- United States

- /

- Machinery

- /

- NYSE:HI

Evaluating Hillenbrand After Shares Surge 28% in the Past Month

Reviewed by Bailey Pemberton

If you have been eyeing Hillenbrand stock and wondering if now is the right moment to make a move, you are not alone. After a period of subdued performance, this industrial player has shown a striking turnaround. Just look at the past month. Hillenbrand's share price jumped an impressive 18.8% in the last seven days, and over the past thirty days, the return stands at 27.8%. That is the kind of momentum that turns heads and gets investors rethinking what they know about the company.

The backdrop to this rally includes a steady stream of news hinting at changes in Hillenbrand's business strategy and operational focus. While none of the latest updates have been market-shaking on their own, together they have shifted perceptions about the company's risk profile and growth potential. Investors are starting to reconsider whether this stock might be a sleeper that is ready to wake up. Year to date, Hillenbrand has nudged up 3.3%, but over the past year, it has posted a solid 16.4% gain. Even with some bumps in the three-year numbers, the five-year track record is a positive 18.0%.

The most compelling part? Hillenbrand currently earns a valuation score of 5 out of 6 based on our established checklist of whether a company is undervalued. That is a rare mark, just shy of perfect, and it sets the stage for a deeper dive into exactly what makes the company so interesting through a valuation lens. Next, we will break down the standard ways to assess a company's value, and at the end, I will share the ultimate signal savvy investors should not miss.

Approach 1: Hillenbrand Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and then discounting those cash flows back to their value in today's dollars. This approach helps investors gauge what a business is really worth, rather than simply looking at its market price.

For Hillenbrand, the current Free Cash Flow (FCF) sits at $99.9 million. Over the next decade, analyst projections and model estimates anticipate strong growth, with FCF expected to reach approximately $432.9 million by 2035. Analysts provide estimates for the first five years, and subsequent years are extrapolated to reflect potential future performance.

Based on this trajectory, and using the DCF approach, Hillenbrand's intrinsic value is calculated at $57.98 per share. In comparison to the current market price, this suggests the stock is trading at a 45.7% discount. Shares may therefore appear significantly undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Hillenbrand is undervalued by 45.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Hillenbrand Price vs Sales

For many manufacturing and industrial companies like Hillenbrand, the Price-to-Sales (PS) ratio is a strong valuation measure, especially when comparing firms that may have uneven profits but reliable revenue streams. The PS ratio is less affected by short-term volatility or accounting adjustments that can distort earnings, making it a practical tool for evaluating a company's value based on its top-line performance.

Growth prospects and risk levels play a key role in what investors consider a "normal" or "fair" PS ratio. Companies with higher expected growth and lower perceived risk typically warrant higher multiples, while slower growers or those facing headwinds usually trade at discounts to peers.

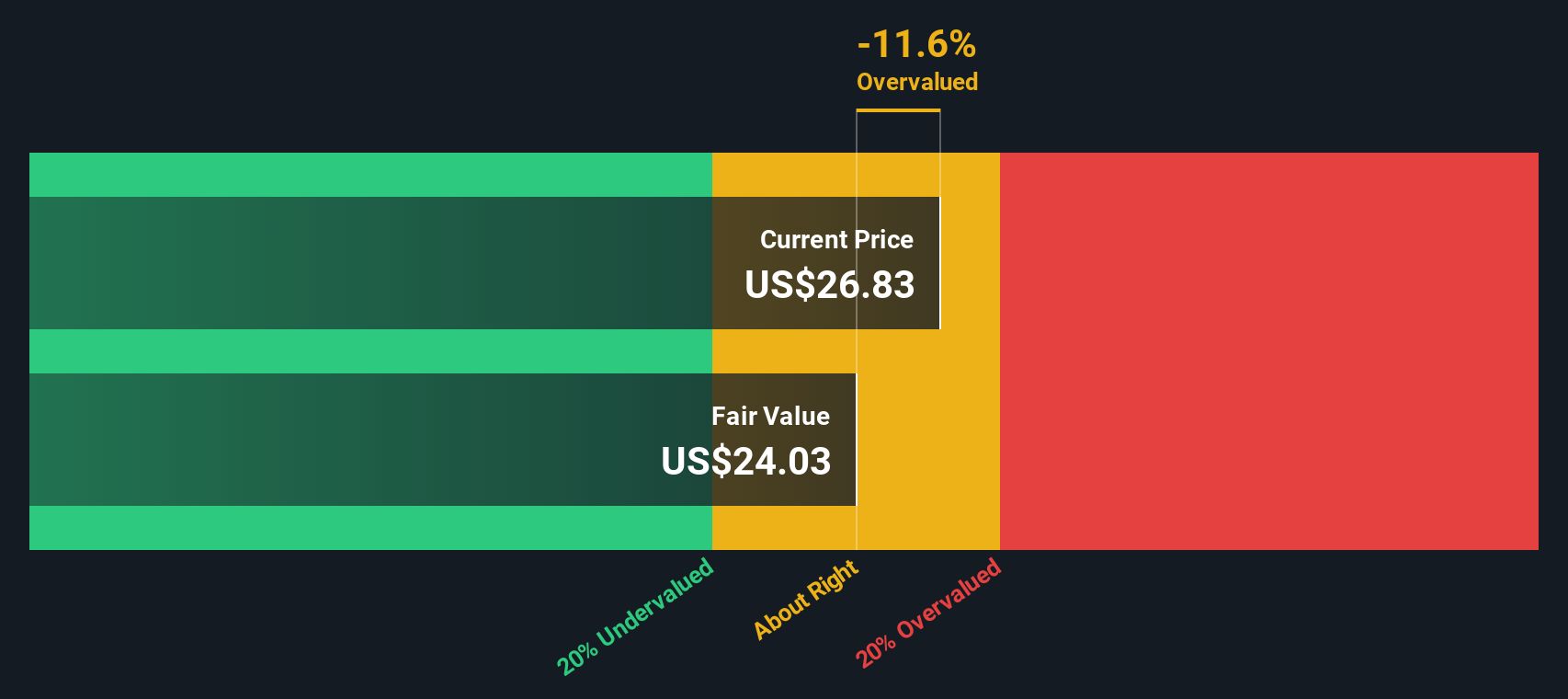

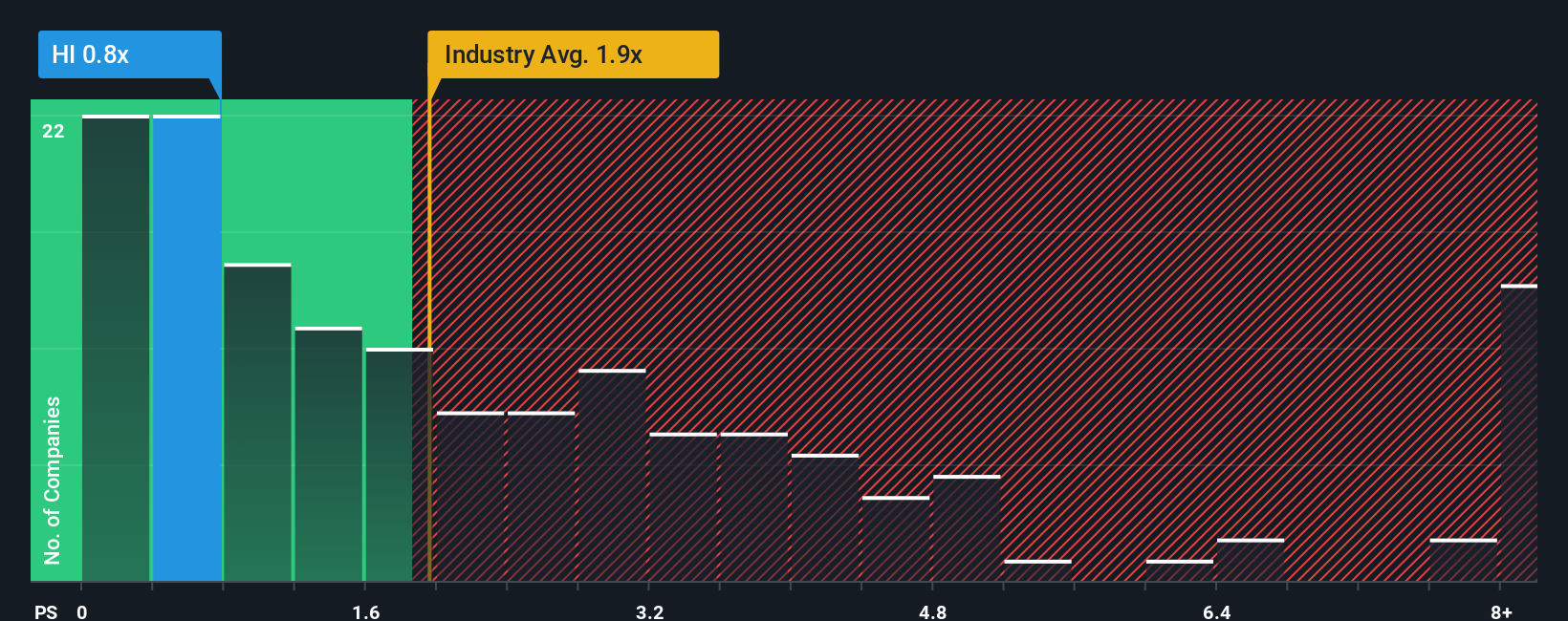

Hillenbrand's current PS ratio sits at 0.78x, which is notably below the machinery industry average of 2.03x and the peer average of 2.49x. This indicates that the stock is trading at a considerable discount relative to its direct competitors and the broader industry. However, instead of simply comparing to these averages, we can turn to Simply Wall St's proprietary Fair Ratio. This benchmark is more insightful because it incorporates not just industry trends but also Hillenbrand's unique growth rate, profit margins, risk profile, and market size, offering a more tailored and balanced perspective.

The Fair Ratio for Hillenbrand is calculated at 1.14x. This suggests that, while the company trades well below industry and peer multiples, its valuation is also somewhat below the fair level given its fundamentals. That points to the stock being undervalued with room for potential upside if market perceptions align more closely with its underlying performance and prospects.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hillenbrand Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, structured story you build around a company like Hillenbrand, connecting your assumptions about its future, such as revenue growth, profit margins, and fair value, to your personal view of the business outlook.

Rather than relying solely on static numbers or average analyst opinions, Narratives allow you to translate your perspective into a practical financial forecast and fair value estimate. This makes your decision-making more transparent and grounded in your thesis. Narratives are accessible and easy to use on Simply Wall St’s Community page, which is already a favorite resource for millions of investors worldwide.

Using Narratives, you can compare your calculated Fair Value to the current share price and see at a glance whether now might be the moment to buy, sell, or hold the stock, all mapped to your outlook. Best of all, Narratives update dynamically whenever new news, earnings, or data become available so your analysis stays current.

For example, one investor might argue that Hillenbrand is poised for a rebound and set a Fair Value of $40.00, while another sees ongoing pressures and rates it only at $24.00, yet both use the Narrative framework to connect their story with the numbers and arrive at a clear investment view.

Do you think there's more to the story for Hillenbrand? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hillenbrand might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HI

Hillenbrand

Operates as an industrial company in the United States and internationally.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives