- United States

- /

- Construction

- /

- NYSE:GVA

How Recent Insider Selling and Materials Shift at Granite Construction (GVA) Are Shaping Its Investment Case

Reviewed by Sasha Jovanovic

- On November 24, 2025, Celeste Mastin, a Director at Granite Construction, sold 7,614 shares of the company's stock following a year in which insider selling significantly outpaced insider buying.

- This insider activity coincides with Granite Construction's stronger-than-expected third-quarter earnings and new analyst coverage emphasizing a shift toward the company's Materials business and increased vertical integration.

- We'll examine how the director share sale and evolving business focus may influence Granite Construction's investment narrative as outlined by analysts.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Granite Construction Investment Narrative Recap

To be a shareholder in Granite Construction, you need to believe in the company’s multi-year growth opportunity tied to federal and state infrastructure spending and its ability to boost profitability through vertical integration, particularly in its expanding Materials business. Despite the recent insider sale by Director Celeste Mastin, there appears to be little material impact on the most immediate catalyst: successful integration and performance of its recent acquisitions. The biggest short-term risk remains execution missteps in integrating new businesses, especially with the company’s debt load and reliance on M&A for expansion.

Granite Construction’s latest quarterly earnings announcement stands out, with third-quarter profits and earnings per share beating analyst expectations, but revenue coming in just under forecasts. This result aligns with the company’s focus on operational improvements and integration in its Materials division, which analysts have highlighted as a key driver for margin expansion going forward. However, with insider selling exceeding insider buying, some investors may watch for signs that management is confident in the company’s ability to manage...

Read the full narrative on Granite Construction (it's free!)

Granite Construction's narrative projects $5.6 billion revenue and $533.1 million earnings by 2028. This requires 10.8% yearly revenue growth and a $374.6 million earnings increase from $158.5 million today.

Uncover how Granite Construction's forecasts yield a $135.50 fair value, a 26% upside to its current price.

Exploring Other Perspectives

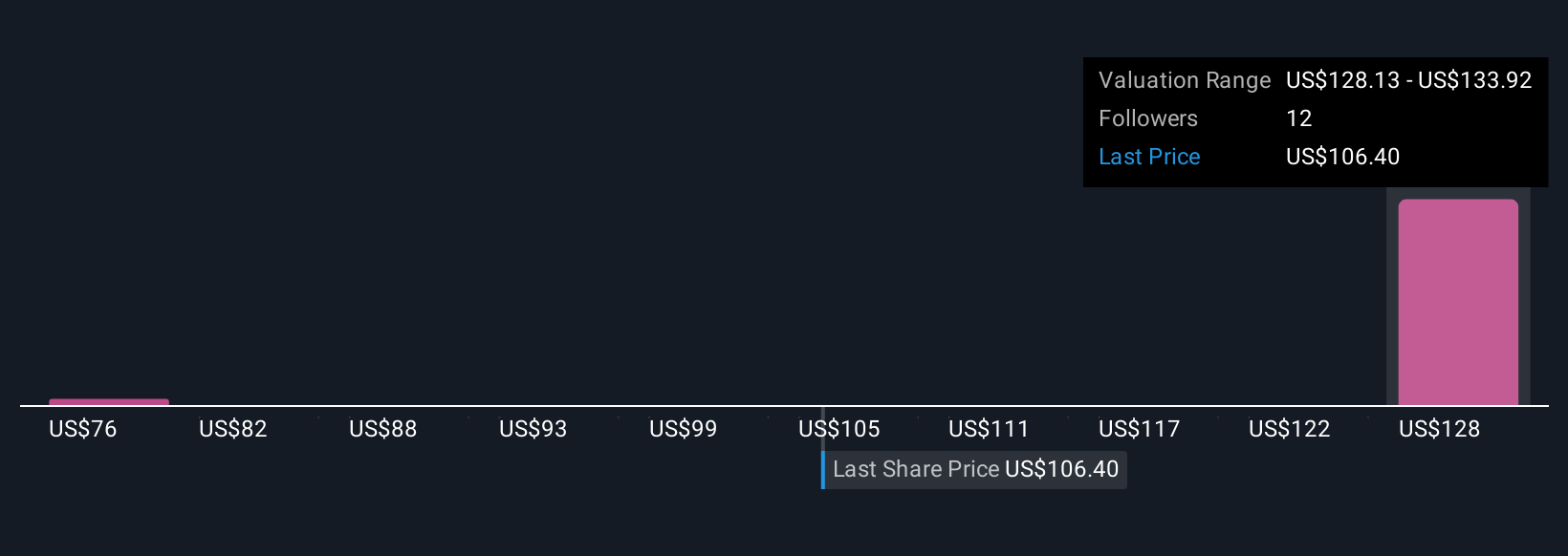

Fair value estimates from three members of the Simply Wall St Community range from US$76 to US$162.31, reflecting a wide spectrum of opinion. With execution risk in recent acquisitions in focus, you can see how many market participants are weighing both growth ambitions and operational challenges.

Explore 3 other fair value estimates on Granite Construction - why the stock might be worth 29% less than the current price!

Build Your Own Granite Construction Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Granite Construction research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Granite Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Granite Construction's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GVA

Granite Construction

Operates as an infrastructure contractor in the United States.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.