- United States

- /

- Building

- /

- NYSE:HAYW

Assessing Hayward Holdings (HAYW) Valuation Following Strong Q2 2025 Earnings and Upbeat Analyst Sentiment

Reviewed by Kshitija Bhandaru

Hayward Holdings (HAYW) posted strong Q2 2025 earnings, sparking fresh optimism among analysts. After the results, several analysts reaffirmed their confidence in the company’s management and its strategic direction.

See our latest analysis for Hayward Holdings.

Momentum appears to be building for Hayward Holdings after its strong Q2 earnings and positive analyst sentiment, even as news of recent insider selling raised some eyebrows. The stock’s 1-year total shareholder return stands at 4.4%, indicating gradual progress for long-term investors despite short-term share price swings and a solid period of performance since its IPO.

If you’re looking for more discovery opportunities beyond Hayward Holdings’ recent moves, now is a perfect time to widen your search and explore fast growing stocks with high insider ownership

With the stock up modestly over the past year and analysts split on future upside, investors now face a key question: Is Hayward Holdings undervalued after its impressive results, or is the market already pricing in all the company’s promise?

Most Popular Narrative: 7.2% Undervalued

Compared to its latest close at $15.44, the most popular narrative suggests Hayward Holdings has more runway, setting fair value at $16.64. This creates an optimistic outlook for those searching for upside, with projected growth and profit drivers coming under the spotlight.

Accelerating adoption of connected, automated pool equipment (like the new OmniX platform) increases average equipment content per pool and positions Hayward for higher-margin sales and digital revenue streams. This supports both revenue growth and EBITDA margin improvement.

Want to know what’s powering this bullish view? The delicate balance here is all about ambitious earnings and margin upgrades, with assumptions that could shift the story in either direction. Discover which future financial leaps make this price target possible.

Result: Fair Value of $16.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high interest rates or a slowdown in new pool construction could challenge Hayward’s growth and weaken the bullish case moving forward.

Find out about the key risks to this Hayward Holdings narrative.

Another View: Market Multiples Tell a Different Story

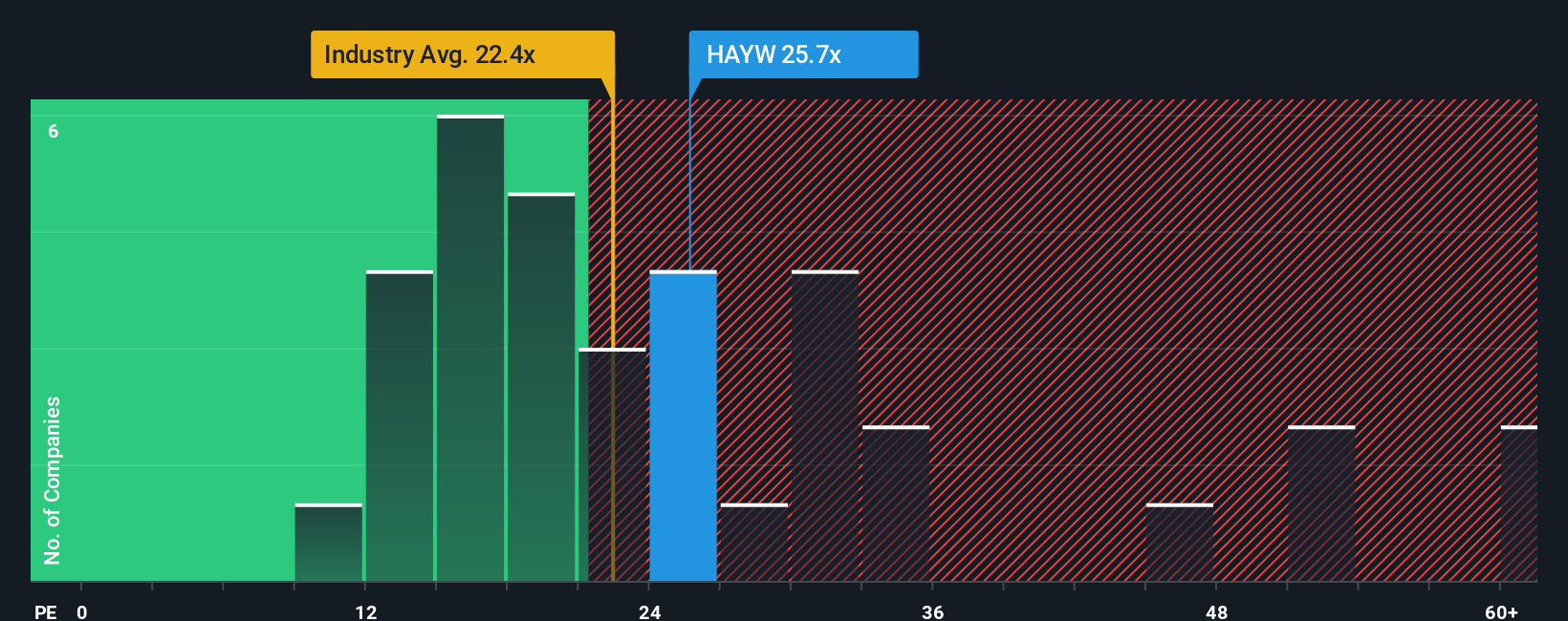

Looking through the lens of price-to-earnings, Hayward Holdings trades at 25.7 times earnings, which is lower than its peer average of 28.8 times but notably above the US Building industry’s 22.2 times and a fair ratio of 21.6 times. This mixed picture raises a key question for investors: will the market reward quality, or could Hayward’s valuation compress toward industry norms?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hayward Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hayward Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hayward Holdings.

Looking for more investment ideas?

Smart investors don’t wait for opportunities to come to them. Try these powerful stock screens from Simply Wall Street to ensure you never miss the next breakout move.

- Uncover massive returns by targeting these 3563 penny stocks with strong financials with robust financials and real growth prospects before they catch the crowd’s attention.

- Seize the AI wave by tapping into these 24 AI penny stocks that are transforming industries and driving innovation at a rapid pace.

- Secure future gains by focusing on these 19 dividend stocks with yields > 3% that deliver attractive yields and help build wealth through consistent income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hayward Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAYW

Hayward Holdings

Designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives