- United States

- /

- Machinery

- /

- NYSE:IEX

IDEX (IEX) Margin Decline Challenges Quality Growth Narrative Despite Forecast 13.2% Earnings Increase

Reviewed by Simply Wall St

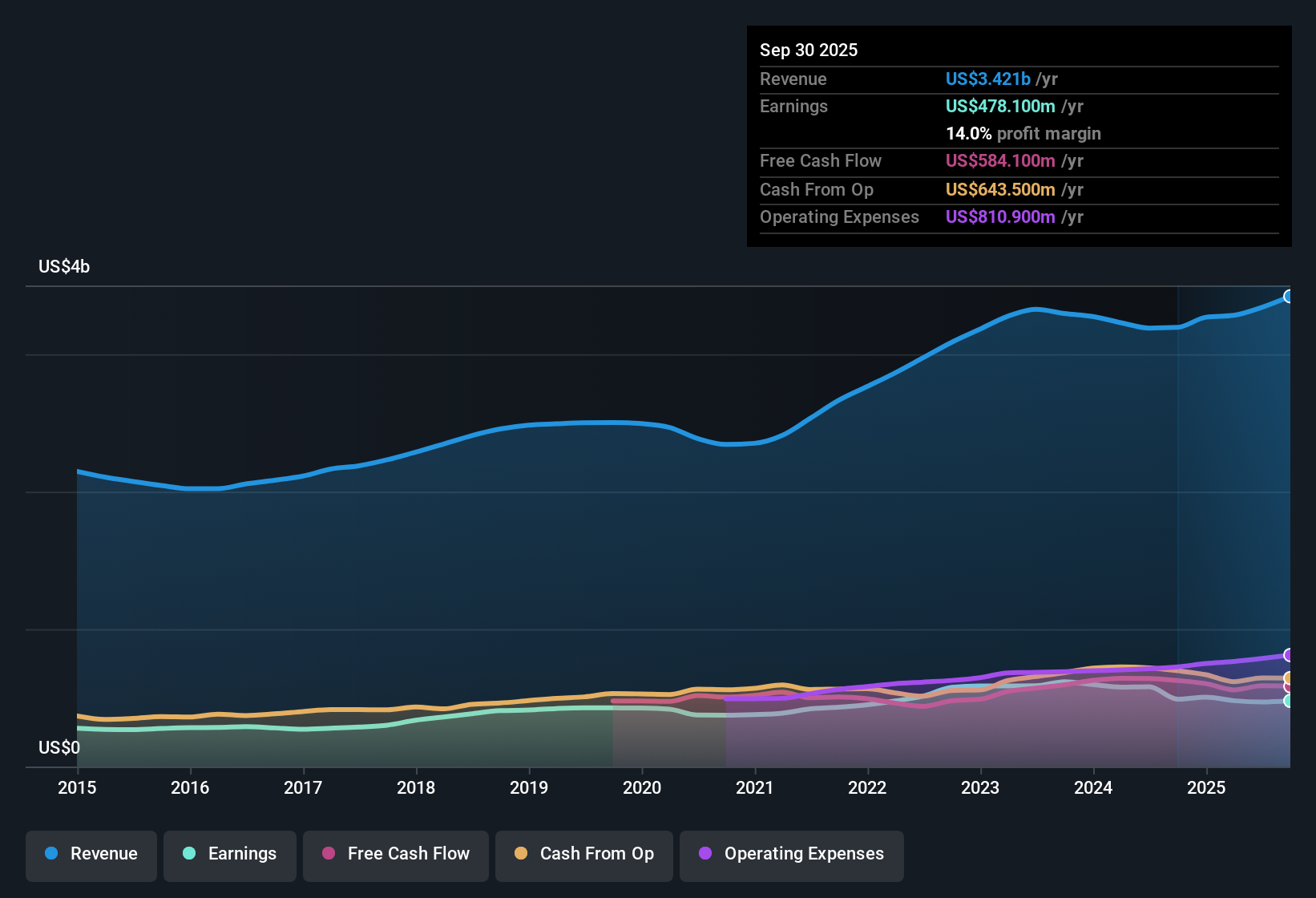

IDEX (IEX) posted earnings that are expected to grow 13.2% annually, with revenue forecast to rise 6% per year going forward. While net profit margins stand at 14%, down from 15.3% the previous year, the company has averaged 5.1% annual earnings growth over the last five years but reported negative earnings growth in the most recent period. With no major risks currently signaled and a reputation for attractive dividend attributes, investors are now weighing past quality against recent margin pressure and growth trends that lag the broader market.

See our full analysis for IDEX.Next up, we will see how these headline figures measure up against the most widely held narratives and expectations for IDEX on Simply Wall St.

See what the community is saying about IDEX

Cost-Saving Efforts Target $20 Million Amid Margin Dip

- IDEX has initiated new cost-saving measures aiming for $20 million in additional savings, following a drop in net profit margin to 14% from 15.3% in the previous year.

- According to the analysts' consensus view, this platform optimization and organizational delayering is expected to support net margin recovery.

- The consensus narrative notes the company is targeting 17.3% margins in three years, which would mark a significant improvement from current levels if savings are fully realized.

- It is notable that even as margins fell recently, these restructuring efforts may partially offset ongoing pressures from rising tariffs and sector-specific setbacks.

- To see if analysts’ optimism is justified amid current margin challenges, dig into the full consensus narrative for IDEX. 📊 Read the full IDEX Consensus Narrative.

Acquisition of Mott Expands Revenue Streams

- The recently completed Mott acquisition, including a $40 million multiyear wastewater filtration deal, is one of several moves anticipated to boost IDEX's capabilities and diversify income sources.

- From the analysts' consensus perspective, strategic M&A is set to enhance growth levers.

- The consensus narrative highlights that innovation and integration from the Mott deal could open new markets, amplifying IDEX's core growth in space, defense, and energy while providing higher-margin solutions in sectors like pharmaceuticals and data centers.

- Critics highlight that margin dilution from acquisitions remains a risk, though the company’s emphasis on cost savings aims to manage integration expenses.

Shares Trade Below DCF Fair Value, But Premium to Peers

- IDEX’s current share price of $170.30 sits well below its DCF fair value estimate of $237.51, but remains expensive versus peers, with its 26.0x price-to-earnings ratio above the US machinery industry average of 24.7x.

- The analysts' consensus narrative stresses the valuation tug-of-war.

- While headline valuation models indicate IDEX could be undervalued on an intrinsic basis, consensus notes justified upside depends on achieving future growth targets, like $698.2 million in earnings and a margin rebound to 17.3% by 2028.

- It is noteworthy that analyst price targets, at $193.67, require belief in a return to sector-leading execution and some market patience, despite trailing growth forecasts compared to the broader market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IDEX on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Share your insight and build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding IDEX.

See What Else Is Out There

IDEX’s recent margin pressure and slower-than-market growth highlight the challenges in maintaining consistent performance and meeting aggressive future targets.

If you want companies already proving steady results, use stable growth stocks screener (2108 results) to zero in on stocks delivering reliable expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IEX

IDEX

Provides applied solutions in the United States, rest of North America, Europe, Asia, and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives