- United States

- /

- Trade Distributors

- /

- NYSE:GWW

Assessing W.W. Grainger (GWW) Valuation After Its Recent Share Price Pullback

Reviewed by Simply Wall St

W.W. Grainger (GWW) has been drifting lower this year after a very strong multi year run, leaving some long term holders wondering whether the recent pullback is a reset or an opportunity.

See our latest analysis for W.W. Grainger.

At around $968.91 per share, the recent slide has pulled W.W. Grainger’s year to date share price return into negative territory. Its five year total shareholder return still reflects a very strong long term compounding story, which suggests momentum has cooled rather than disappeared.

If this kind of late cycle pullback has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership for other compelling ideas.

With shares now trading modestly below analyst targets but still reflecting years of strong execution, the key question is whether Grainger’s premium is finally stretched or whether today’s reset hides the next leg of growth.

Most Popular Narrative Narrative: 8.1% Undervalued

With W.W. Grainger closing at $968.91 versus a narrative fair value of $1,054.60, the story leans toward upside and hinges on execution.

The acceleration of digital transformation in B2B or industrial commerce is expanding the addressable market for Grainger's online platforms (especially Zoro and MonotaRO), driving faster than industry top line gains, operating leverage, and margin expansion as e commerce penetration rises.

Curious how steady but unspectacular growth assumptions can still back a premium earnings multiple, rising margins, and shrinking share count. Want to see the full math behind that confidence.

Result: Fair Value of $1054.6 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering inflationary and LIFO pressures, combined with a muted MRO demand backdrop, could squeeze margins and slow the earnings trajectory that underpins this valuation.

Find out about the key risks to this W.W. Grainger narrative.

Another Lens On Valuation

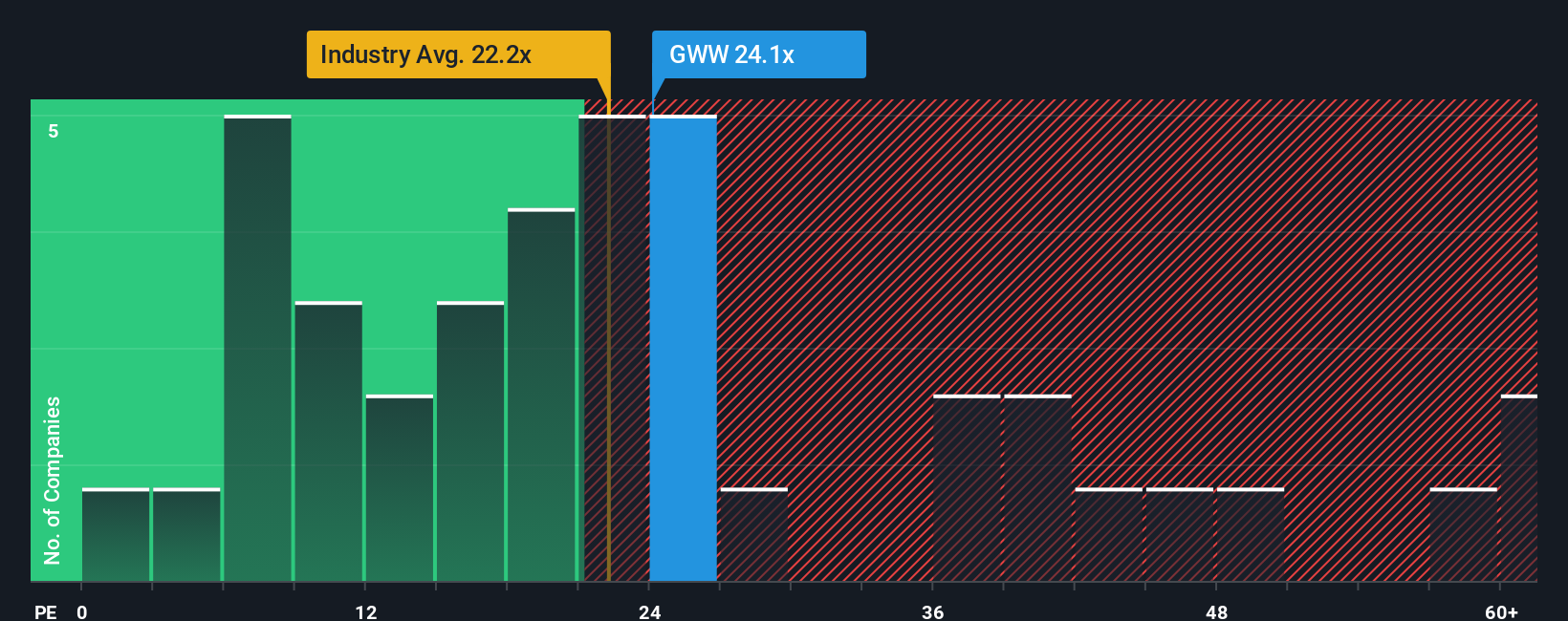

On earnings, the picture looks less forgiving. Grainger trades on a 26.6x price to earnings ratio versus 19.8x for the US Trade Distributors industry and 23.2x for peers, while our fair ratio sits nearer 27.6x. That slim cushion raises the question: how much execution hiccup can this valuation really absorb?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own W.W. Grainger Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your W.W. Grainger research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider your next set of ideas with a few focused screeners that surface opportunities other investors may be overlooking right now.

- Identify income-oriented candidates by scanning these 15 dividend stocks with yields > 3% that may support your portfolio’s cash flow without taking on higher-yield, higher-risk positions.

- Gain exposure to innovation trends by targeting these 26 AI penny stocks that combine established business activity with participation in artificial intelligence themes.

- Enhance your margin of safety by focusing on these 914 undervalued stocks based on cash flows that the market may be mispricing based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if W.W. Grainger might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GWW

W.W. Grainger

Distributes maintenance, repair, and operating products and services primarily in North America, Japan, and the United Kingdom.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026