- United States

- /

- Electrical

- /

- NYSE:GNRC

A Fresh Look at Generac Holdings (GNRC) Valuation as Investor Momentum Builds

Reviewed by Kshitija Bhandaru

See our latest analysis for Generac Holdings.

Generac Holdings has shown some volatility lately, with a 90-day share price return of 12.72% but a flat total return over the past year. Near-term momentum appears to be building despite a modest pullback over the last month. This may indicate that investors are starting to price in renewed growth potential, given a backdrop of mixed longer-term performance.

If you're interested in what else is gaining traction in the market right now, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership

With Generac trading just under analyst targets and showing signs of recovery, the key question is whether investors are overlooking hidden value or if the current share price already reflects all of its future growth potential.

Most Popular Narrative: 16% Undervalued

Generac's most widely followed narrative suggests the stock is meaningfully below its estimated fair value, granting significant upside if assumptions hold. With the last close at $171.33, this narrative calculates a fair value much higher. This sets the stage for a deeper look at the story behind these numbers.

Accelerating demand for backup power solutions in data centers driven by AI adoption and global digitalization has resulted in a structural supply deficit for large commercial generators. Generac's rapid entry and >$150 million backlog position it to capture significant revenue growth and operating leverage over the next several years, with further potential upside as the company expands capacity to address 2027+ demand.

What is the real growth machine powering this bold valuation? The narrative’s core is a multi-year surge in demand with relentless earnings improvement and a profit multiple more common in much-hyped growth industries. Want to see what aggressive financial assumptions are driving this price target? Dig into the full narrative and uncover the projections fueling this market view.

Result: Fair Value of $203.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in residential solar and the unpredictable nature of outage-driven demand could quickly undermine Generac’s positive growth outlook.

Find out about the key risks to this Generac Holdings narrative.

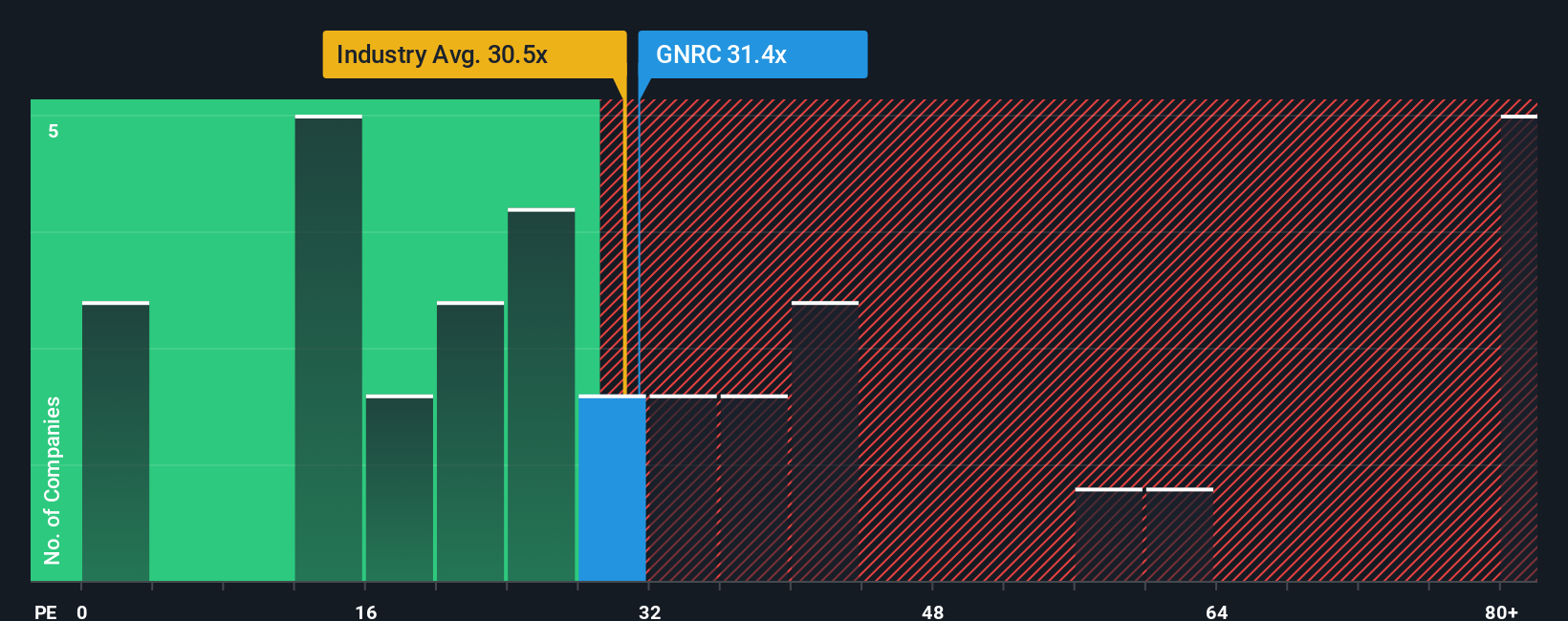

Another View: Valuation Through Multiples

While analysts see Generac as undervalued based on earnings growth, another approach examines the stock’s price-to-earnings ratio. At 27.9x, Generac trades below both its industry (28.2x) and peer (37.5x) averages, and under its fair ratio of 30.1x. This comparison raises the question: does this alignment hint at lingering upside, or does it simply signal that the market is already pricing in much of the future improvement?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Generac Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Generac Holdings Narrative

If you see Generac’s story differently or want to dig deeper yourself, you can build your own view from the same company data in just a few minutes. Do it your way

A great starting point for your Generac Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself a real edge by checking out more tailored stock ideas today. You could miss out on tomorrow’s biggest opportunities if you wait.

- Boost your income stream by tapping into these 19 dividend stocks with yields > 3% with yields currently above 3%.

- Catalyze growth in your portfolio with these 25 AI penny stocks that are positioned to benefit from AI innovation and industry transformation.

- Tap into future breakthroughs by browsing these 26 quantum computing stocks to see who is leading advances in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNRC

Generac Holdings

Designs, manufactures, and distributes energy technology products and solution worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives