- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Howmet Aerospace (HWM): Reassessing Valuation After Strong Quarterly Growth and Ongoing Market Outperformance

Reviewed by Simply Wall St

Howmet Aerospace (HWM) just delivered upbeat quarterly results, with revenue and earnings per share climbing solidly year over year. The stock has been quietly outpacing the broader Dow over the past three months.

See our latest analysis for Howmet Aerospace.

Even after a recent pullback, with a 30 day share price return of negative 7.6 percent and a 7 day decline, Howmet’s year to date share price surge above 70 percent and five year total shareholder return above 600 percent signal powerful, still intact momentum.

If this kind of outperformance has your attention, it is worth seeing which other names in the sector are gaining traction through aerospace and defense stocks.

With earnings growth accelerating, a strong multiyear run behind it, and analyst targets still implying upside, investors now face a key question: Is Howmet still misunderstood by the market, or is future growth already fully priced in?

Most Popular Narrative: 17.7% Undervalued

With Howmet Aerospace last closing at $190.98 against an implied fair value near $232, the prevailing narrative leans toward meaningful upside still ahead.

Strategic investments in automation and digital manufacturing, combined with cost rationalization and product mix optimization, are driving underlying productivity improvements and gross margin expansion, supporting robust long-term earnings growth.

Want to see what kind of revenue runway and margin lift could justify this premium earnings multiple on a capital intensive manufacturer? The most followed narrative lays out an aggressive path for top line growth, expanding profitability, and shrinking share count that aims to support a valuation framework usually reserved for faster growing sectors. Curious which specific earnings and revenue milestones this view depends on, and how long the market is expected to pay up for that trajectory? Explore the full narrative to unpack the assumptions driving this fair value call.

Result: Fair Value of $232.15 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimistic path could be challenged if aerospace build rates stumble or major OEM customers renegotiate contracts, which could pressure margins and earnings visibility.

Find out about the key risks to this Howmet Aerospace narrative.

Another Lens on Valuation

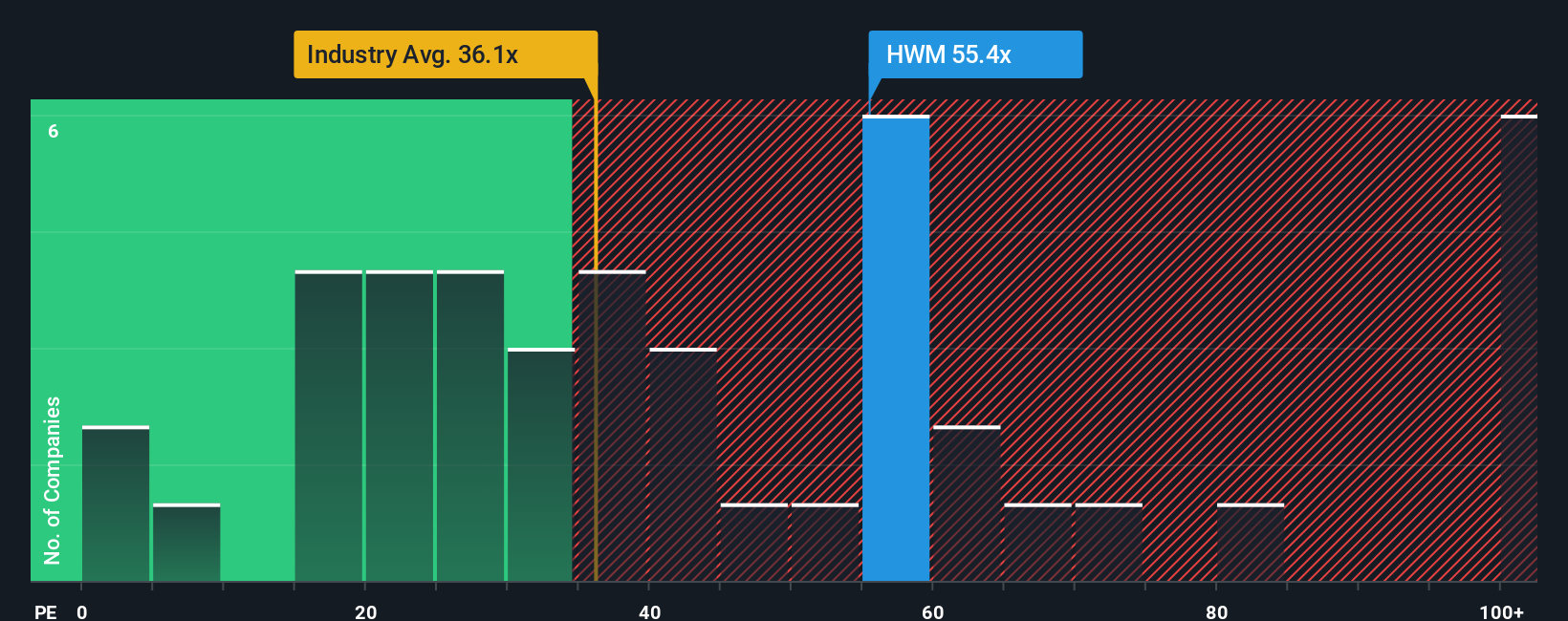

While the narrative model suggests upside, a simple earnings multiple tells a tougher story. At roughly 53 times earnings versus 37 times for the US Aerospace and Defense group and 26.7 times for peers, and above a fair ratio of 35.1 times, Howmet already bakes in a lot of perfection. This leaves investors to ask how much future surprise is really left.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Howmet Aerospace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

Before you move on, lock in a few high potential ideas from the Simply Wall St Screener so you are not relying on just one winning story.

- Capture mispriced opportunities by targeting companies flagged as undervalued using these 903 undervalued stocks based on cash flows before the rest of the market catches on.

- Position yourself for structural growth by focusing on innovation leaders highlighted in these 26 AI penny stocks at the heart of the AI transformation.

- Boost your potential income stream by zeroing in on reliable payers surfaced through these 15 dividend stocks with yields > 3% while yields remain attractive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026