- United States

- /

- Machinery

- /

- NYSE:ITW

Illinois Tool Works (ITW): Digging Into Valuation After Fed Rate Cut Hopes Spur Stock Rally

Reviewed by Simply Wall St

If you own or are eyeing Illinois Tool Works (ITW), you probably noticed the stock’s jump after Federal Reserve Chair Jerome Powell spoke at the Jackson Hole symposium. Powell’s hints that interest rates could head lower soon sent a wave of optimism through the market, easing concerns about borrowing costs and reviving interest in names like Illinois Tool Works. For investors, sudden policy shifts like this can instantly reshape expectations, especially for industrial companies tied closely to economic cycles.

This policy-driven upswing builds on a quietly steady year for Illinois Tool Works. After a stretch of caution from investors and a period when the stock lagged behind some market trends, ITW’s share price has now climbed around 11% over the past 12 months. Most of this momentum has accelerated in the past quarter. The company’s recent earnings topped expectations again, and management lifted its guidance, sending reassuring signals about operational strength. This comes even as overall demand in the sector remains mixed.

But after this surge, investors face a familiar question: does the big move signal that Illinois Tool Works is finally trading at fair value, or is there still a window to buy into future growth?

Most Popular Narrative: 4.1% Overvalued

According to community narrative, Illinois Tool Works is viewed as slightly overvalued based on consensus analyst projections and key assumptions about future growth and profitability.

"Analysts expect earnings to reach $3.6 billion (and earnings per share of $12.8) by about August 2028, up from $3.4 billion today. The analysts are largely in agreement about this estimate."

Curious about the math behind this bold valuation call? This narrative relies on ambitious growth assumptions, future multiples that exceed typical industry norms, and some surprising margin forecasts. Looking to understand which specific financial levers are influencing the estimated fair value and why the analyst target is just below today’s price? Explore the details behind this market call and develop your own perspective on what is currently priced in for Illinois Tool Works.

Result: Fair Value of $258.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, unexpected revenue declines or persistent weakness in major segments could still threaten Illinois Tool Works' resilience and put pressure on its future valuation outlook.

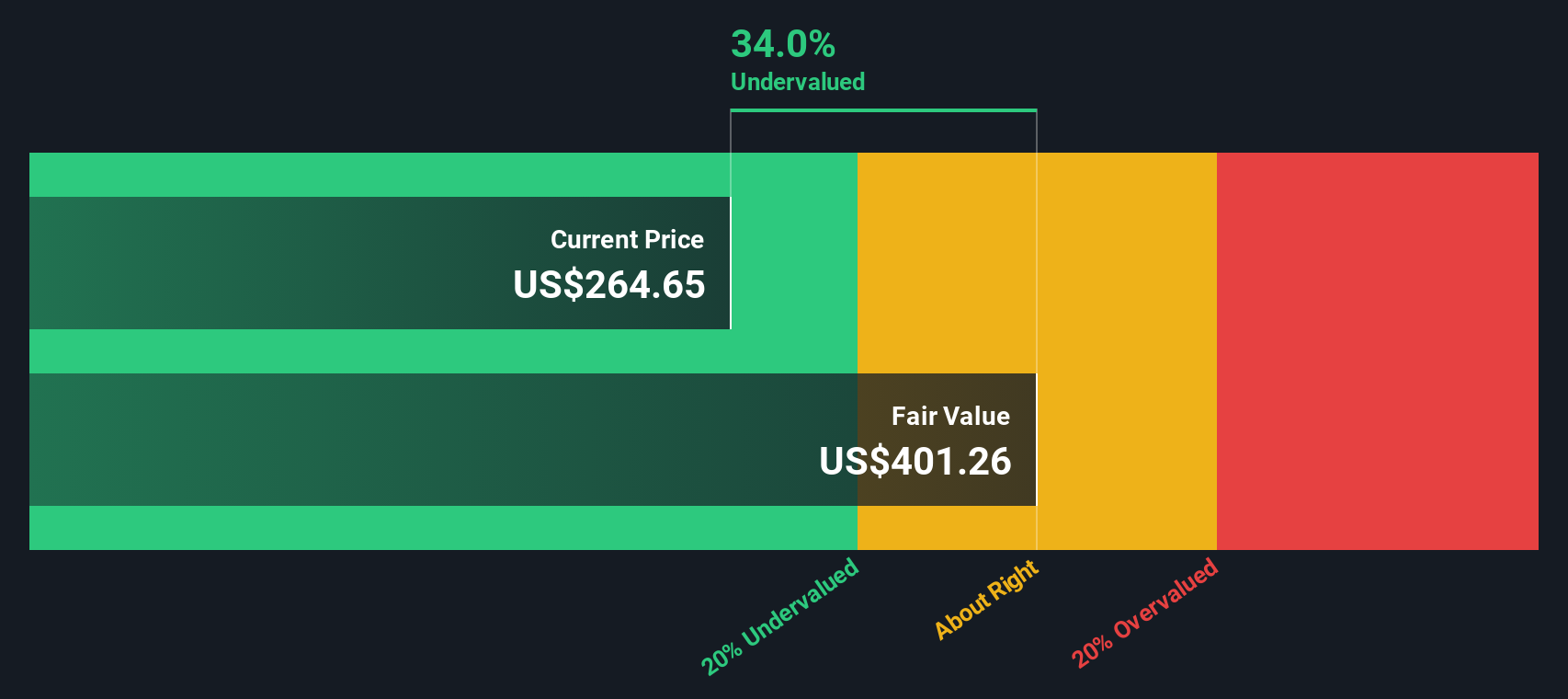

Find out about the key risks to this Illinois Tool Works narrative.Another View: The SWS DCF Model Says Undervalued

While analyst price targets suggest Illinois Tool Works is a bit overvalued, our DCF model presents a different perspective and indicates the stock might actually be undervalued. Which outlook do you trust when making investment choices?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Illinois Tool Works Narrative

If you see things differently or want to go deeper into the numbers yourself, you can quickly build your own view from scratch in just a few minutes. do it your way.

A great starting point for your Illinois Tool Works research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one stock? Explore powerful opportunities the market has to offer right now by checking out these hand-picked themes. Stay ahead of the crowd and make your next move with confidence by searching for stocks that align with what matters most to you.

- Uncover growth by targeting high-yield opportunities through dividend stocks with yields > 3% that consistently deliver attractive income streams for your portfolio.

- Strengthen your portfolio against market shifts by identifying AI penny stocks reshaping industries with breakthrough artificial intelligence.

- Maximize your edge by scanning today’s undervalued stocks based on cash flows and find companies trading well below their projected cash flows before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITW

Illinois Tool Works

Provides industrial products and equipment in North America, Europe, the Middle East, Africa, the Asia Pacific, and South America.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives