- United States

- /

- Electrical

- /

- NYSE:GNRC

Does Dealer Restocking and Weather-Driven Demand Signal a Turning Point for Generac Holdings (GNRC)?

Reviewed by Sasha Jovanovic

- Earlier this quarter, Conestoga Capital Advisors highlighted Generac Holdings' improving sales outlook, driven by strong dealer activity and channel restocking trends, as well as operational recovery supported by cost controls and supply chain improvements.

- An interesting insight is that ongoing demand fueled by recurring extreme weather events and growing concerns around grid reliability is boosting market sentiment for Generac's backup power and energy solutions.

- We'll explore how the favorable dealer restocking trends and operational improvements may influence Generac Holdings' investment narrative and outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Generac Holdings Investment Narrative Recap

To be a shareholder in Generac Holdings, you need confidence in persistent demand for backup power solutions, especially given increased grid vulnerabilities and unpredictable weather. The recent update from Conestoga Capital Advisors highlighting improved dealer activity and channel restocking trends reinforces near-term sales momentum, but the short-term catalyst remains tied to continued strength in dealer restocking and supply stabilization. The biggest risk, ongoing weakness or contraction in the residential solar market, was not materially affected by this news, so longer-term growth uncertainties persist.

Among recent announcements, the launch of the 820W PWRmicro microinverter stands out, directly tied to Generac’s efforts to expand its clean energy offerings and support its transition to diversified, higher-margin revenue streams. This product enhancement could increase the company’s competitiveness within distributed energy and home backup markets, a catalyst that may support resilience amid changing conditions in core residential and C&I generator sales.

Yet, in contrast to positive near-term momentum, investors should be aware of the ongoing risk that if the residential solar market contracts faster than anticipated...

Read the full narrative on Generac Holdings (it's free!)

Generac Holdings is projected to reach $5.5 billion in revenue and $593.3 million in earnings by 2028. This outlook assumes a 7.4% annual revenue growth rate and a $232.8 million increase in earnings from current earnings of $360.5 million.

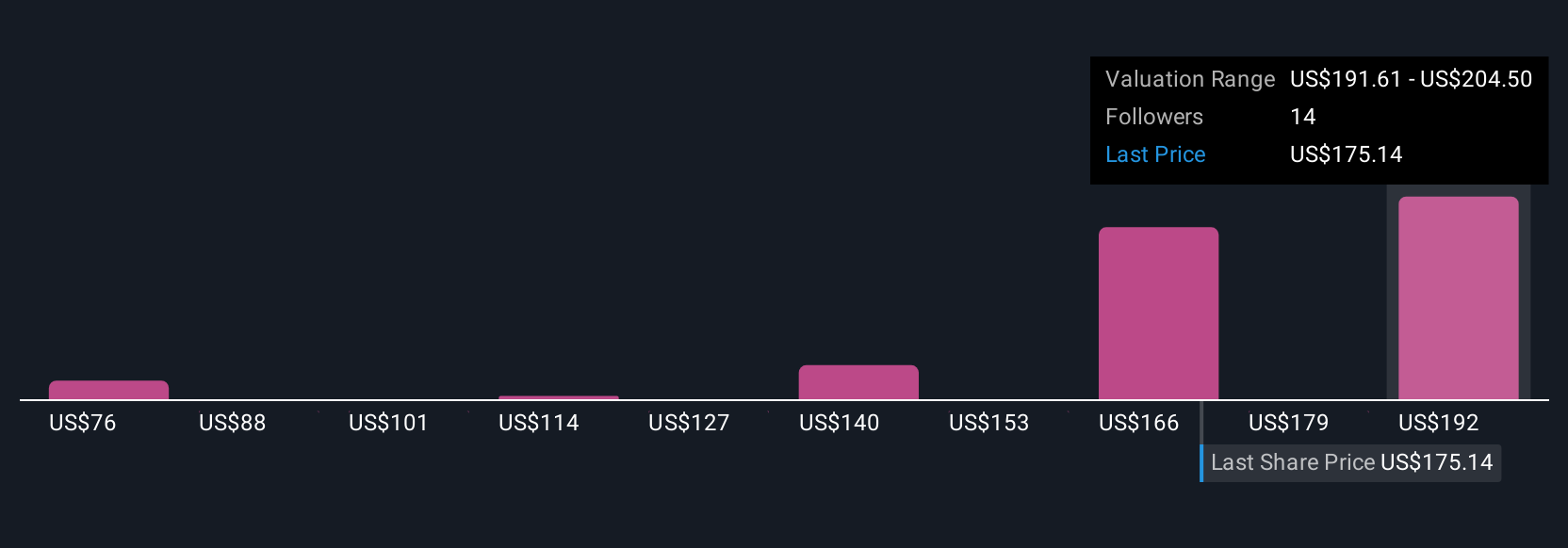

Uncover how Generac Holdings' forecasts yield a $203.88 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer six different fair value estimates for Generac between US$80 and US$203.88, showing wide disagreement. As market participants take diverging views, remember that Generac’s near-term recovery is still dependent on dealer activity and supply chain improvements, inviting you to consider a broader mix of opinions.

Explore 6 other fair value estimates on Generac Holdings - why the stock might be worth less than half the current price!

Build Your Own Generac Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Generac Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Generac Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Generac Holdings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives