- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

Huntington Ingalls Industries (HII): Valuation Insights Following Major Virginia-Class Submarine Sea Trials and Upbeat Earnings Outlook

Reviewed by Kshitija Bhandaru

Huntington Ingalls Industries has completed a major milestone with the successful initial sea trials of the Virginia-class submarine Massachusetts. This technical progress highlights the company's ongoing execution strength and adds momentum for the stock.

See our latest analysis for Huntington Ingalls Industries.

On the heels of these successful sea trials, Huntington Ingalls Industries has continued to attract attention with steady contract wins, defense tech advances, and upcoming financial results. The stock’s 1-year total shareholder return of 11.9% and a strong year-to-date 50.8% share price gain indicate that market momentum is still building, supported by robust operational execution and an optimistic sector outlook.

If you’re interested in seeing what other major players are achieving in the defense and aerospace arena, check out See the full list for free.

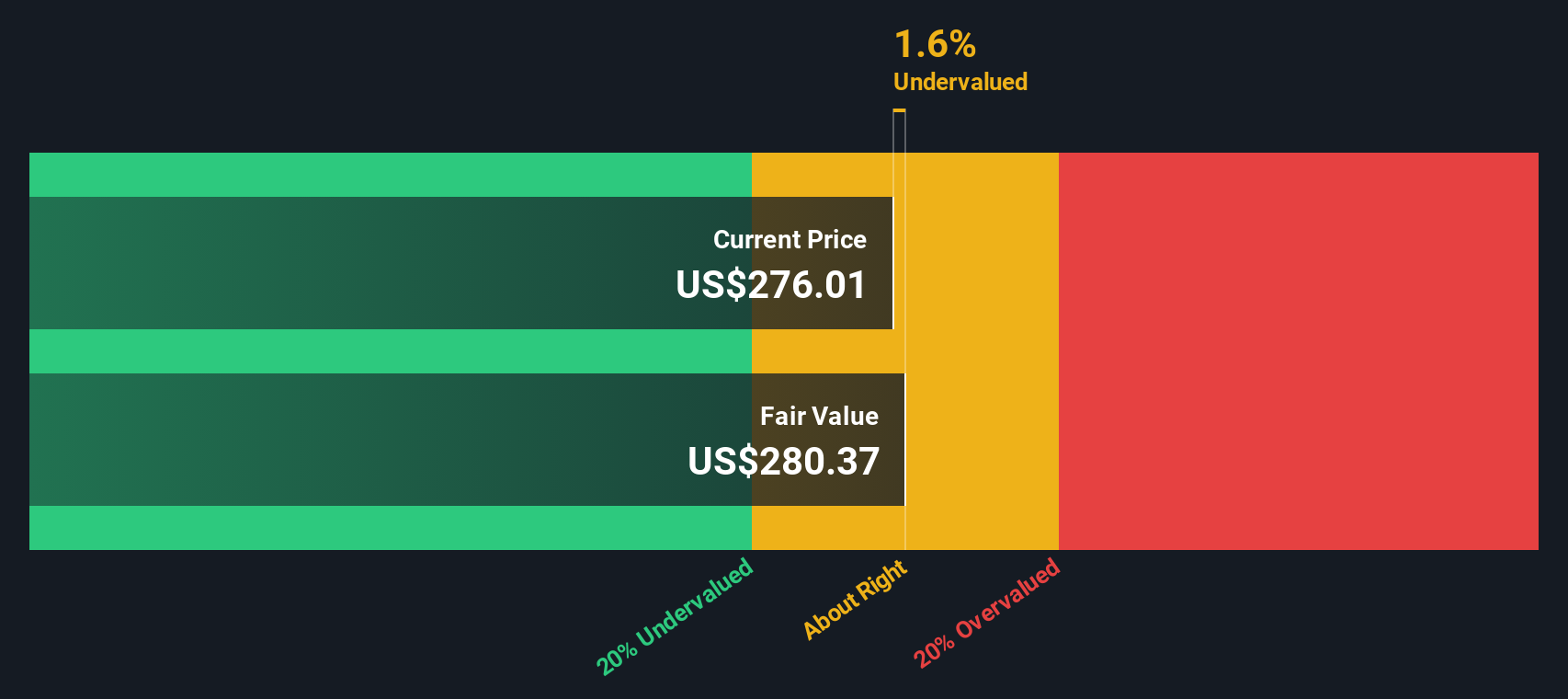

With upward-trending earnings estimates and substantial gains already on the books, investors now face a critical question: Is Huntington Ingalls Industries still undervalued, or has the market already priced in the company’s future growth?

Most Popular Narrative: 4.4% Undervalued

The most widely followed narrative values Huntington Ingalls Industries at $296 per share, which is modestly above the last close of $282.99. This signals a gap between where analysts see fair value and current market pricing, setting the stage for competing views on the stock’s upside.

The accelerated shift towards autonomous and unmanned maritime systems, highlighted by HII's Mission Technologies segment winning new U.S. Navy orders for uncrewed undersea vehicles and opportunities for 200+ further vehicles, positions HII to benefit disproportionately from expansion in high-growth, technologically advanced defense segments. This supports revenue diversification and potential margin expansion.

Want to know the forecast driving this target? This narrative hinges on ambitious profit margin gains, sector-leading contract wins, and analyst expectations for steady multi-year growth. Something big is lurking in the full breakdown. Get ready for the quantitative punchline that could justify the bullish valuation.

Result: Fair Value of $296 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain challenges and potential delays in major contract awards could still disrupt HII’s upward momentum and put pressure on near-term earnings growth.

Find out about the key risks to this Huntington Ingalls Industries narrative.

Another View: SWS DCF Model Suggests Modest Overvaluation

While the narrative-based fair value signals Huntington Ingalls Industries is undervalued, our DCF model points to a different story. It estimates fair value at $275.63 per share, slightly below the last close of $282.99. This subtle gap raises the question: could the market be a bit ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Huntington Ingalls Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Huntington Ingalls Industries Narrative

If these perspectives don’t fully capture your take, or you’d rather dive into the details firsthand, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to tap into some of the market’s most compelling opportunities. These screens help you focus quickly on trends that matter right now.

- Grab the edge in long-term growth and income with these 19 dividend stocks with yields > 3%, which delivers reliable yields and helps build steady wealth.

- Spot companies set to benefit from healthcare innovation and the AI revolution by starting with these 33 healthcare AI stocks.

- Seize early-mover advantages by checking out these 3585 penny stocks with strong financials primed for big potential before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives