- United States

- /

- Trade Distributors

- /

- NYSE:GWW

Here's Why We Think W.W. Grainger (NYSE:GWW) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in W.W. Grainger (NYSE:GWW). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide W.W. Grainger with the means to add long-term value to shareholders.

Check out our latest analysis for W.W. Grainger

W.W. Grainger's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that W.W. Grainger has managed to grow EPS by 33% per year over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

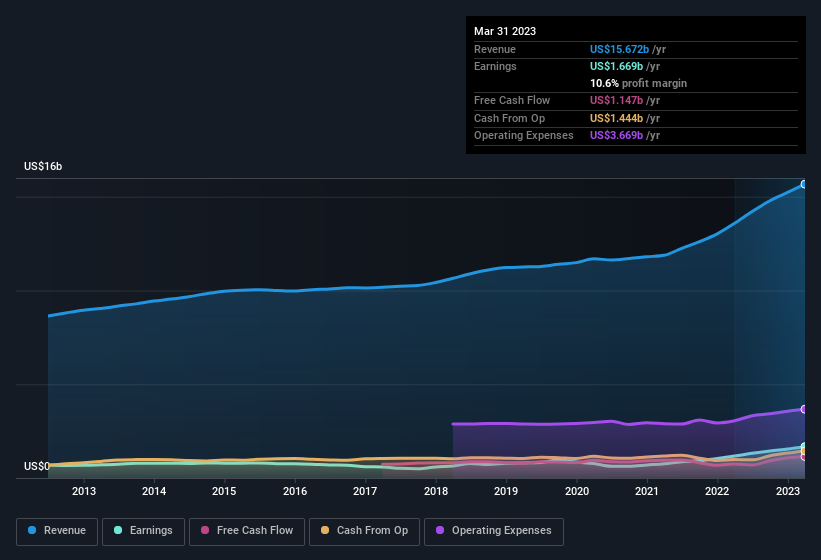

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for W.W. Grainger remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to US$16b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of W.W. Grainger's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are W.W. Grainger Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$35b company like W.W. Grainger. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$3.9b. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations over US$8.0b, like W.W. Grainger, the median CEO pay is around US$12m.

W.W. Grainger offered total compensation worth US$10.0m to its CEO in the year to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does W.W. Grainger Deserve A Spot On Your Watchlist?

You can't deny that W.W. Grainger has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the key takeaway is that W.W. Grainger is worth keeping an eye on. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for W.W. Grainger that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, the United Kingdom, and internationally.

Flawless balance sheet with proven track record.