- United States

- /

- Trade Distributors

- /

- NYSE:GWW

W.W. Grainger (GWW): Valuation Insights Following Price Changes and Raised Earnings Guidance

Reviewed by Kshitija Bhandaru

W.W. Grainger (GWW) updated its pricing in September, which resulted in stronger pricing trends for the third quarter and set up further gains ahead. These changes prompted management to raise earnings guidance and highlighted their positive financial effect.

See our latest analysis for W.W. Grainger.

After a strong start to the year, W.W. Grainger’s share price has moderated, with the latest price sitting at $956.59 and a 1-year total shareholder return of nearly flat but a robust 95% over three years. Recent pricing changes and raised earnings guidance suggest the company is regaining momentum and strengthening its position for long-term growth, even as industry competition persists.

If you’re interested in uncovering other companies making bold strategic moves, consider broadening your search with our fast-growing stocks featuring high insider ownership. This can be a smart way to spot emerging leaders: fast growing stocks with high insider ownership

But with Grainger’s share price nearly flat over the past year and recent gains already factored in, the key question for investors is whether the stock is now undervalued or if the market has already accounted for future growth.

Most Popular Narrative: 8.2% Undervalued

With W.W. Grainger closing at $956.59 and the most widely followed narrative estimating fair value around $1,041.77, consensus points to potential upside from current levels. The narrative’s assumptions hinge on continued operational improvement and strong industry positioning, which shape the optimistic valuation outlook.

Grainger’s scale, digital platforms, and supply chain strength support market share gains and margin growth amid changing B2B e-commerce and infrastructure demands. Strong free cash flow and ongoing operational investments enable reliable shareholder returns and stability despite near-term margin headwinds.

Think this is the whole story? Not even close. The full narrative breaks down bold expectations for growth, profitability, and valuation, hinting at key drivers only revealed inside. If you want to see what’s fueling these price targets and future projections, discover the formulas behind the headline numbers before making your move.

Result: Fair Value of $1,041.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from tariffs and a sluggish MRO market could challenge Grainger's ability to deliver on the optimistic outlook described above.

Find out about the key risks to this W.W. Grainger narrative.

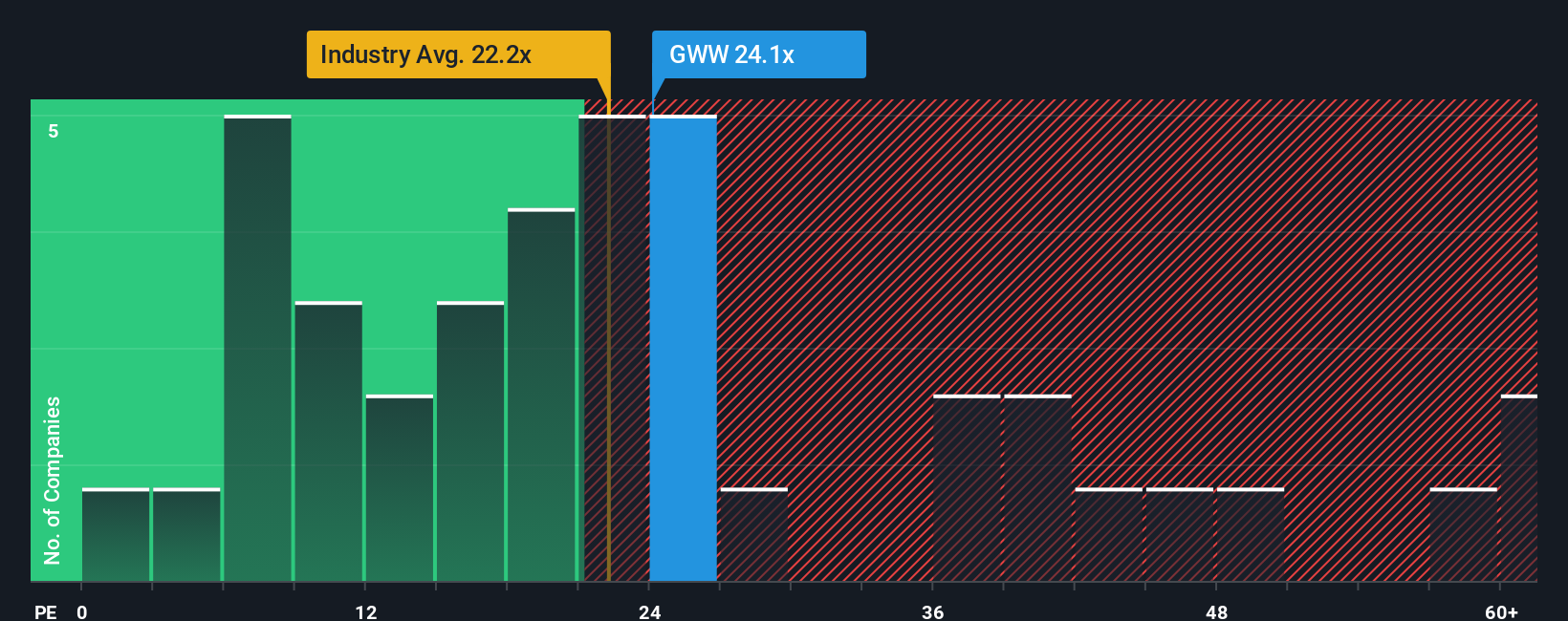

Another View: Multiples Point to a Mixed Story

Looking at W.W. Grainger's valuation through its price-to-earnings ratio tells a slightly different tale. The company's ratio is 23.8x, which is a bit higher than the industry average of 22.7x, but lower than the peer average of 25.4x. The current ratio is also very close to the market's fair ratio of 24x, suggesting there may not be much room for upward revaluation in the near term. Does this tighter spread mean the market fully appreciates Grainger's strengths, or is something being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out W.W. Grainger for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own W.W. Grainger Narrative

If you have a different perspective or want to dive deeper into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your opportunity to get ahead. If you want to find stocks on the verge of their next big move, Simply Wall St’s tools put you in the driver’s seat. Check out these unique ways to sharpen your portfolio:

- Pinpoint steady income with these 19 dividend stocks with yields > 3% with impressive yields above 3 percent, making your money work for you even while you wait for growth.

- Uncover the innovators shaping tomorrow's breakthroughs by scanning these 26 quantum computing stocks, where pioneers in quantum computing are rewriting the rules of tech.

- Tap into explosive growth trends with these 24 AI penny stocks, connecting you to firms at the forefront of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives