- United States

- /

- Electrical

- /

- NYSE:GNRC

Generac Holdings (GNRC): Evaluating Valuation Ahead of Q3 2025 Earnings and Analyst Growth Projections

Reviewed by Kshitija Bhandaru

Generac Holdings (GNRC) is attracting attention ahead of its upcoming third quarter 2025 earnings report, which is set for release on October 29. Investors are eager to see how the company confronts recent challenges related to revenue growth and margins.

See our latest analysis for Generac Holdings.

After facing some pressure earlier in the year, Generac’s shares have staged a notable comeback, rising over 25% in the past three months. Its 1-year total shareholder return sits at a solid 14%. Despite some challenges around growth and margins, momentum is building into the third quarter update and investors are watching closely for signs the business is regaining its stride.

If this recent rebound has you thinking bigger, consider expanding your search and discover fast growing stocks with high insider ownership

With shares on the rise and the next earnings report looming, the central question is whether Generac Holdings is trading at a discount or if market expectations already capture its future growth. Could there still be a buying opportunity?

Most Popular Narrative: 5.5% Undervalued

Generac Holdings' most widely followed narrative pegs its fair value at $203.88, notably above the last close price of $192.64. This positions shares at a modest discount, fueling debate as investors weigh whether the next earnings surge can fully close the gap.

Accelerating demand for backup power solutions in data centers, driven by AI adoption and global digitalization, has resulted in a structural supply deficit for large commercial generators. Generac's rapid entry and a backlog of over $150 million position it to capture significant revenue growth and operating leverage over the next several years. There is further potential upside as the company expands capacity to address demand beyond 2027.

What is behind this bold valuation call? The narrative hinges on a forward-looking surge in market share and margin expansion, anchored by a powerful set of growth projections. The real intrigue lies in the ambitious financial benchmarks that shape analyst optimism. Curious what they are?

Result: Fair Value of $203.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in residential solar demand or a lull in major power outage events could quickly challenge the bullish outlook for Generac Holdings.

Find out about the key risks to this Generac Holdings narrative.

Another View: Market Ratios Tell a Different Story

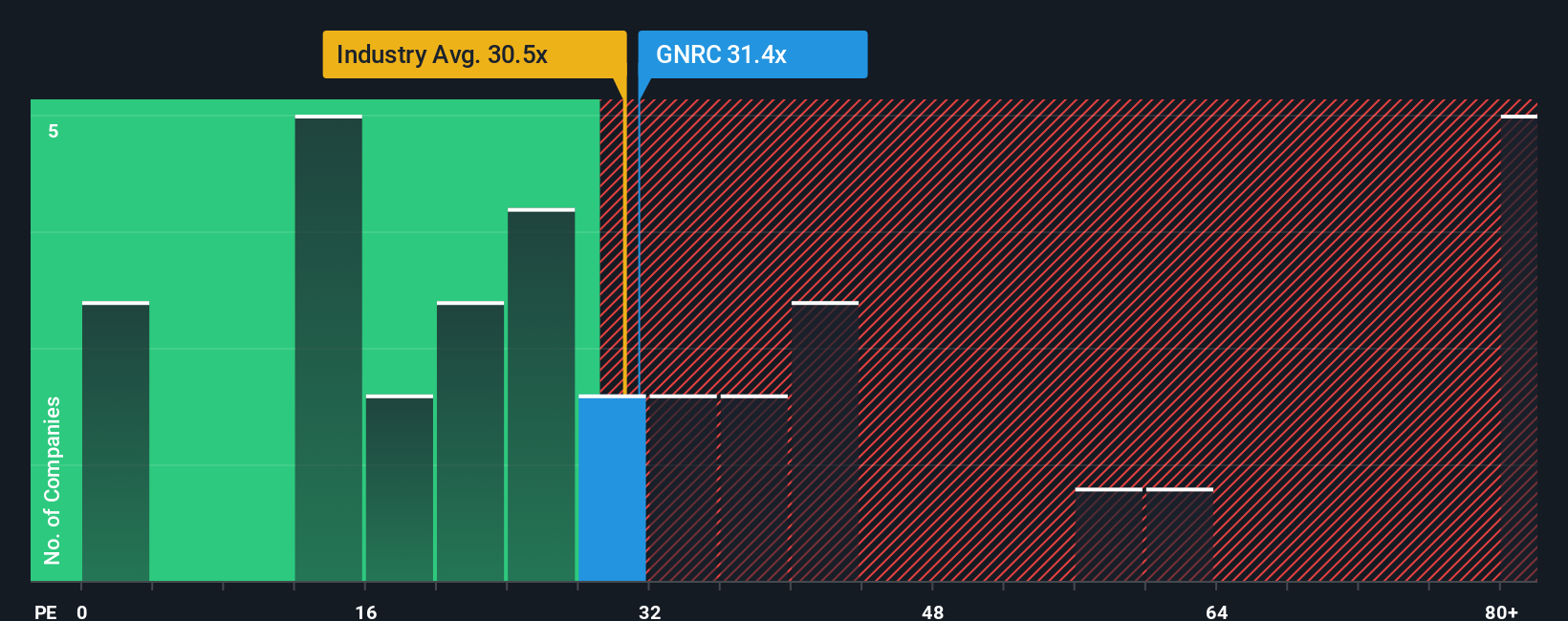

Looking at Generac Holdings through the lens of a price-to-earnings ratio, shares currently trade at 31.4 times earnings. This is slightly above both the US Electrical industry average of 30.5 times and the estimated fair ratio of 30.8 times. While Generac is cheaper than its peer average of 42.6, its premium to industry standards could mean investors face valuation risk if sentiment shifts. Which perspective will ultimately drive Generac's price action?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Generac Holdings Narrative

If you have a different perspective or want to dig deeper into Generac Holdings yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your Generac Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by acting on trends others might miss. Power up your portfolio with unique stock ideas you will not find just anywhere.

- Capture tomorrow’s breakthroughs by scanning these 24 AI penny stocks which bring real AI innovation to industries and set new standards in intelligent automation.

- Maximize your passive income by exploring yield opportunities through these 20 dividend stocks with yields > 3% selected for stable payouts and robust financial health.

- Get ahead of the crowd by searching these 3577 penny stocks with strong financials that balance high-return potential with resilient fundamentals for the ambitious investor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives