- United States

- /

- Aerospace & Defense

- /

- NYSE:HEI

HEICO (HEI): Evaluating Valuation and Market Confidence Following Leadership Transition

Reviewed by Kshitija Bhandaru

HEICO (NYSE:HEI) is navigating a leadership transition following the passing of longtime Executive Chairman Laurans A. Mendelson. His sons, Eric and Victor Mendelson, have stepped up as Co-Chairmen in line with the company’s established succession plan.

See our latest analysis for HEICO.

HEICO’s share price has held steady despite this major leadership transition, which signals the market’s confidence in the company’s long-term strategy and steady cash generation. Total shareholder return over the past five years stands out at nearly 189%, reflecting consistent value for long-term investors even as momentum has moderated in the short term.

Curious where the next big names in aerospace and defense could be found? Take your research a step further and explore See the full list for free..

With the stock holding firm and strong returns already in the books, investors are left with a central question: is HEICO undervalued at these levels, or has the market already priced in its next stage of growth?

Most Popular Narrative: 9.2% Undervalued

HEICO is trading at $320.65, while the narrative's fair value is estimated at $353. This creates a gap that analysts believe the company could close, based on forecasted profit growth and margin expansion.

The worldwide trend of aging commercial and military aircraft fleets, combined with increasing pressure for cost-effective maintenance solutions, strongly favors HEICO's business model. As airlines and governments seek alternatives to expensive OEM parts, HEICO's FAA-approved PMA parts and repairs continue to gain market share and drive margin expansion, as reflected in rising operating and EBITA margins.

Want to know what drives this optimistic price target? The forecast is built on bold assumptions about future growth, higher profit margins, and dominance in a high-stakes market. Find out which surprising numbers and trends power the full narrative and could define HEICO’s next chapter.

Result: Fair Value of $353 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from OEMs and unexpected regulatory changes could challenge HEICO’s market share. These factors could potentially slow its impressive earnings growth.

Find out about the key risks to this HEICO narrative.

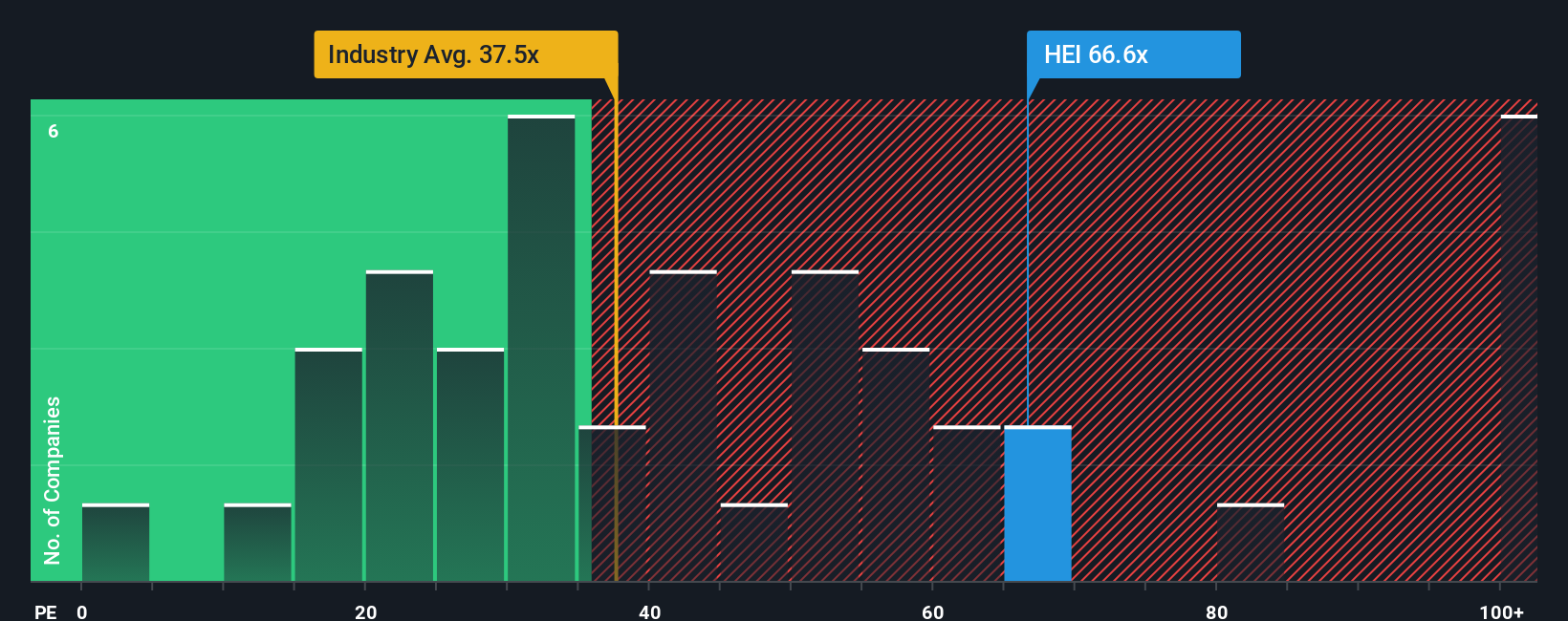

Another View: Looking at Price Ratios

While the fair value narrative points to HEICO being undervalued, a look at its price-to-earnings ratio tells a different story. HEICO trades at 69.6 times earnings, which is far higher than both the industry average (39.1x) and its peers (75.3x). The fair ratio for the stock is just 29.7x. This suggests the market has priced in a lot of future growth and makes the current valuation a potential risk if expectations slip. Could the market be getting ahead of itself, or is HEICO’s pipeline truly that strong?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HEICO Narrative

If our analysis isn’t quite your style, or you’d rather draw your own conclusions, you can chart your own HEICO story and insights in under three minutes. Do it your way.

A great starting point for your HEICO research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

If you’re serious about taking your portfolio to the next level, don’t get stuck watching from the sidelines while others uncover new market winners and strong trends.

- Unlock opportunities for consistent income by tapping into these 19 dividend stocks with yields > 3%, which offers proven yields above 3% in a volatile market.

- Pinpoint under-the-radar tech disruptors as you filter through these 24 AI penny stocks, which are leading advancements in automation and intelligent solutions.

- Maximize value with ease by spotting attractive bargains using these 896 undervalued stocks based on cash flows, based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEICO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HEI

HEICO

Provides aerospace, defense, and electronic related products and services in the United States and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives