- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

Is Huntington Ingalls Still Attractively Priced After 68% Share Price Surge in 2025?

Reviewed by Bailey Pemberton

- Curious if Huntington Ingalls Industries is as undervalued as some are saying, or if its recent surge has left it looking expensive? You are not alone. Even long-time followers are asking the same question right now.

- The stock has seen an impressive 67.8% gain year-to-date and is up 63.1% over the past year, suggesting investors are getting more optimistic or reassessing the company's risks.

- Several recent headlines have put the spotlight on Huntington Ingalls, including increased defense spending and new contract wins in the shipbuilding sector. These developments are fueling speculation about the company's long-term growth prospects and adding momentum to the stock's climb.

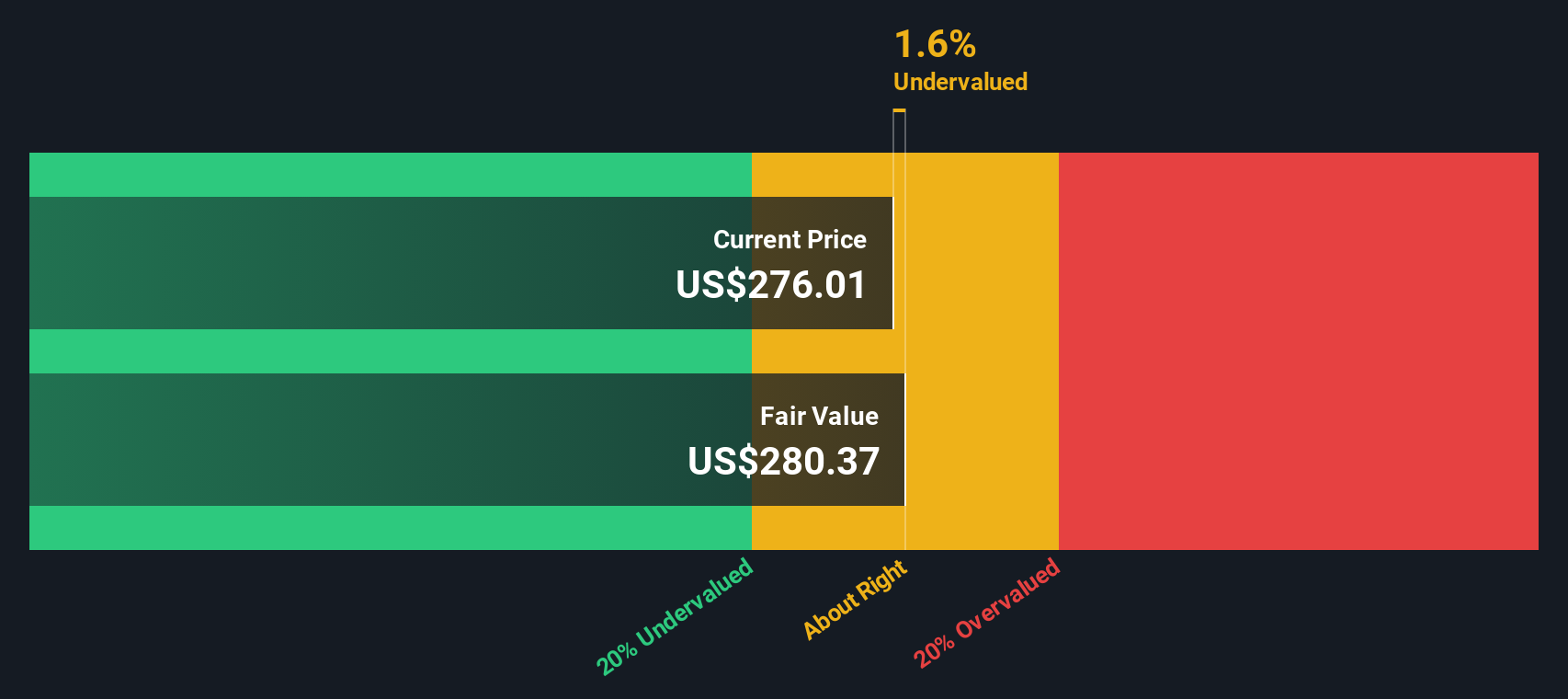

- On our simple six-point valuation checklist, Huntington Ingalls scores a strong 5 out of 6 for undervaluation. But is there more to the story? Let us dig into some popular valuation approaches next, and later, reveal the method that could matter most for long-term investors.

Approach 1: Huntington Ingalls Industries Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts to today’s dollars. For Huntington Ingalls Industries, this method uses recent and forecasted cash flows to assess what the business is truly worth right now.

Currently, Huntington Ingalls Industries generates free cash flow (FCF) of about $580.9 million per year. According to analyst estimates, FCF is expected to rise each year, reaching $840 million by the end of 2029. Beyond that, Simply Wall St extrapolates further growth, with FCF projected to top $1 billion by 2035. All these projections are denominated in U.S. dollars and provide a forward-looking view of the company’s earnings power.

When all these expected cash flows are added up and discounted back to the present, the estimated fair value per share is $451.75. With the stock currently trading at a 30.3% discount to this figure, the DCF model indicates that Huntington Ingalls Industries may be undervalued based on its future cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Huntington Ingalls Industries is undervalued by 30.3%. Track this in your watchlist or portfolio, or discover 929 more undervalued stocks based on cash flows.

Approach 2: Huntington Ingalls Industries Price vs Earnings

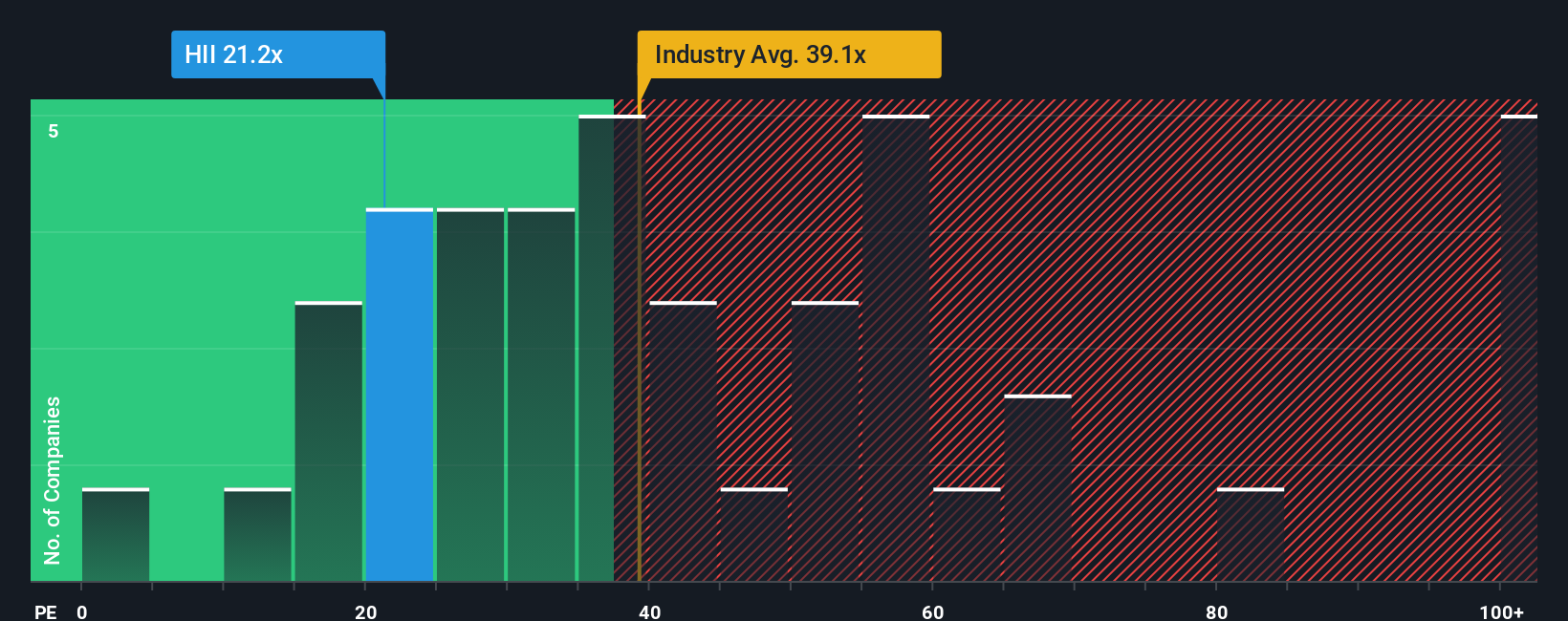

For well-established, profitable companies like Huntington Ingalls Industries, the Price-to-Earnings (PE) ratio is a go-to metric for evaluating value. The PE ratio gives investors a quick snapshot of how much they are paying for each dollar of company earnings, making it especially useful when earnings are steady and predictable.

However, what counts as a "normal" or "fair" PE ratio depends on expectations for growth and perceived risks. Companies with stronger growth outlooks or lower risks tend to command higher PE multiples. Those facing uncertainty or slower growth might see a lower ratio as justified.

At the moment, Huntington Ingalls Industries is trading at a PE ratio of 21.7x. This is below both the aerospace and defense industry average of 38.1x and the average among its peers at 30.2x. These comparisons suggest Huntington Ingalls might be attractively priced.

Simply Wall St's proprietary "Fair Ratio" for Huntington Ingalls, which factors in its earnings growth, industry, profit margin, market cap, and risk profile, stands at 26.2x. This metric is more tailored than conventional industry or peer benchmarks because it incorporates company-specific factors that truly influence long-term valuation.

With a current PE of 21.7x compared to a Fair Ratio of 26.2x, Huntington Ingalls Industries appears to be undervalued by this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Huntington Ingalls Industries Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative brings your story and unique perspective to the numbers, letting you combine your own assumptions for a company’s future revenue, earnings, and margins with a valuation forecast that’s easy to compare to the current price.

In short, a Narrative connects what you believe about Huntington Ingalls Industries, such as new contract wins, supply chain challenges, or future demand for advanced shipbuilding, to tangible financial forecasts and a fair value estimate. Narratives make this simple and accessible, with millions of investors using the tool on Simply Wall St’s Community page to share, debate, and refine their investment cases.

By building a Narrative, you can clearly see if the stock trades above or below your fair value, helping you decide when to buy or sell. What’s more, your Narrative is kept up to date automatically whenever new company results or significant news is released, so you are always making decisions with the latest insights.

For example, one Narrative for Huntington Ingalls Industries assumes strong contract wins, steady revenue growth near 5.4% per year, and expanding margins, leading to a bullish fair value over $324 per share. Another applies more cautious forecasts based on possible delays and cost challenges, arriving at a fair value closer to $221. Narratives help you tailor your investment decisions to your beliefs and adapt swiftly as circumstances change.

Do you think there's more to the story for Huntington Ingalls Industries? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.