- United States

- /

- Aerospace & Defense

- /

- NYSE:HII

A Fresh Look at Huntington Ingalls Industries (HII) Valuation After Breakthrough Autonomous Vessel Launch and New Partnerships

Reviewed by Kshitija Bhandaru

If you’re looking at Huntington Ingalls Industries (HII) stock right now, you’re hardly alone. The company’s rollout of the ROMULUS family of AI-enabled unmanned surface vessels, headlined by the 190-foot modular ROMULUS 190, turned heads across the defense sector. Add in fresh collaborations with tech players like Shield AI and allies such as Babcock International and Thales, and it’s clear HII is not just building ships anymore, but engineering what comes next for autonomous maritime defense.

After this wave of innovation news, HII’s stock has shown signs of building momentum. Over the past 3 months, shares are up 16%, a strong run following steady positive developments all year, including new military contract wins and deeper outsourcing moves to accelerate ship production. Longer term, the stock’s multi-year returns still impress, but it’s the latest surge in investor interest that suggests the market sees something changing, possibly reflecting optimism about HII’s edge in unmanned and autonomous maritime systems.

So with such rapid product and partnership expansion, is HII’s valuation lagging behind its future potential, or has the market already caught on to what’s coming next?

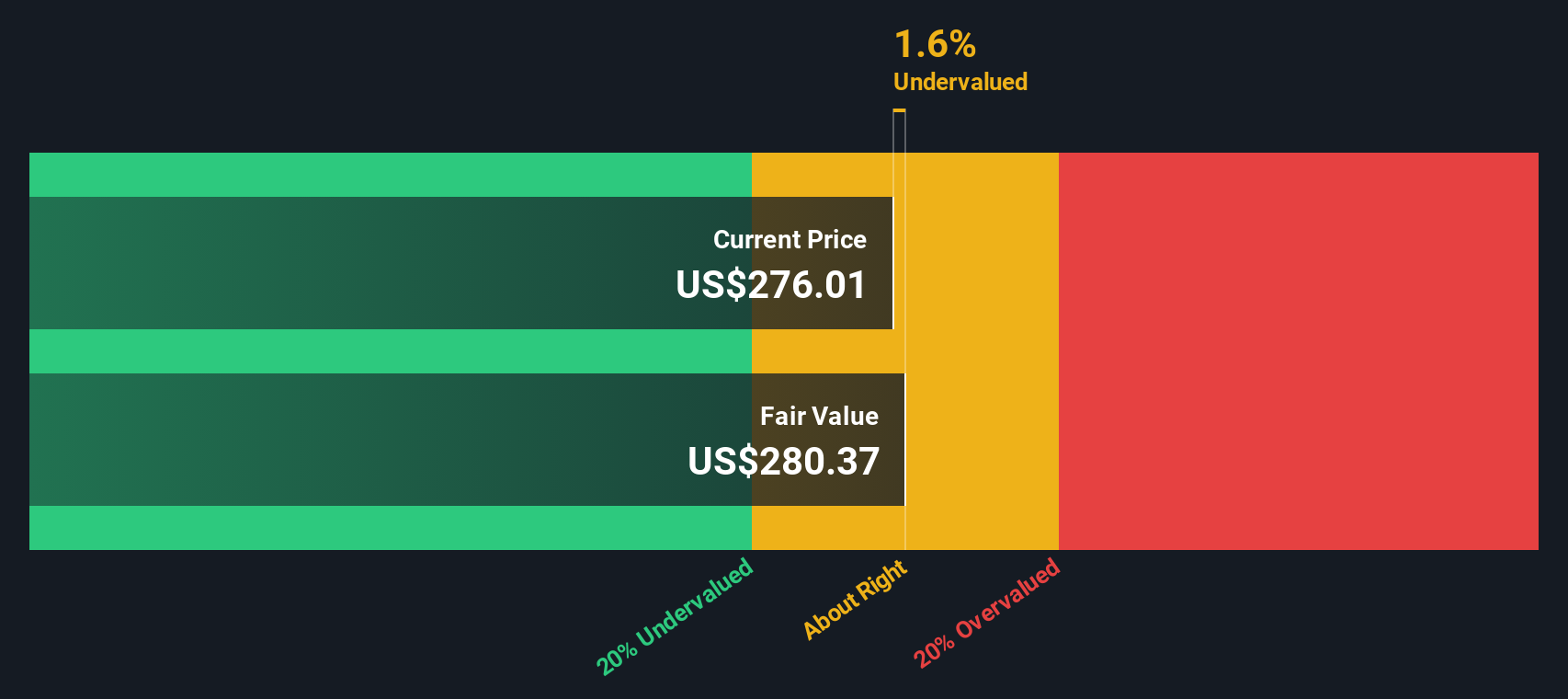

Most Popular Narrative: 5.7% Undervalued

The most popular view among analysts suggests that Huntington Ingalls Industries stock is currently trading at a discount to its estimated intrinsic value, hinting at unrealized upside potential according to consensus projections.

Sustained increases in U.S. defense budgets and policy tailwinds, as evidenced by multi-year funding allocations in the FY26 budget (including support for Columbia-class, Virginia-class, and amphibious ship programs), along with the reconciliation bill's directed industrial base investments, ensure robust multi-year order flow and underpin long-term revenue growth and backlog visibility.

Curious what’s powering this undervaluation call? Hint: A bold outlook on future revenues, expanding profit margins, and a profit multiple that bucks industry norms. Is Wall Street’s current price missing something big? The real story behind the numbers could surprise you.

Result: Fair Value of $291.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain issues and delays with major Navy contracts could affect HII’s momentum and may introduce volatility in revenue and earnings growth expectations.

Find out about the key risks to this Huntington Ingalls Industries narrative.Another View: SWS DCF Signals More Value

Taking a different approach, our DCF model also suggests Huntington Ingalls Industries is undervalued. This method frames that potential based on expected future cash flows instead of just earnings multiples. Could this approach be capturing something the consensus missed?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Huntington Ingalls Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Huntington Ingalls Industries Narrative

If the numbers or narratives above don’t line up with your own views, you can easily dive in and build your own take on HII’s outlook in just a few minutes. Do it your way Do it your way.

A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let your next winning idea pass you by. The Simply Wall Street Screener offers unique stock picks you can act on right now.

- Tap into tomorrow’s breakthrough tech and gain an edge by checking out up-and-coming AI penny stocks that are shifting the landscape with artificial intelligence.

- Lock in resilient returns by targeting companies with generous yields, made easy through our handpicked selection of dividend stocks with yields > 3%.

- Catch the upside potential before it goes mainstream by zeroing in on seriously undervalued stocks based on cash flows stocks often overlooked by the wider market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huntington Ingalls Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HII

Huntington Ingalls Industries

Designs, builds, overhauls, and repairs military ships in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives