- United States

- /

- Aerospace & Defense

- /

- NYSE:HXL

Should You Reconsider Hexcel After a 17.8% Weekly Surge?

Reviewed by Bailey Pemberton

If you're wondering what to do with Hexcel stock after its recent run, you're not alone. With the share price closing at $72.79 and up a whopping 17.8% over the last week alone, Hexcel has grabbed investors' attention in a serious way. Zooming out, the stock has gained 14.9% over the last 30 days and is up 124.6% over five years. A multiyear climb like this naturally gets investors asking if there is still value left on the table, or if all the growth is already priced in.

A quick look at Hexcel's year-to-date returns reveals the same strong momentum, matching its one-year performance at 17.8%. Some of this energy stems from ongoing developments in the aerospace sector, where demand for advanced composites and lightweight materials continues to intensify. While there have not been major game-changing announcements recently, a steady drumbeat of positive sentiment about industry recovery and new contracts has helped sustain investor optimism.

But momentum alone does not tell us if the stock is fairly valued. According to our analysis, Hexcel currently earns a value score of 2, meaning it is undervalued under two out of six key valuation checks. This suggests there may still be some overlooked value, but it is far from a slam dunk bargain.

So how exactly is Hexcel stacking up when we dig deeper into different valuation yardsticks? Let's walk through each method, and as we go, consider what really matters most when assessing a company's true value.

Hexcel scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Hexcel Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a stock by projecting the company's future free cash flows and then discounting those cash flows back to their present value. This approach helps investors assess whether the current share price appropriately reflects the company's future earning power.

For Hexcel, the current Free Cash Flow stands at $176.46 million. Analysts forecast steady growth, with Free Cash Flow projected to reach $351.35 million by the end of 2028. These projections only span five years, so the remaining ten-year cash flow estimates are extrapolated by financial models rather than direct analyst forecasts.

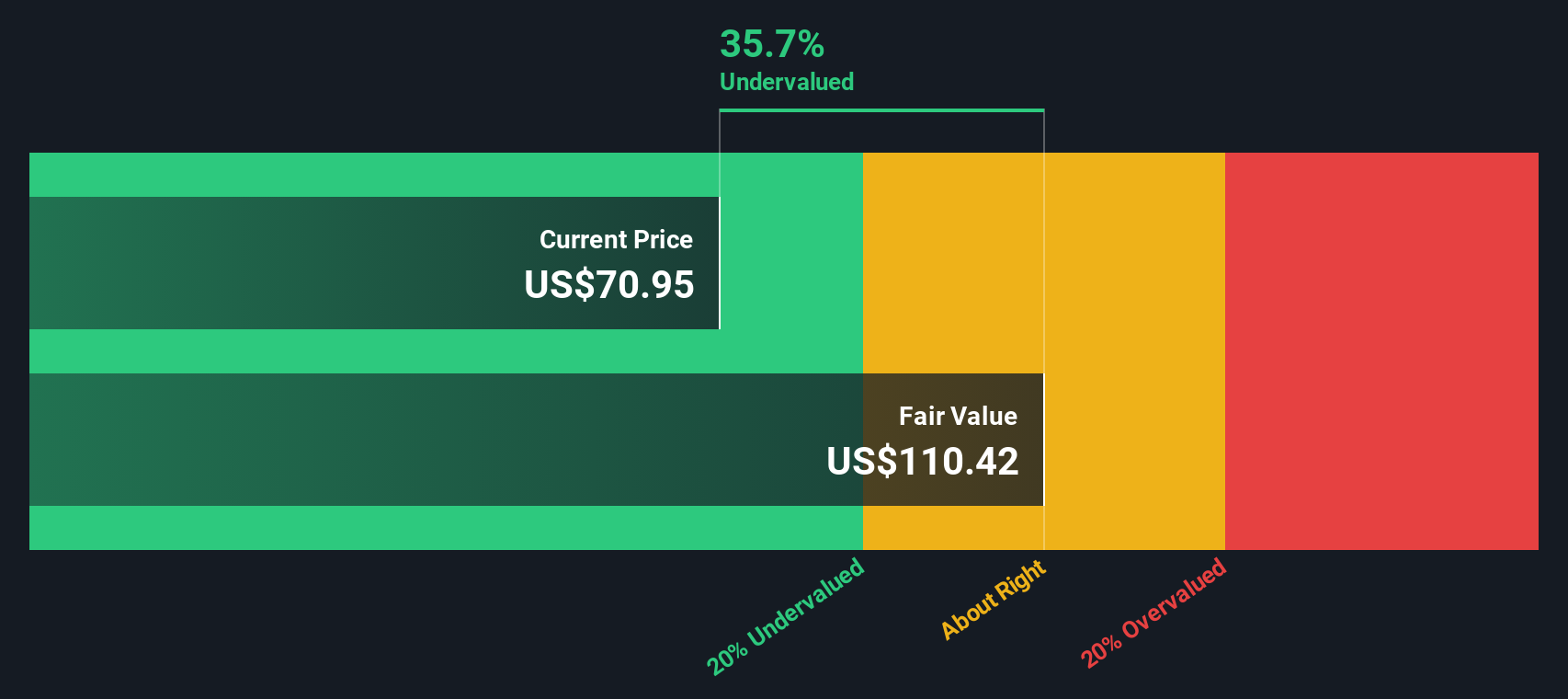

Using a 2 Stage Free Cash Flow to Equity model and discounting all future cash flows, the resulting estimated intrinsic value is $113.08 per share. Compared to the current market price of $72.79, this implies the stock is trading at a 35.6% discount to its intrinsic value, meaning it is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hexcel is undervalued by 35.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hexcel Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a go-to valuation metric for profitable companies, like Hexcel, because it connects a company's current share price to its earnings per share. Investors often rely on this multiple to determine whether the stock price fairly reflects future profit potential, especially given that strong, stable earnings provide a reliable benchmark for comparison.

Of course, what counts as a "fair" or “normal” P/E ratio is shaped by expectations about a company's future growth, as well as its risk profile. Growing companies with steady profits often warrant higher P/E ratios, while those facing uncertainty or slowdowns typically trade at lower multiples.

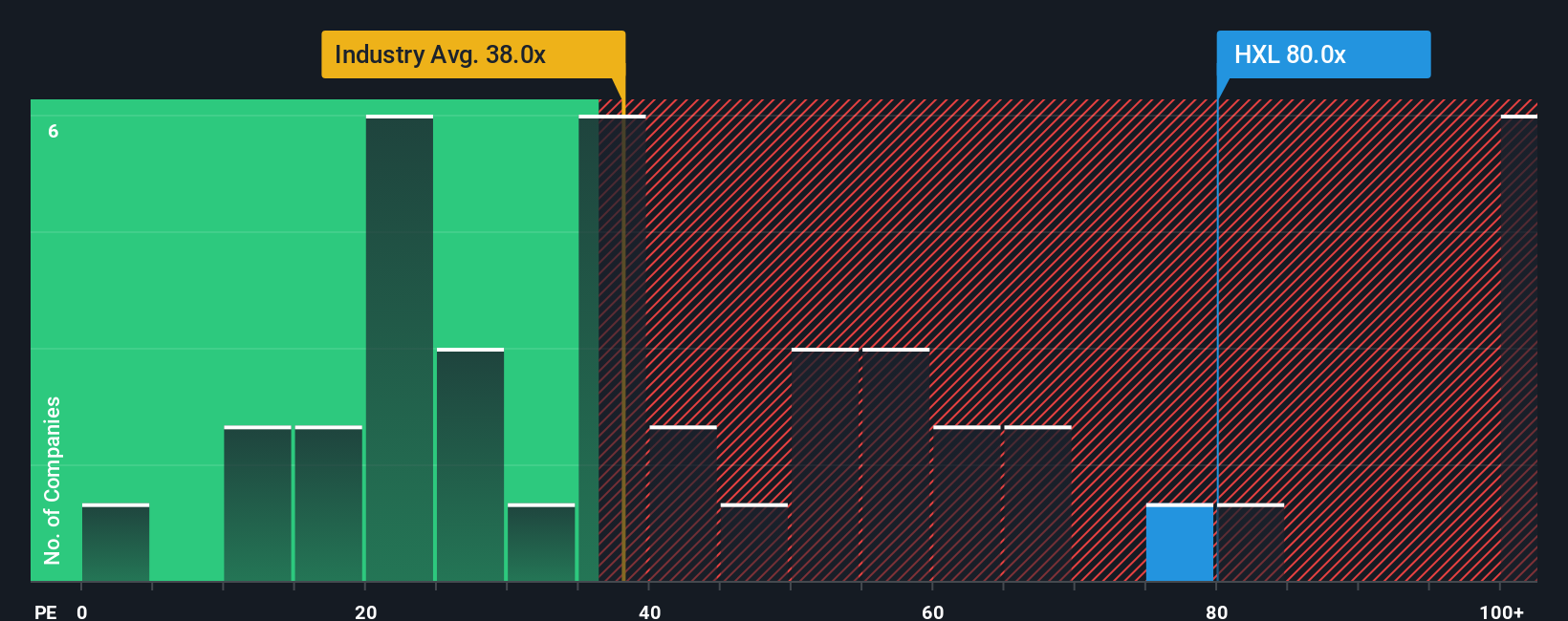

Currently, Hexcel trades at a P/E ratio of 84.22x. This stands out notably higher than the broader Aerospace & Defense industry average of 39.61x and the peer group average of 80.00x. However, the more tailored "Fair Ratio," a proprietary metric developed by Simply Wall St that factors in Hexcel’s earnings growth, margins, industry, scale, and specific risks, comes in at 39.16x. Unlike a simple comparison to peers or industry averages, the Fair Ratio is designed to reflect the company’s unique operating profile and future prospects.

Comparing the Fair Ratio of 39.16x to Hexcel’s actual P/E of 84.22x, the shares are trading well above what would be expected given the company’s fundamentals and risk profile. This suggests that, based on this valuation method, the stock is overvalued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hexcel Narrative

Earlier, we mentioned there is an even better way to understand valuation. Now let’s introduce you to Narratives. A Narrative is simply your story about a company, a way to express your perspective and assumptions behind the numbers, connecting what you believe about Hexcel’s future revenue, earnings, and margins to a calculated fair value.

This approach goes beyond static metrics by linking your personal outlook with a transparent financial forecast. It then shows you a fair value estimate so you can see if the stock is mispriced. Narratives are easy to create and adjust within the Simply Wall St Community page, empowering millions of investors to back up their viewpoints with real numbers.

They also keep you up to date. When new information, such as earnings results or significant news, comes in, Narratives are dynamically updated so your valuation always reflects the latest data. These tools help you decide when to buy or sell by constantly comparing your own fair value to the live share price, all in one place.

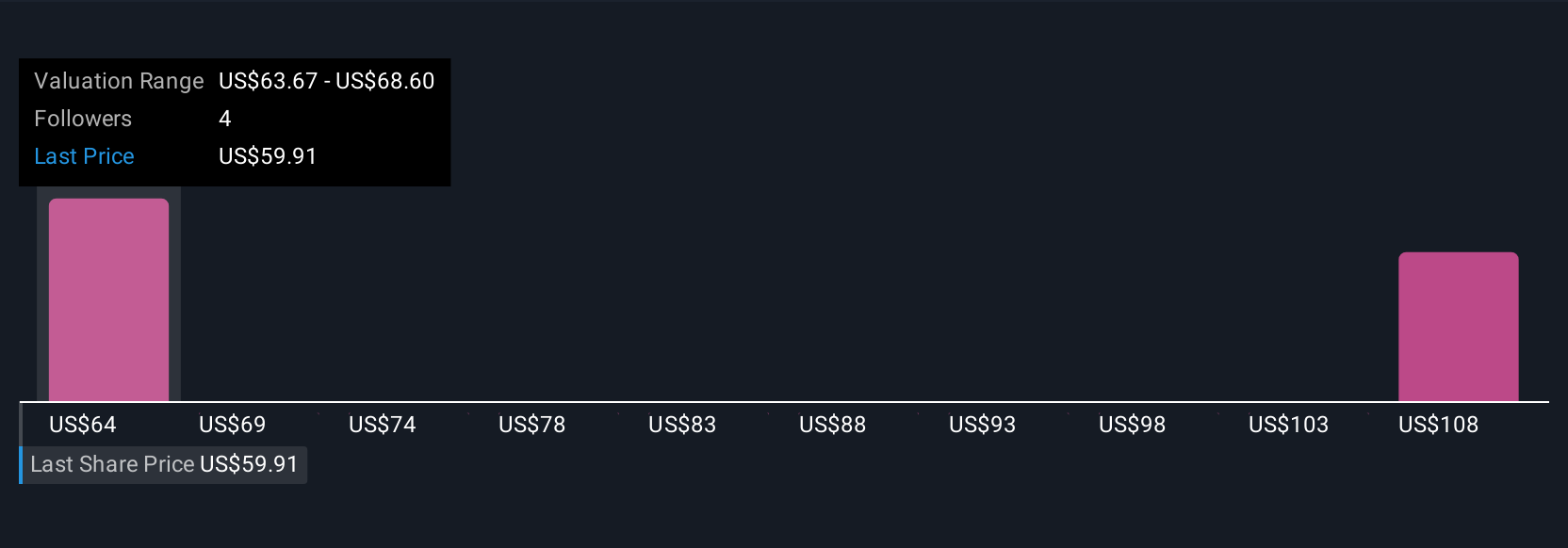

For example, some Hexcel investors build bullish Narratives based on robust free cash flow and strong aerospace demand, resulting in fair value estimates as high as $80. More cautious perspectives focus on supply chain risks and lower earnings forecasts, producing price targets around $55.

Do you think there's more to the story for Hexcel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexcel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HXL

Hexcel

Develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives