- United States

- /

- Aerospace & Defense

- /

- NYSE:HWM

Can Howmet’s Soaring Share Price in 2025 Still Be Justified After Record Aircraft Orders?

Reviewed by Bailey Pemberton

Thinking about what to do with your Howmet Aerospace shares or considering making a move? You would not be alone. After all, Howmet's gains have been hard to ignore this year. The stock has powered up by 72.5% since January, left the S&P 500 in the dust over the last year with a 90.2% jump, and long-term investors have been treated to a stunning 933.5% surge over five years. Even in the last month, the shares are up more than 10%.

What is fueling this performance? Much of the momentum traces back to optimism about the broader aerospace sector. Recent increases in aircraft demand and supply chain improvements have drawn new attention to specialty suppliers like Howmet, which produces the crucial engine parts and components that keep modern aviation flying. As markets shake off volatility and revisit sectors that were once seen as risky, Howmet is suddenly on a lot of radars.

With so much growth already priced in, though, the big question is clear: is Howmet still a good value at $191.08 per share, or are these returns mostly in the past? If you like to crunch numbers, here is the quick reality check. Using six standard undervaluation metrics, Howmet scores a 0 out of 6, meaning it is not undervalued by any typical benchmark right now.

But as you will see, valuation is a nuanced topic and no single number tells the full story. Let’s dive into the most common methods used to judge value, and later, we will explore if there is a smarter way to analyze what Howmet is really worth.

Howmet Aerospace scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Howmet Aerospace Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting how much cash it will generate in the future, then discounting those cash flows back to today's dollars. This approach uses projections of Free Cash Flow (FCF), a key measure of financial health and profitability.

Howmet Aerospace currently produces $1.11 Billion in FCF. Analysts provide explicit FCF growth estimates for the next five years, expecting strong expansion. By 2029, FCF is projected to reach $2.53 Billion. Beyond the analyst forecast period, Simply Wall St extrapolates further estimates, but it is worth noting that extended projections become more speculative.

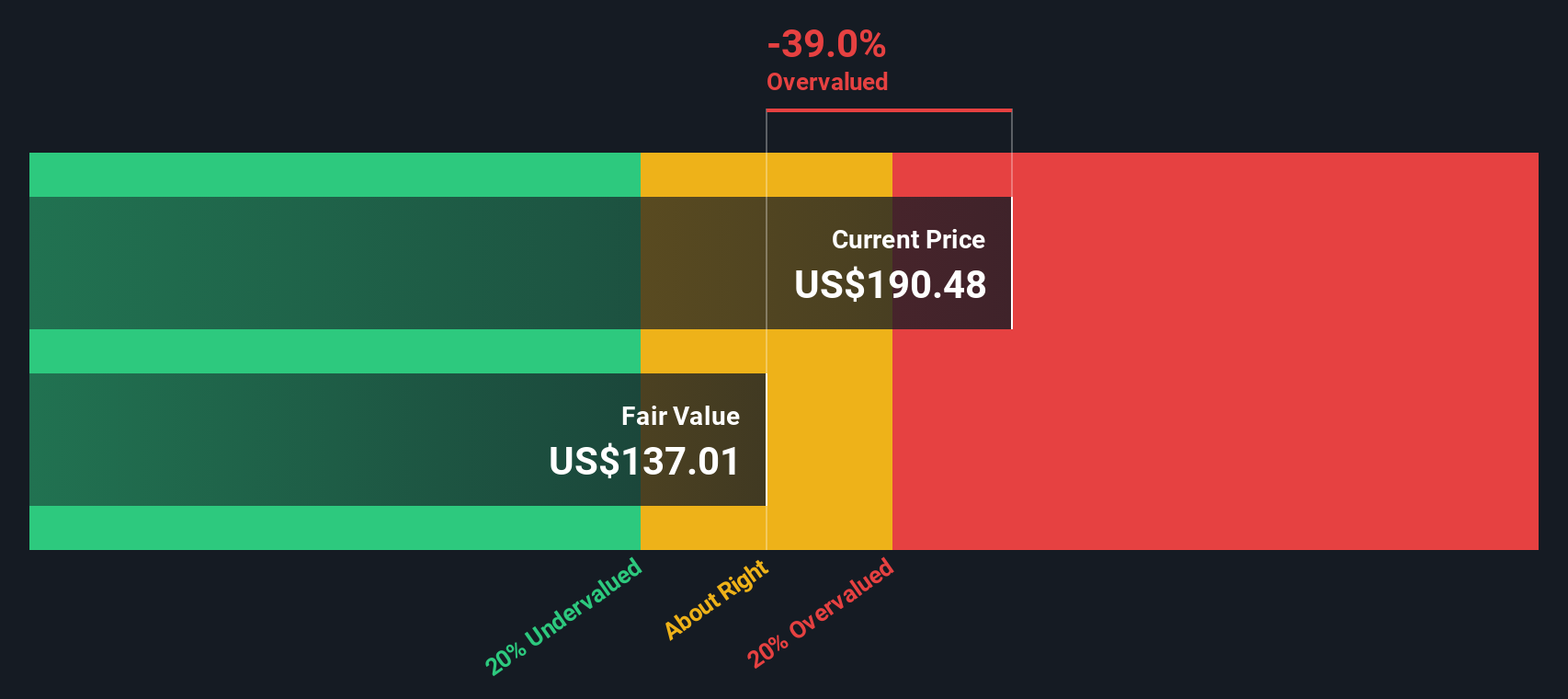

According to the 2 Stage Free Cash Flow to Equity DCF model, the fair value calculated for Howmet Aerospace is $137.41 per share. However, with the stock currently trading at $191.08, the DCF suggests shares are approximately 39.1% overvalued. This indicates the market price assumes more optimistic growth than the model projects.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Howmet Aerospace may be overvalued by 39.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Howmet Aerospace Price vs Earnings (PE)

For profitable companies like Howmet Aerospace, the Price-to-Earnings (PE) ratio is one of the most widely used and reliable valuation multiples. It gives investors a sense of how much they are paying for a dollar of current earnings, making it easier to compare across businesses and industries.

Interpreting the PE ratio, however, is more nuanced than just looking for a low number. A higher PE can be justified if investors expect faster earnings growth or if the business faces lower risk. Conversely, a lower PE might signal slower growth or more uncertainty. That is why it is important to compare a company’s multiple to those of its industry and similar peers.

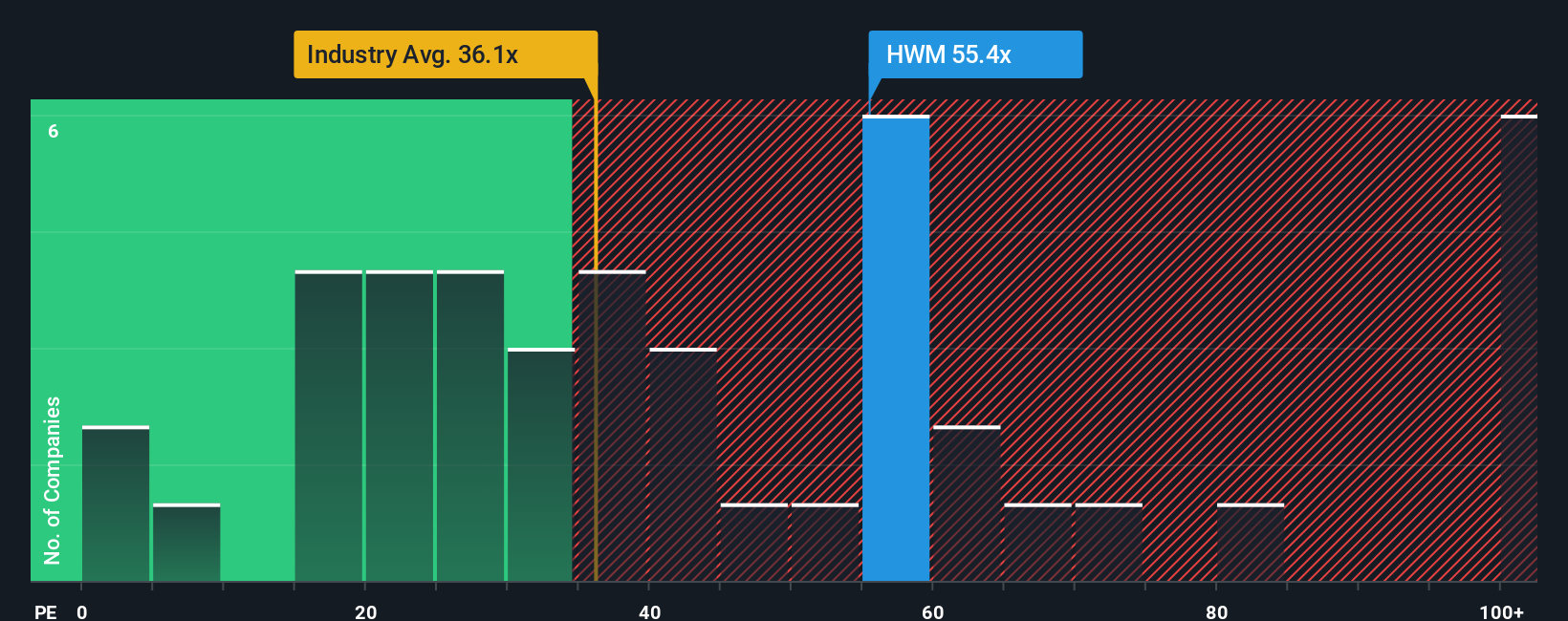

Right now, Howmet Aerospace trades at a PE of 55.2x, which is well above both the Aerospace & Defense industry average of 39.1x and its peer group average of 29.6x. At first glance, this might suggest the shares are expensive. However, Simply Wall St’s proprietary “Fair Ratio,” a custom benchmark that considers the company’s unique growth outlook, profitability, market cap, and specific risks, comes in lower at 35.5x. Unlike basic peer or industry comparisons, the Fair Ratio digs deeper by balancing context and the company’s fundamentals to set a more tailored benchmark.

Since Howmet’s actual PE of 55.2x is significantly higher than its Fair Ratio of 35.5x, the stock looks overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Howmet Aerospace Narrative

As we hinted earlier, there is a more insightful way to approach valuation by building a Narrative. A Narrative goes beyond just crunching numbers; it is your own investment story, where you connect what you believe about Howmet Aerospace’s business, strategy, and future with logical, data-backed forecasts for revenue, earnings, and margins, resulting in your own calculated fair value.

Simply Wall St makes Narratives accessible to everyone: within the Community page, investors can easily craft and share their Narratives, updating them as fresh news or financial results become available. Narratives help you decide when to buy or sell by comparing your fair value to the current share price, and because they update dynamically with new information, your perspective stays relevant.

For example, investors with a bullish Narrative on Howmet might expect robust aircraft demand and margin gains, supporting a fair value as high as $225 per share. More cautious investors may highlight supply chain risks and advocate a lower fair value near $186. Narratives empower you to see both the “why” and the “what” behind an investment decision, so you always invest according to your own convictions and understanding.

Do you think there's more to the story for Howmet Aerospace? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Howmet Aerospace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HWM

Howmet Aerospace

Provides advanced engineered solutions for the aerospace and transportation industries in the United States, Japan, France, Germany, the United Kingdom, Mexico, Italy, Canada, Poland, China, and internationally.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives