- United States

- /

- Building

- /

- NYSE:GFF

Griffon (GFF): Assessing Valuation After Softer Earnings and New 2026 Outlook

Reviewed by Simply Wall St

Griffon (GFF) just released fourth quarter earnings, reporting that sales were mostly unchanged from last year while net income and earnings per share declined. Investors also received new 2026 revenue guidance and information about a quarterly dividend.

See our latest analysis for Griffon.

Griffon’s share price has seen modest movement lately, with a recent uptick suggesting investors may be finding renewed confidence after steady earnings and fresh 2026 revenue guidance. While the 1-year total shareholder return is down over 10%, the longer-term picture remains strong. Griffon has delivered an impressive 129% total return over three years and more than 350% over five years, reflecting a track record of significant value creation even as near-term momentum ebbs and flows.

If you’re curious where value and momentum could collide next, this is a great moment to discover fast growing stocks with high insider ownership

With Griffon now trading at a notable discount to analysts’ targets and long-term returns appearing robust, investors have to consider whether this signals a genuine buying opportunity or if the market has already accounted for future growth.

Most Popular Narrative: 26.9% Undervalued

With Griffon's most widely followed narrative setting fair value at $102.83, which is far above its last close of $75.17, the stage is set for a discussion about just how much upside analysts see in the business from today’s price.

Ongoing investments in automation and modernization projects, particularly in HBP, are expected to further improve operating efficiencies and gross margins over the next several years, bolstering future earnings and cash generation. The company's strategic focus on product innovation and diversification in areas like specialty and premium doors positions it well to capitalize on increasing consumer demand for resilient, energy-efficient, and customizable home solutions, potentially increasing average selling prices and revenue per unit.

Curious which bold assumptions made this fair value possible? What kind of growth and margin leaps are baked in? Don’t miss the surprising quantitative drivers behind this ambitious price target. Click through to unravel the details that could change how you see Griffon’s future.

Result: Fair Value of $102.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak consumer demand and rising tariffs could significantly curb Griffon's earnings power. These factors pose real risks to the current growth outlook.

Find out about the key risks to this Griffon narrative.

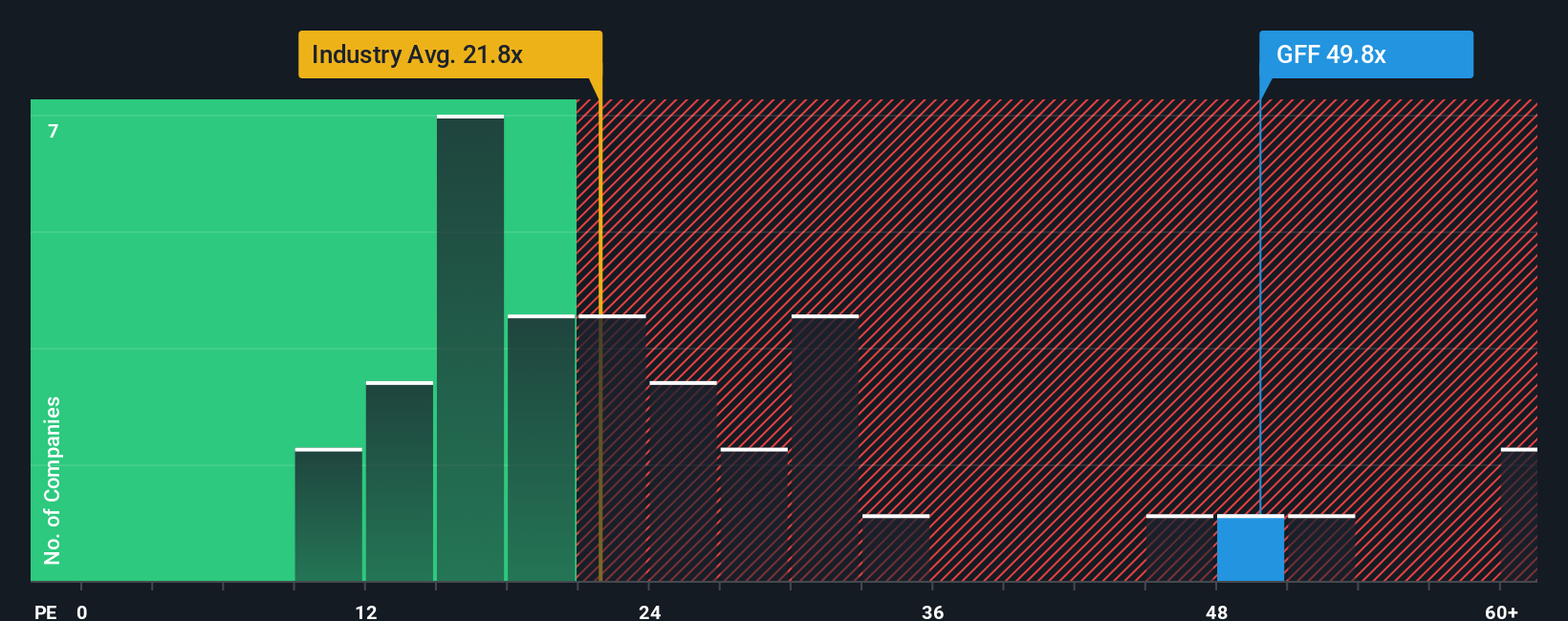

Another View: High Earnings Multiple Raises Caution

While our first look suggests Griffon is significantly undervalued, a glance at its price-to-earnings ratio paints a different picture. Griffon’s current P/E stands at 68x, which is much higher than both its industry average of 18.9x and the fair ratio of 36.1x. This large gap could signal that investors are paying a premium, increasing the risk if growth falls short. Is the market too optimistic, or is there something more at play?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Griffon Narrative

If you want to dig deeper or think there’s another angle worth exploring, you can put together your own narrative using the available data in just a few minutes. Do it your way

A great starting point for your Griffon research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Opportunities?

Smart investors never stop searching for game changers. Uncover new possibilities beyond Griffon with our top screens. Don’t let the next winner pass you by.

- Boost your portfolio with steady income by tapping into these 15 dividend stocks with yields > 3% which delivers attractive yields and strong fundamentals.

- Seize exciting growth potential when you browse these 25 AI penny stocks as these power innovations in artificial intelligence and transform entire industries.

- Uncover exceptional value by reviewing these 933 undervalued stocks based on cash flows that the market may have priced below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GFF

Griffon

Through its subsidiaries, provides home and building, and consumer and professional products in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.