- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

A Look at Huntington Ingalls Industries’s Valuation Following New High-Energy Laser Facility Investment and Analyst Upgrades

Reviewed by Kshitija Bhandaru

Huntington Ingalls Industries (HII) has announced a capital investment in a new integration, production, and test facility for the second phase of the U.S. Army’s Enduring-High Energy Laser program. This move highlights the company’s push to advance its defense technology capabilities.

See our latest analysis for Huntington Ingalls Industries.

Huntington Ingalls Industries’ major investment in advanced laser systems arrives as investor interest appears to be gaining steam. On the heels of fresh earnings upgrades and a favorable value rating compared to its peers, the 1-year total shareholder return stands at 0.12%, and the 5-year figure tops 1.1%, indicating a steady long-term performance with a tilt toward renewed momentum.

If HII’s focus on next-gen defense tech has you curious, this is the perfect moment to discover other leading names in aerospace and defense. See the full list for free.

With valuation grades signaling an attractive entry point and analyst upgrades bolstering confidence, the question now is whether HII shares still offer meaningful upside for new investors or if the market has already accounted for future growth.

Most Popular Narrative: Fairly Valued

With the latest close at $282.22 and a narrative fair value of $291.90, the stock appears priced in line with future growth rather than offering a deep discount. This narrative draws on a mix of government defense spending momentum, technological wins, and evolving sector dynamics to justify its pricing outlook.

The accelerated shift towards autonomous and unmanned maritime systems, as highlighted by HII's Mission Technologies segment winning new U.S. Navy orders for uncrewed undersea vehicles and opportunities for 200+ further vehicles, positions HII to benefit disproportionately from expansion in high-growth, technologically advanced defense segments, supporting revenue diversification and potential margin expansion.

What exactly powers this “fair value” narrative? Analysts are betting on a bold profit boost, shifting revenue streams, and expanding margins in a fast-moving tech race. Want to see the full math and the triggers behind this projection? Dive in to uncover the financial leap and the bets driving HII’s future story.

Result: Fair Value of $291.90 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain fragility and the risk of delayed contract awards could quickly challenge current forecasts and change HII’s near-term growth trajectory.

Find out about the key risks to this Huntington Ingalls Industries narrative.

Another View: What Multiples Say

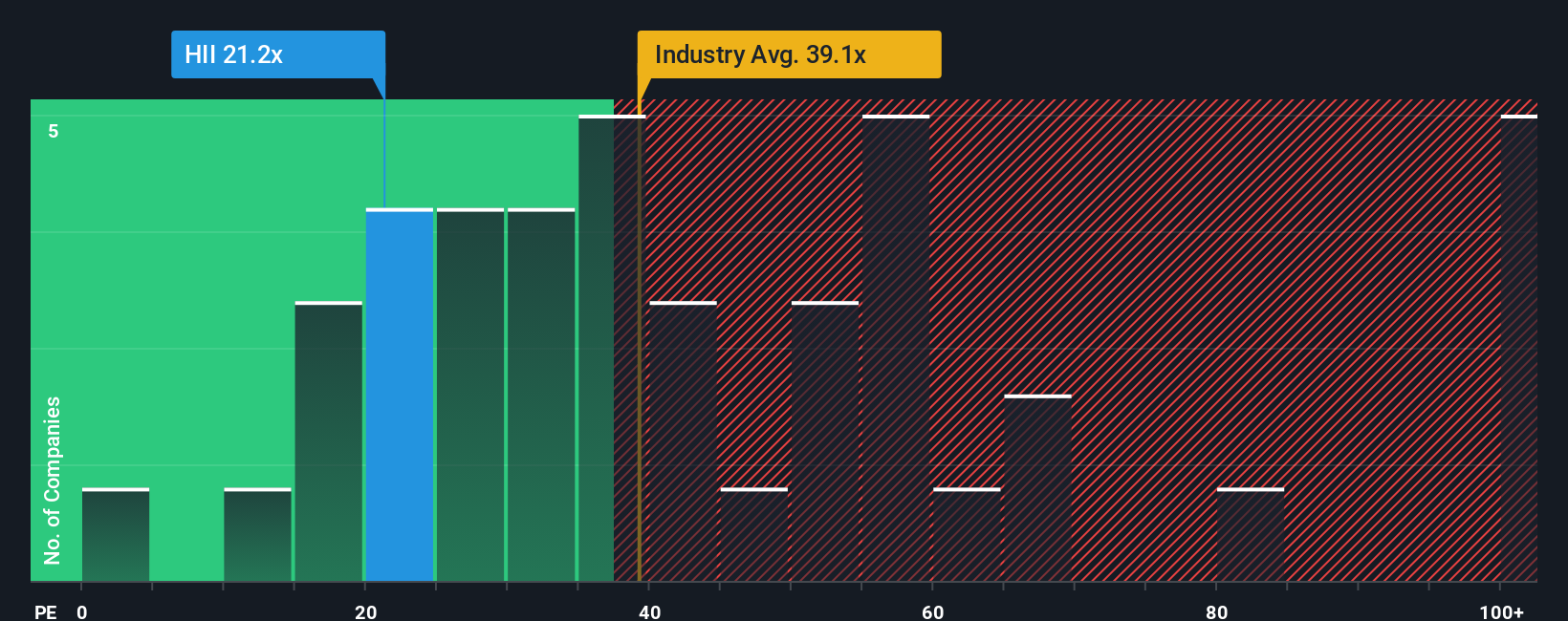

While analysts peg HII’s fair value close to its current price based on earnings expectations, a quick check of its price-to-earnings ratio puts things in context. At 21.1x, HII trades not only below the US Aerospace & Defense sector average of 38.9x, but also well under its fair ratio estimate of 30x. This sizable gap hints that the market may be overlooking some potential, or it could signal lower growth expectations ahead. Does this valuation difference mean opportunity or caution for investors?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Huntington Ingalls Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Huntington Ingalls Industries Narrative

If you want to dig deeper or think your perspective offers something new, you can craft your own narrative and analysis in just a few minutes. Do it your way.

A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio. These opportunities could help you stay ahead of the market. Take action now and supercharge your investment research before trends take off.

- Target reliable income by checking out these 19 dividend stocks with yields > 3% with generous yields and steady cash flows surpassing 3%.

- Outpace the ordinary and tap into artificial intelligence growth with these 24 AI penny stocks poised to lead innovation across industries.

- Tap the future of currency and financial infrastructure by starting with these 78 cryptocurrency and blockchain stocks for companies blazing trails in blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives