- United States

- /

- Electrical

- /

- NYSE:HUBB

Hubbell (NYSE:HUBB) Projects 2025 EPS Growth Despite Q1 Sales Decline

Reviewed by Simply Wall St

Hubbell (NYSE:HUBB) has recently gained attention for announcing new corporate guidance and robust financial performance for the first quarter of 2025. With the company projecting strong earnings per share and sales growth for the year, these positive financial disclosures likely contributed to the company's 3% increase in share price over the past month. Amid these announcements, broader market trends showed strength, as the S&P 500 reached its longest winning streak in two decades following a strong jobs report and improved trade outlook. Hubbell's encouraging financial results and guidance further supported the positive market momentum.

Buy, Hold or Sell Hubbell? View our complete analysis and fair value estimate and you decide.

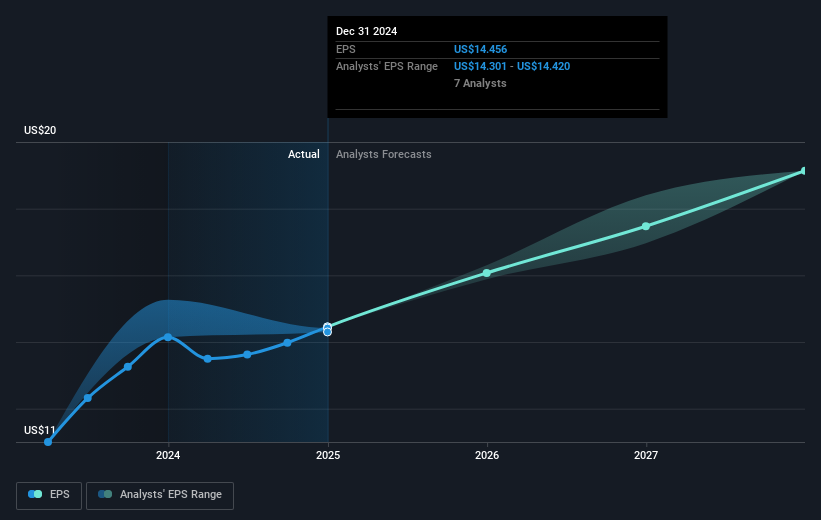

The recent corporate guidance and robust first-quarter financial performance announced by Hubbell are important as they align with the company's broader strategy to leverage data centers and renewables for future success. These developments may support the company's efforts to unify its Electrical Solutions segment and capitalize on utility market trends, potentially leading to improved margins and revenue growth. Furthermore, this positive news could impact analysts’ revenue and earnings forecasts, bolstering their confidence in the company’s growth trajectory and its price target of US$415.46, which sits 13.5% above the current share price of US$359.47.

Over the past five years, Hubbell has delivered a total shareholder return, including share price and dividends, of 215.59%. This long-term performance reflects the company's resilience and growth potential, even as it underperformed the US Electrical industry over the past year by returning less than the industry's 6.3%. Despite near-term challenges, such as tariff uncertainties and telecom segment pressures, the optimistic guidance and market momentum offer a favorable outlook. Analysts remain relatively in agreement, predicting earnings of US$1 billion by 2028, which aligns with their expected fair value estimation, while the share price’s proximity to the analyst consensus suggests a potential upside.

Examine Hubbell's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubbell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBB

Hubbell

Designs, manufactures, and sells electrical and utility solutions in the United States and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives