- United States

- /

- Machinery

- /

- NYSE:IR

A Fresh Look at Ingersoll Rand (IR) Valuation Following Recent Share Price Uptick

Reviewed by Simply Wall St

Ingersoll Rand (IR) shares moved moderately higher today, catching the attention of investors who track industrial stocks closely. As the stock’s price action over the past month has shown minor shifts, market participants are watching for indicators of shifting sentiment.

See our latest analysis for Ingersoll Rand.

After a bumpy start to the year, Ingersoll Rand’s share price has started to regain some ground, jumping 6% over the past week even as the year-to-date share price return remains negative. Looking at the longer term, the stock’s total shareholder return is up an impressive 65% across three years and 130% over five, indicating that momentum over the past year has faded but the long-term growth story remains very much intact.

If you’re looking to spot more promising moves across industrials, now is the perfect time to broaden your watchlist and explore fast growing stocks with high insider ownership

With the stock climbing in recent days but longer-term returns already strong, investors may be wondering whether Ingersoll Rand is currently undervalued or if the market has already accounted for all the future growth potential they are hoping for.

Most Popular Narrative: 10.7% Undervalued

The market close of $80.36 sits just below the fair value projected by the most closely followed narrative, pointing to untapped upside. Here is the key driver analysts have zeroed in on.

Ingersoll Rand is capitalizing on accelerating global demand for energy-efficient and sustainable industrial equipment, supported by new breakthroughs like the CompAir Ultima oil-free compressor and the EVO Series electric diaphragm pump. Both deliver notable efficiency gains. These innovations reinforce pricing power and are anticipated to drive revenue growth and margin expansion as regulatory and customer focus on sustainability intensifies.

What if the real story behind this premium valuation lies in relentless earnings momentum, aggressive revenue targets, and margin expansion that surprises? The financial assumptions powering this calculation are anything but modest. Want the full breakdown?

Result: Fair Value of $90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing acquisition challenges and prolonged geopolitical uncertainty could quickly change the outlook, which may make these growth assumptions much harder to achieve.

Find out about the key risks to this Ingersoll Rand narrative.

Another View: High Multiple Signals Caution

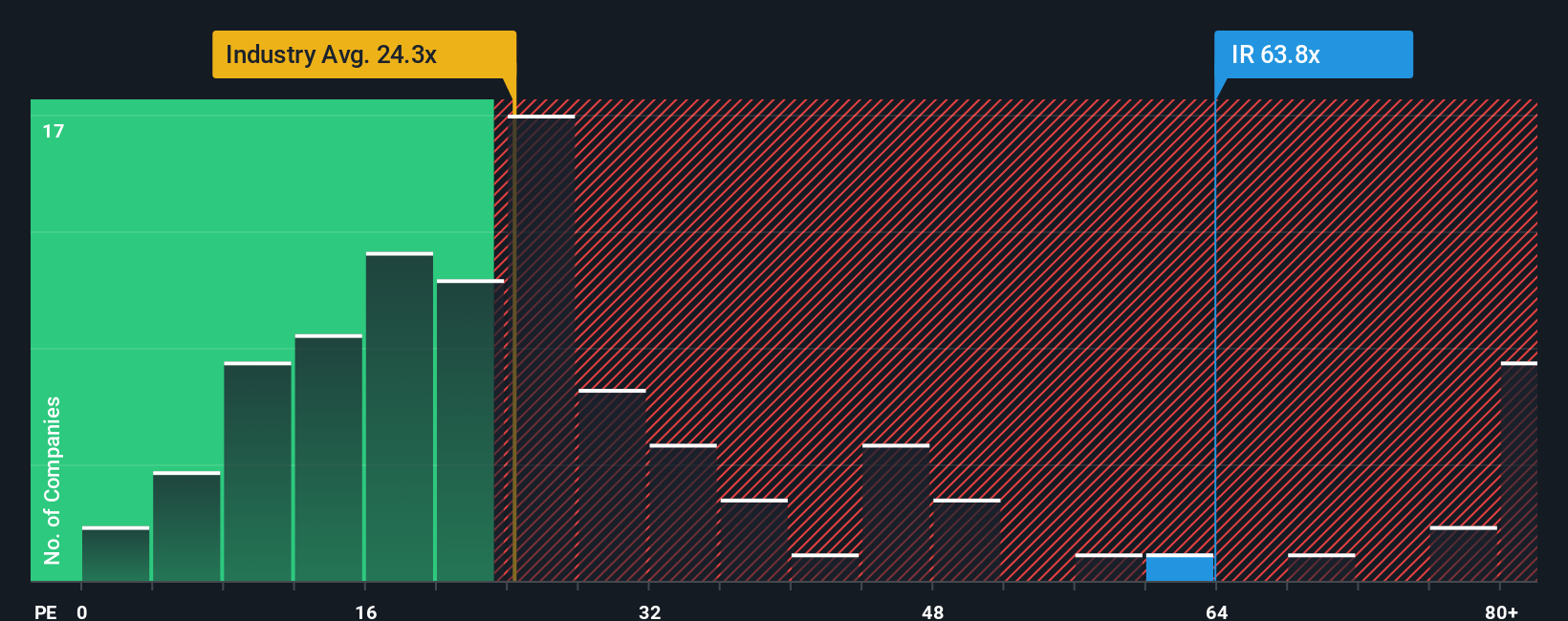

Looking at valuation through the lens of earnings multiples, Ingersoll Rand is currently trading at a price-to-earnings ratio of 61.1 times, which is significantly higher than both its peer group’s average (25.9x) and the sector’s fair ratio (36.8x). This wide gap means the market is pricing in big future growth, but it also introduces a higher risk if expectations fall short. After such a strong run, could this premium set up for future disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ingersoll Rand Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily craft your own story in just a few minutes with Do it your way.

A great starting point for your Ingersoll Rand research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. With just a few clicks, you can spot trends and strategies across different sectors and make your next smart investment move today.

- Scan high yield opportunities and boost your passive income by browsing these 17 dividend stocks with yields > 3% that consistently deliver dividend payouts above 3%.

- Access breakthrough innovations shaping the future of medicine with these 33 healthcare AI stocks powered by advances in artificial intelligence and next-generation diagnostics.

- Capitalize on the unstoppable momentum in digital assets and financial technology by checking out these 80 cryptocurrency and blockchain stocks leading the blockchain and cryptocurrency ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IR

Ingersoll Rand

Provides various mission-critical air, fluid, energy, and medical technologies services and solutions worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives