- United States

- /

- Machinery

- /

- NYSE:HLIO

How Investors May Respond To Helios Technologies (HLIO) Divestment and Distribution Focus in Australia

Reviewed by Sasha Jovanovic

- Helios Technologies announced it has completed the sale of Custom Fluidpower to Questas Group and entered into a long-term exclusive distribution agreement to maintain Sun Hydraulics’ position in the Australian hydraulics market.

- This transaction sees Helios realign its portfolio and capital allocation priorities, highlighting a focus on operational efficiency, debt reduction, and enhanced shareholder returns.

- We’ll examine how the divestiture and new distribution agreement strengthen Helios’s investment narrative with a sharper focus on core markets.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Helios Technologies Investment Narrative Recap

For Helios Technologies, the core belief underpinning ownership hinges on disciplined capital allocation, efficient execution in core markets, and successful adaptation as industrial technology evolves. The recent sale of Custom Fluidpower and entry into an exclusive distribution agreement in Australia supports operational focus and financial flexibility but does not materially change the key short-term catalyst: a resumption of organic revenue growth, nor does it resolve dependence on cyclical end-markets, which remains the biggest risk.

Among recent announcements, Helios’s increased sales guidance to US$810 million - US$830 million stands out, signaling management’s confidence in the refocused business post-divestiture. How sustained this momentum proves, and whether it can insulate earnings from sector volatility, will be central for near-term investors. Despite this sharper focus, it’s important for investors to be aware that ongoing exposure to construction, agriculture, and recreational markets means...

Read the full narrative on Helios Technologies (it's free!)

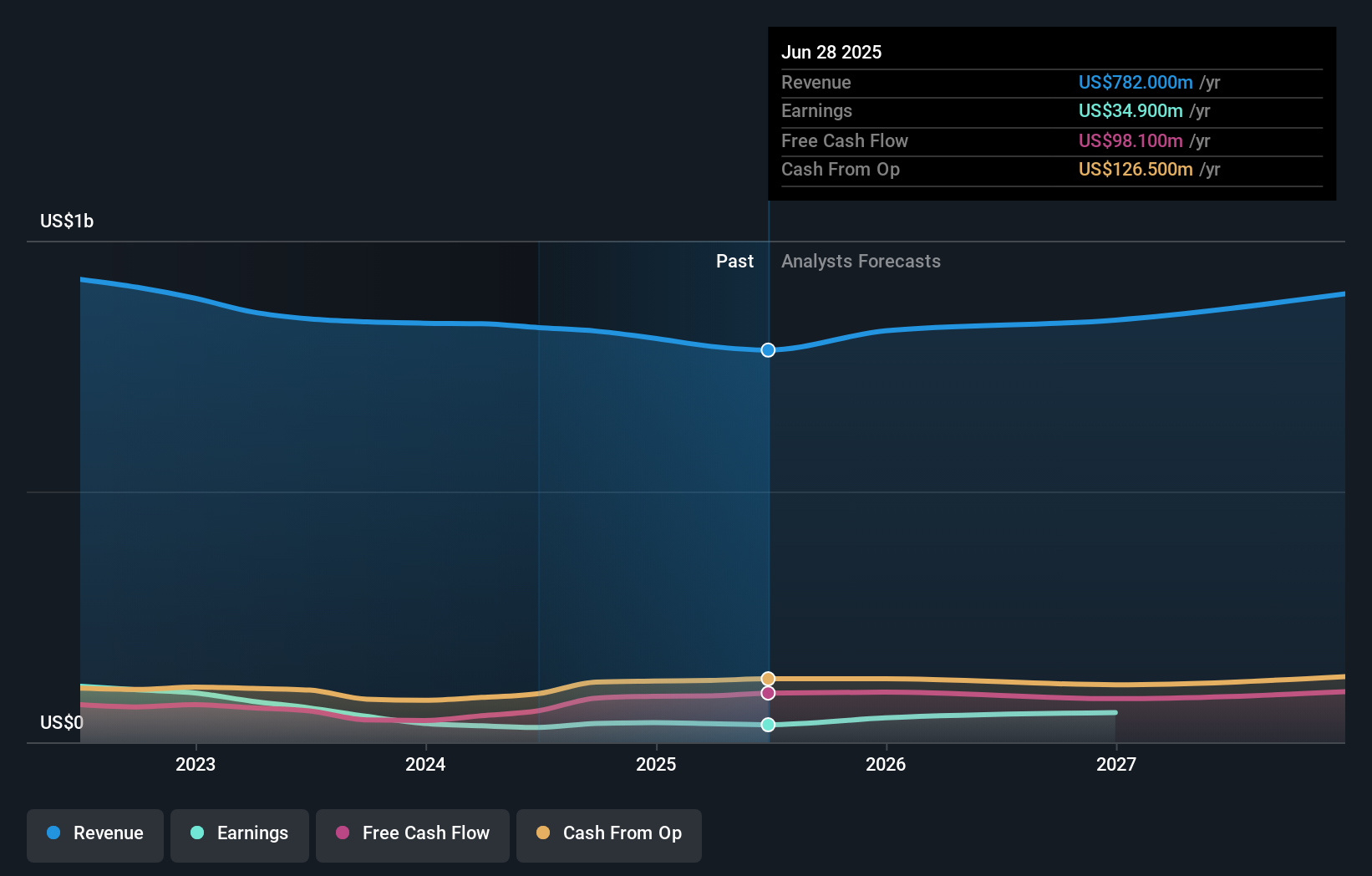

Helios Technologies is projected to achieve $881.8 million in revenue and $95.2 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 4.1% and reflects a $60.3 million increase in earnings from the current $34.9 million.

Uncover how Helios Technologies' forecasts yield a $60.60 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community puts Helios at US$60.60. Many market participants are watching to see if Helios’s increased operational focus can counter sector cyclicality and lead to more stable performance. Explore how different perspectives can inform your own views.

Explore another fair value estimate on Helios Technologies - why the stock might be worth just $60.60!

Build Your Own Helios Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Helios Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Helios Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Helios Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives