- United States

- /

- Machinery

- /

- NYSE:GGG

Graco (GGG): Evaluating Valuation and Growth Potential After Recent Share Stabilization

Reviewed by Kshitija Bhandaru

See our latest analysis for Graco.

While Graco’s share price has seen modest movement recently, its year-to-date return hints at momentum picking back up, supported by decades of compounding for long-term holders. The one-year total shareholder return has been essentially flat but remains strong over the past three and five years, signaling resilience even as short-term sentiment shifts.

If you’re looking for your next idea, now is a perfect time to expand your search and discover fast growing stocks with high insider ownership

But with shares trading at a small discount to analyst targets and solid long-term growth in revenue and income, it prompts a key question: is Graco undervalued now, or is future growth already priced in?

Most Popular Narrative: 8% Undervalued

At $84.86, Graco shares trade 8% below the most widely tracked fair value estimate of $92.44. This positions the stock as potentially underpriced if expected growth is realized.

The strategic decision to maintain a strong U.S. manufacturing footprint may give Graco an advantage over competitors who manufacture offshore. Especially in light of ongoing trade tensions and tariffs, this could potentially improve net margins due to cost control and pricing power.

Curious what powers this bullish call? The key is a chain reaction of profit margin gains, share buybacks, and a premium multiple typically reserved for high-growth leaders. Want to know how ambitious the future forecasts really are? Unlock the full narrative for the surprising assumptions driving this price target.

Result: Fair Value of $92.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if tariffs or slowing contractor segment margins have a greater impact than expected, Graco’s earnings and valuation thesis could be challenged moving forward.

Find out about the key risks to this Graco narrative.

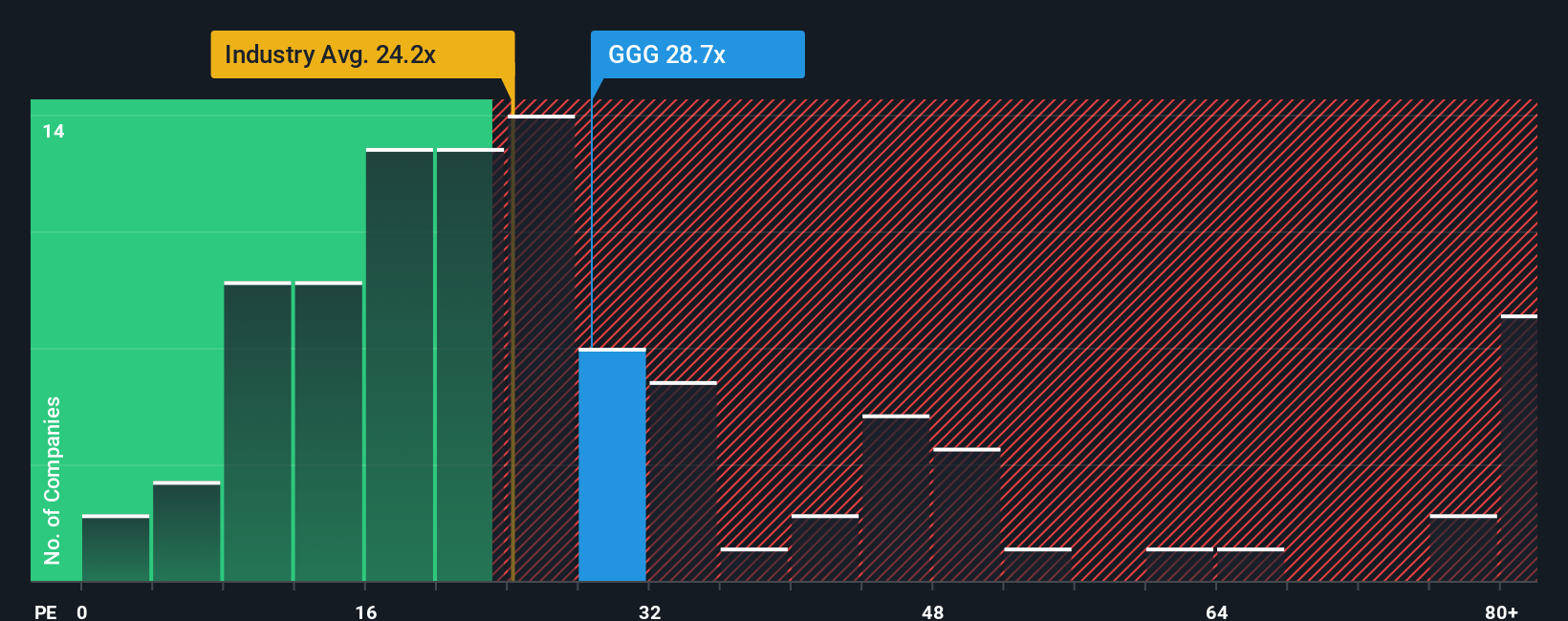

Another View: Rich Valuation on Earnings Metric

Taking a different angle, Graco shares currently trade at 29.1 times earnings, which is noticeably higher than both the industry average of 24.1 and the peer average of 25.6. The fair ratio for the company, based on market trends, would be 21 times earnings. This suggests that, even with quality fundamentals and growth, investors today are being asked to pay a higher price. This raises questions about whether future upside is already reflected in the price or if there are greater risks than the consensus view implies. Could this premium signal opportunity or caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Graco Narrative

If you want to challenge these takes or dive deeper into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Graco.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Level up your strategy with fresh stock picks that could outperform today's headlines and shape tomorrow's winners.

- Catch the surge in healthcare by taking action on these 31 healthcare AI stocks. These companies are making breakthroughs in AI-driven medicine and transforming patient care.

- Capitalize on high-yield potential and financial security with these 19 dividend stocks with yields > 3%. These picks consistently deliver strong dividend returns year after year.

- Experience the excitement of rapid innovation by reviewing these 24 AI penny stocks, which feature companies poised to leverage artificial intelligence for significant growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GGG

Graco

Designs, manufactures, and markets systems and equipment used to move, measure, mix, control, dispense, and spray fluid and powder materials in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives