- United States

- /

- Trade Distributors

- /

- NYSE:GWW

Grainger’s Price Increases Might Change the Case for Investing in W.W. Grainger (GWW)

Reviewed by Sasha Jovanovic

- In September 2025, W.W. Grainger implemented price adjustments expected to lift its third-quarter results, with a more substantial impact forecast for the fourth quarter as the company continues navigating margin pressures in a competitive market.

- The decision to increase prices reflects Grainger’s efforts to offset cost pressures and signals its continued focus on capturing income growth despite challenges from industry peers.

- To understand how these recent price adjustments may impact Grainger’s earnings outlook and competitive positioning, we’ll explore the implications for its long-term investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

W.W. Grainger Investment Narrative Recap

To own W.W. Grainger stock, you need to believe in the long-term resilience of MRO demand, Grainger’s supply chain strength, and its capacity to pass through cost increases without materially eroding margins or market share. The recent September 2025 price adjustments are timely for addressing short-term margin pressures. While these adjustments may boost results in the next two quarters, the bigger risk remains whether Grainger can maintain pricing power if inflation persists or competitors undercut on price, so the news is relevant but not a game changer.

The August 2025 guidance update stands out: Grainger raised its sales outlook to as much as US$18.2 billion, but trimmed earnings-per-share guidance. This combination highlights the tension between growing top-line revenue and ongoing margin challenges, making the recent price adjustments a test of how successfully Grainger can balance both.

By contrast, what investors should be aware of is the risk that repeated price increases may challenge customer loyalty if rivals respond aggressively...

Read the full narrative on W.W. Grainger (it's free!)

W.W. Grainger's outlook anticipates $21.3 billion in revenue and $2.3 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 6.7% and a $0.4 billion increase in earnings from the current $1.9 billion level.

Uncover how W.W. Grainger's forecasts yield a $1042 fair value, a 9% upside to its current price.

Exploring Other Perspectives

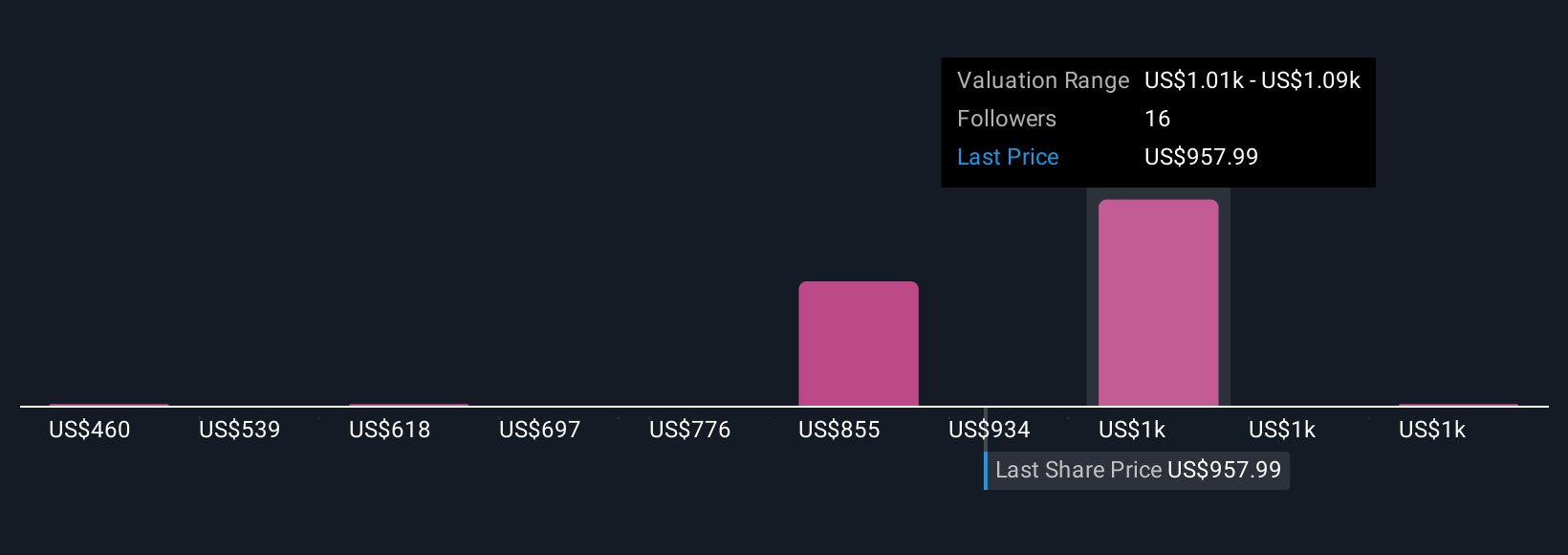

Five estimates from the Simply Wall St Community put Grainger’s fair value from US$460 to US$1,250, showing how wide investor opinions can be. At the same time, recent upward sales guidance paired with margin pressures prompts you to consider how different views reflect both optimism and caution about Grainger’s future performance.

Explore 5 other fair value estimates on W.W. Grainger - why the stock might be worth less than half the current price!

Build Your Own W.W. Grainger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your W.W. Grainger research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free W.W. Grainger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate W.W. Grainger's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives