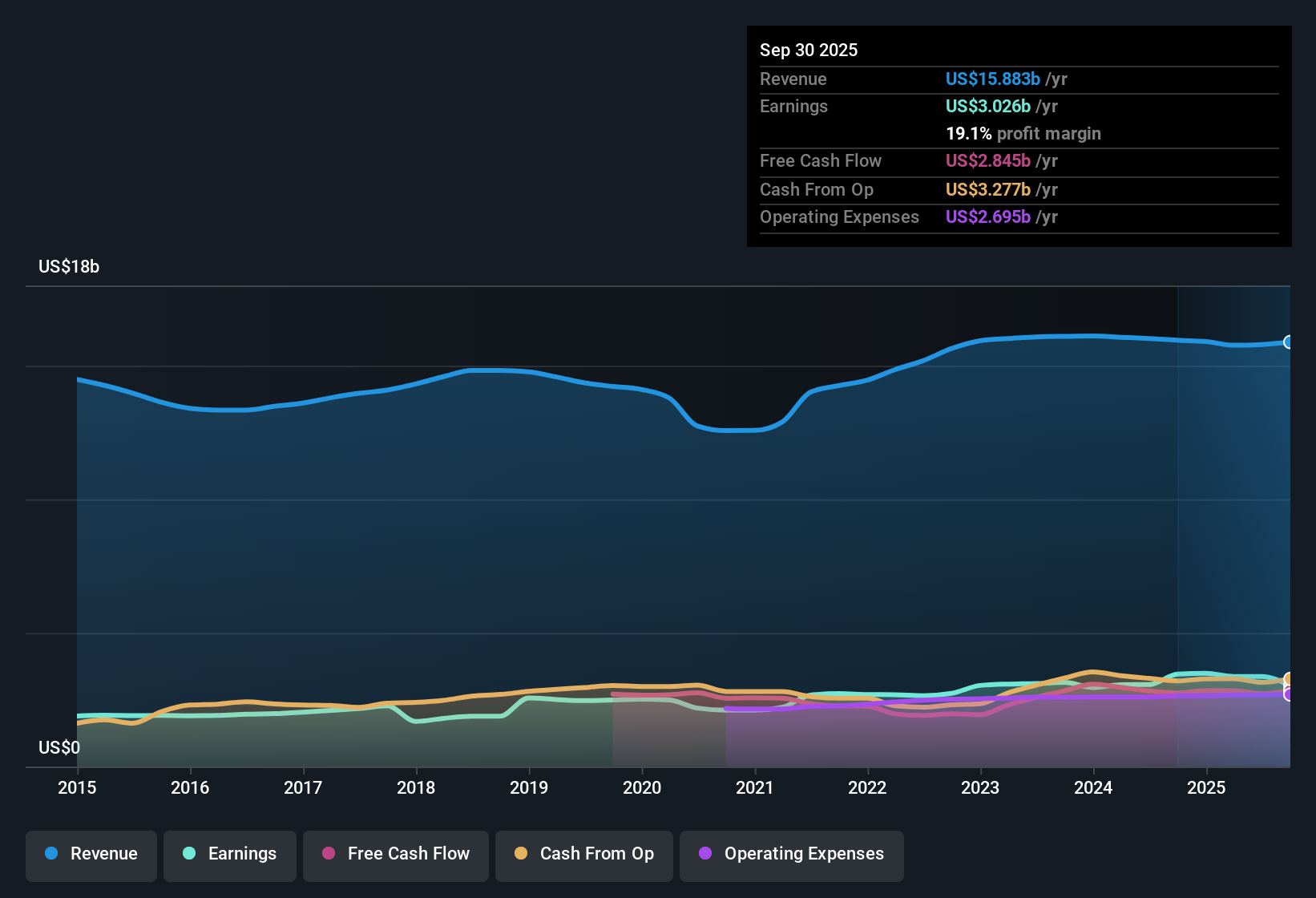

Illinois Tool Works (ITW) reported annual earnings growth of 9.1% over the past five years, with most recent earnings rising 9.7% and a net profit margin expanding to 21.3% from 19.2% a year earlier. The stock trades at $245.75, which is below an estimated fair value of $582.03 and comes with a price-to-earnings ratio of 21.3x, a discount to both the US Machinery industry and its peer group. With a strong past earnings record, attractive dividend, and improved margins, the latest results give investors plenty to weigh, even as forward-looking growth estimates for earnings and revenue trail broader market expectations.

See our full analysis for Illinois Tool Works.Now, let’s see how ITW’s reported results measure up against the established narratives shaping investor sentiment.

See what the community is saying about Illinois Tool Works

Margin Expansion Offsets Slower Growth Forecast

- Analysts expect net profit margins to shrink from 21.3% today to 20.4% over the next three years, reflecting anticipated competitive or cost pressures even as ITW emphasizes efficiency initiatives.

- Consensus narrative notes that ITW’s decentralized structure and manufacturing strategy are designed to protect margins against market swings,

- even as the company’s revenue growth forecast of 3.7% per year lags the broader US market’s 10% benchmark,

- raising questions over how effectively these initiatives will insulate profitability from industry headwinds if growth continues to underperform peers.

To see how Wall Street’s balanced take matches up with the actual business momentum, check out the consensus view for Illinois Tool Works. 📊 Read the full Illinois Tool Works Consensus Narrative.

Valuation Discount Stands Out Versus Industry

- ITW trades at a price-to-earnings ratio of 21.3x, below the US Machinery industry average of 24.7x and well beneath its peer group average of 37.7x, while its share price of $245.75 represents a substantial discount to the DCF fair value estimate of $582.03.

- Consensus narrative points out that this relative value,

- when paired with an analyst price target of $258.75 that rests just 1.2% above today’s share price,

- implies that while current pricing appears attractive on a fundamental basis, analysts are cautious about upside given slower projected growth and narrowing margins.

Dividend Appeal Supports Quality Thesis

- Alongside its record of high-quality past earnings, ITW is recognized for paying an attractive dividend, highlighted as one of five reward signals in recent filings.

- Consensus narrative highlights that the dividend,

- in combination with margin resilience and decentralized operations, reinforces the long-term quality proposition for investors

- but also comes at a time when the only risk flagged is minor and linked to the company’s financial position, suggesting limited near-term threats to payout stability.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Illinois Tool Works on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something unique in the figures? Take a couple of minutes to craft your own interpretation and put your perspective into the story. Do it your way

A great starting point for your Illinois Tool Works research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Illinois Tool Works faces concerns about its slower revenue growth projections and margin pressures compared to industry peers and broader market benchmarks.

If you want to focus on companies delivering stronger, more reliable growth, use stable growth stocks screener (2098 results) to zero in on businesses with consistent expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITW

Illinois Tool Works

Provides industrial products and equipment in North America, Europe, the Middle East, Africa, the Asia Pacific, and South America.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives