- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

Huntington Ingalls Industries (HII): Assessing Valuation Following Dividend Boost Signaling Management Confidence

Reviewed by Simply Wall St

Huntington Ingalls Industries has declared a higher quarterly cash dividend of $1.38 per share, an increase of $0.03 from the prior payout. This move indicates solid confidence in the company’s financial foundation and its outlook.

See our latest analysis for Huntington Ingalls Industries.

Huntington Ingalls Industries has seen remarkable momentum this year, with a 51.2% share price return year-to-date. This performance far outpaces many peers in the defense sector. High-profile moves such as boosting its dividend and expanding its partnership with HD Hyundai Heavy Industries underscore the company’s commitment to innovation and growth. Over the past year, the total shareholder return of 13.7% and strong five-year total returns further highlight a solid track record. These recent gains may reflect renewed investor optimism about long-term prospects.

If you want to expand your search for opportunities in aerospace and defense, now’s a great time to check out See the full list for free.

With such an impressive run behind it, the key question now is whether Huntington Ingalls Industries’ growth potential is fully reflected in the share price, or if there is still room for new investors to benefit from future gains.

Most Popular Narrative: 4.3% Undervalued

With the narrative setting a fair value above the last close, Huntington Ingalls Industries appears to have more upside, according to consensus expectations. This gap suggests analysts see ongoing earnings potential that has not been fully priced in yet.

The accelerated shift towards autonomous and unmanned maritime systems, highlighted by HII's Mission Technologies segment winning new U.S. Navy orders for uncrewed undersea vehicles and opportunities for over 200 additional vehicles, positions HII to benefit disproportionately from expansion in high-growth, technologically advanced defense segments. This supports revenue diversification and potential margin expansion.

What is driving this tantalizing valuation? It is the ambitious growth bets, including expanding into next-generation defense technology, margin-boosting contracts, and an earnings leap that could surprise. Can this narrative’s bold projections hold up? Find out what numbers are fueling the optimism about Huntington Ingalls Industries’ future profitability.

Result: Fair Value of $296.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain challenges and delays in major contract awards could create earnings volatility and threaten the growth outlook for Huntington Ingalls Industries.

Find out about the key risks to this Huntington Ingalls Industries narrative.

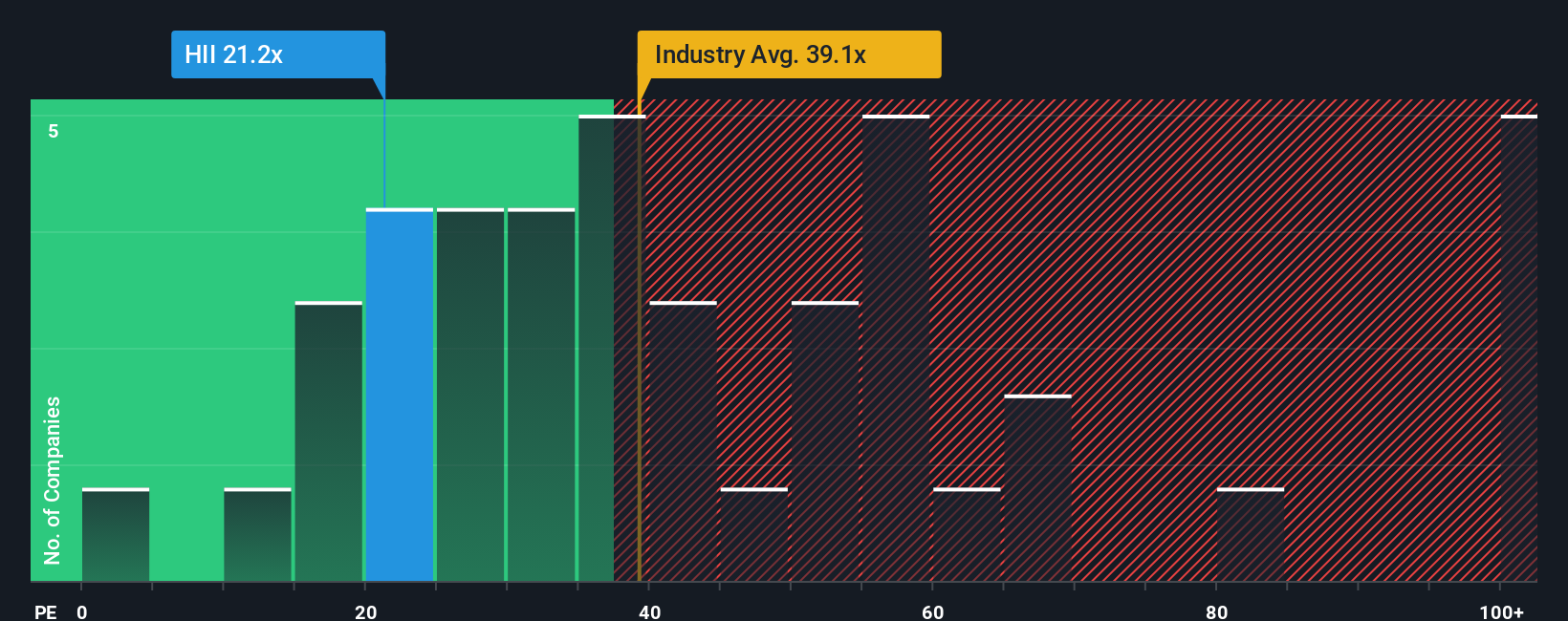

Another View: Multiples Tell Their Own Story

Looking at Huntington Ingalls Industries through the lens of its price-to-earnings ratio, the company trades at 21.2x. This appears attractive compared to the US Aerospace & Defense industry average of 39x and a peer average of 39.5x. The fair ratio, or what the multiple could move toward over time, is estimated at 31.1x. This sizable gap points to both upside potential and the risk that the market could reevaluate how it prices HII in the future. But does the market’s caution reflect hidden challenges, or could there be a value opportunity hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Huntington Ingalls Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Huntington Ingalls Industries Narrative

Keep in mind, if you see the story differently or want to dig into the numbers yourself, you can quickly craft your own perspective in just a few minutes. Do it your way

A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Thousands of opportunities are at your fingertips. Sharpen your portfolio with new themes and strategies, and be the first to spot tomorrow’s winning stocks using these premium research shortcuts:

- Uncover future leaders by targeting high-potential AI innovators with these 26 AI penny stocks, identifying those reshaping everything from automation to predictive analytics.

- Strengthen your income strategy by checking out these 17 dividend stocks with yields > 3%, offering reliable yields above 3% for steady returns in any market.

- Position yourself at the forefront of financial evolution by sizing up these 80 cryptocurrency and blockchain stocks, powering next-generation blockchain and digital asset growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives