- United States

- /

- Machinery

- /

- NYSE:HLIO

Helios Technologies (HLIO): Assessing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Helios Technologies (HLIO) stock has tracked modest movement over the past month, rising around 45% in the past 3 months but staying relatively flat in the past week. This performance comes as investors weigh the company’s longer-term returns and growth trends.

See our latest analysis for Helios Technologies.

While Helios Technologies' share price has surged over 45% in the past three months, its one-year total shareholder return stands at a modest 12%. This suggests recent momentum is building on a previously slower run. This pattern hints that investors may be seeing renewed growth potential or shifting risk perceptions after a quieter period.

If this kind of momentum shift piques your interest, now's a compelling time to branch out and discover fast growing stocks with high insider ownership

With Helios trading at a notable discount to both analyst targets and estimated intrinsic value, the central question is whether the current price underestimates future growth, or if optimism is already fully reflected and leaves little room for upside.

Most Popular Narrative: 13.6% Undervalued

Helios Technologies’ most followed narrative sets its fair value at $60.60, above the recent close of $52.35. This positions the stock as undervalued by 13.6%, judging by the consensus of those closely tracking its future outlook and strategic pivot.

Rapid product innovation and industry electrification position Helios for growth, margin expansion, and increased market share in evolving automation and control solutions. Operational restructuring, diversified revenue streams, and improved capital allocation enhance financial stability, efficiency, and potential for higher long-term earnings.

Want to uncover the reason behind this bullish target? The secret is in Helios’s ambitious margin expansion, disciplined growth roadmap, and a profit outlook that challenges the status quo in industrial technology. Don’t miss the full story to see what’s driving the premium that analysts put on Helios today.

Result: Fair Value of $60.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering industry shifts toward advanced digital solutions and end-market volatility could challenge Helios’s traditional strengths and potentially slow its projected earnings growth.

Find out about the key risks to this Helios Technologies narrative.

Another View: Is Helios Actually Expensive for Its Sector?

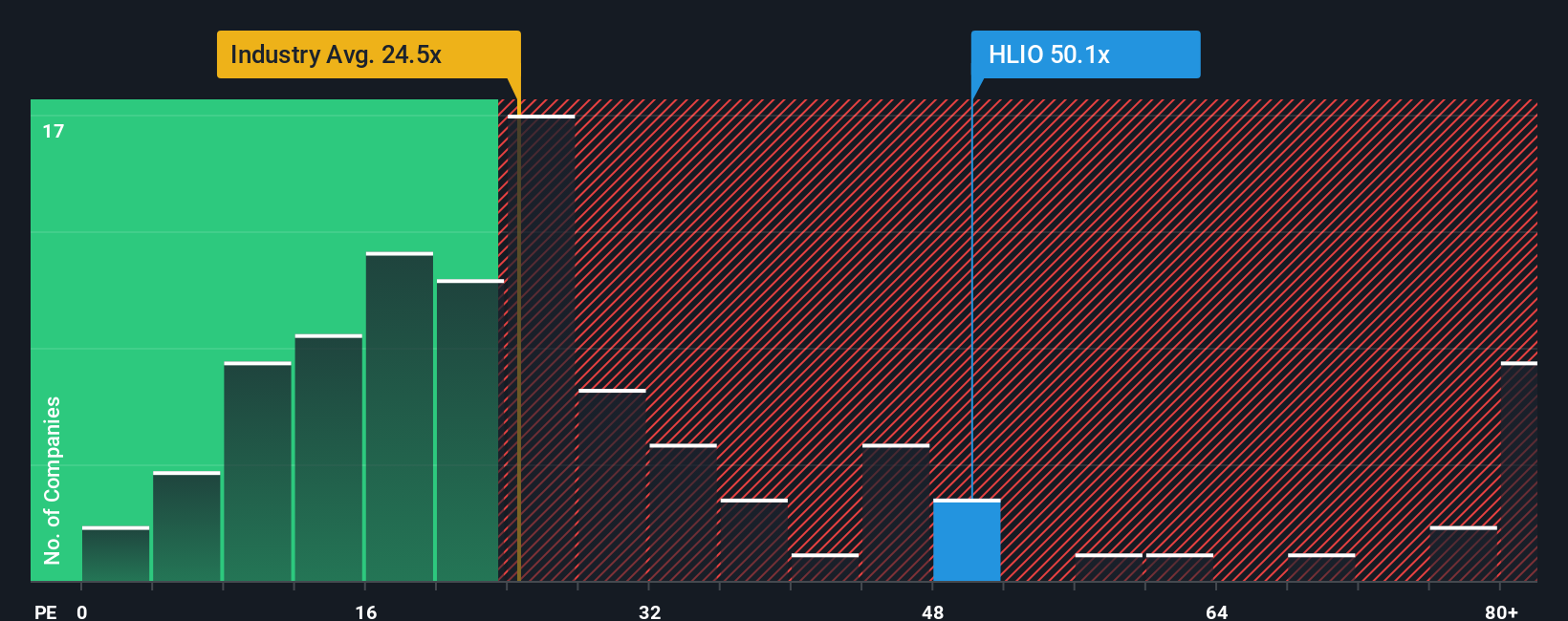

Looking at valuation through the lens of the price-to-earnings ratio tells a different story. Helios trades at 49.7x earnings, well above both the Machinery industry average of 24.1x and the peer average of 37.9x. Even compared to a calculated fair ratio of 40.8x, the stock stands out as pricey. This premium signals investors may be paying up for growth expectations, which could mean there is less margin for error if those numbers do not materialize. Could this lofty multiple introduce added risk for buyers at current prices?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Helios Technologies Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Helios Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never let big opportunities pass by. Supercharge your research and give yourself an edge by tapping into handpicked stocks across powerful growth trends right now.

- Boost your portfolio with potential high yielders and jump into these 19 dividend stocks with yields > 3% for stocks offering robust income opportunities.

- Supercharge your search for innovation and target the future with these 24 AI penny stocks making waves in technology advancements and automation.

- Capitalize on strong value by hunting underappreciated opportunities using these 904 undervalued stocks based on cash flows for stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helios Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLIO

Helios Technologies

Provides engineered motion control and electronic controls technology solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives