- United States

- /

- Trade Distributors

- /

- NYSE:GWW

W.W. Grainger (NYSE:GWW) Reports Strong Earnings, Increases Dividend By 10%

Reviewed by Simply Wall St

W.W. Grainger (NYSE:GWW) recently experienced a month-long price move of 4%, coinciding with several significant events. The company announced strong first-quarter earnings with a sales increase to USD 4,306 million, along with confirming its annual sales and earnings guidance. Additionally, a 10% dividend increase was declared, reflecting robust financial health and likely boosting investor confidence. The slight price move mirrored broader market trends, as the Dow Jones and S&P 500 were positive following strong tech earnings and easing trade tensions. These developments collectively reinforced positive sentiment around Grainger, aligning with ongoing market gains.

The recent news surrounding W.W. Grainger's strong first-quarter earnings and dividend increase could bolster market confidence, aligning with the company's strategic initiatives outlined in its narrative. This investor-friendly approach may support its revenue growth initiatives in machine learning and AI, potentially enhancing operational efficiency and customer insights. The annual sales and earnings guidance confirmation is likely to foster a positive outlook on future performance.

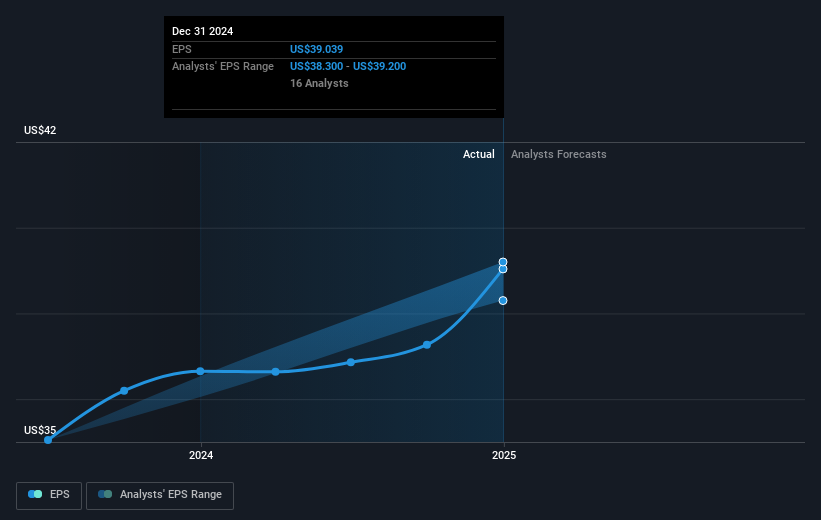

Over a five-year period, Grainger's total shareholder return, including both share price appreciation and dividends, was substantial at 288.42%. This compares favorably against macroeconomic benchmarks, evidencing significant long-term growth. However, on a one-year basis, Grainger's performance outpaced the US Market, which returned 9.9%, marking strong near-term results and reflecting the company's relative outperformance against broader industry trends.

The recent announcements also hold potential implications for future revenue and earnings forecasts. Continued investments in technology and supply chain expansion through distribution centers could sustain revenue momentum, while a strengthening brand presence via increased marketing efforts may capture additional demand. Despite economic uncertainties and reliance on key sectors, the market seems optimistic, albeit cautiously, as evidenced by the minor share price increase of 4% and its proximity to the analyst consensus price target of US$1035.6, which is a 2.2% premium over the current share price of US$1012.71.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade W.W. Grainger, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives