- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Howmet Aerospace (HWM): Assessing Valuation as Earnings Growth and Industry Momentum Accelerate

Reviewed by Kshitija Bhandaru

Howmet Aerospace (HWM) just declared a quarterly dividend of 12 cents per share, to be paid in late November. This move comes as the company posts impressive growth numbers and benefits from industry momentum.

See our latest analysis for Howmet Aerospace.

Howmet Aerospace's share price has been gaining steady ground as commercial aerospace tailwinds and double-digit segment growth draw attention. With momentum building thanks to rising demand from key clients like Boeing and Airbus, its one-year total shareholder return stands at a solid 0.86%, reflecting both resilience and growth potential.

Considering aerospace is in focus right now, it could be the perfect moment to discover other sector standouts. Check out See the full list for free..

Yet with eye-catching earnings growth and continued industry tailwinds, is Howmet currently trading at a discount or have investors already priced in the company’s expected gains? Could this be a genuine buying opportunity, or is future growth already reflected in the share price?

Most Popular Narrative: 6.8% Undervalued

Howmet Aerospace’s narrative-based fair value is higher than the latest closing price, suggesting there may be potential for further upside. Explore the thesis that is drawing attention from market-watchers and learn what could influence the story moving forward.

The record high commercial aircraft backlog and accelerating global air travel, especially in Asia Pacific and Europe, are fueling increased production rates (for example, 737 MAX and A320). This is leading to sustained and growing demand for Howmet's structural engine components, which supports higher revenues and multi-year visibility on earnings.

Curious which bold projections drive this valuation? The full narrative details the major growth levers, margin goals, and market dynamics underpinning analyst confidence. See exactly what financial performance is anticipated from Howmet in the next stage.

Result: Fair Value of $204.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain hiccups or any slowdown in aircraft production rates could quickly cloud the company’s growth outlook and dampen future revenue momentum.

Find out about the key risks to this Howmet Aerospace narrative.

Another View: Multiples Tell a Cautionary Story

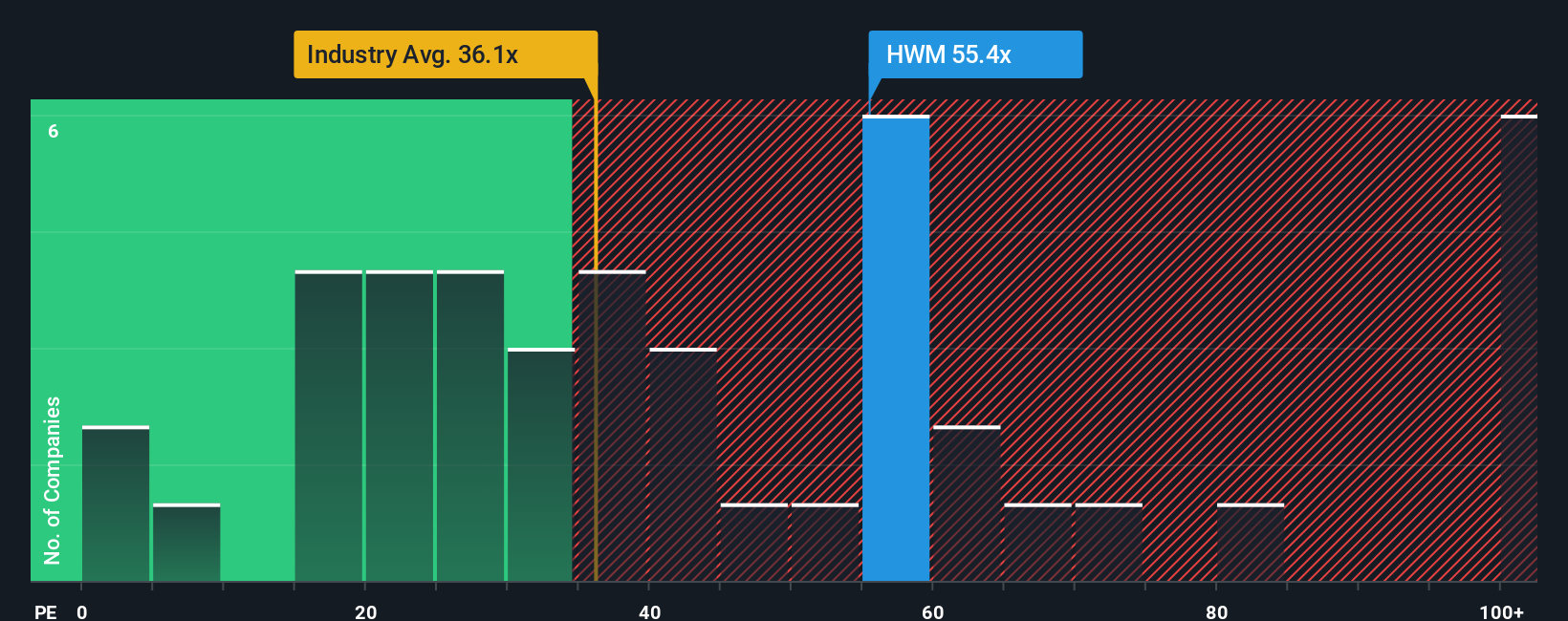

While some see upside based on fair value, the current price-to-earnings ratio for Howmet Aerospace is steep at 55 times earnings. That's far above the US Aerospace & Defense industry average of 39.9 and the peer average of 30.1. The fair ratio, as estimated by regression analysis, sits even lower at 35.3. This suggests investors may face a risk if market expectations cool or growth stumbles. Could this premium be sustained, or is it flashing a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Howmet Aerospace Narrative

If you want to investigate the numbers firsthand or examine different scenarios, you can build your own narrative for Howmet Aerospace in just a few minutes. Do it your way

A great starting point for your Howmet Aerospace research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and spot smart opportunities by checking out unique stock picks trusted by savvy investors. You don’t want to miss what’s trending.

- Maximize your yield potential and find reliable income streams by reviewing these 19 dividend stocks with yields > 3% with strong returns and yields above 3%.

- Tap into the AI revolution by seeing which companies are gaining traction right now with these 25 AI penny stocks transforming the next wave of intelligent tech.

- Position yourself early in blockchain innovation by investigating these 78 cryptocurrency and blockchain stocks that are shaking up the digital future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives