- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova’s Valuation: Weighing Strong Results, Cautious Outlook, and Prolec GE Deal

Reviewed by Simply Wall St

GE Vernova (NYSE:GEV) landed in the spotlight after posting stronger-than-expected quarterly results, pairing robust growth in new orders with an expanded backlog. Investors took note as the company reaffirmed optimistic full-year guidance, but cautious executive commentary and deal news added fresh wrinkles to the outlook.

See our latest analysis for GE Vernova.

GE Vernova's share price has soared this year, with a year-to-date return of 72% and a remarkable 1-year total shareholder return just under 100%. Recent sessions, however, have seen volatility. After upbeat earnings and a major growth acquisition, investor nerves set in when management signaled capital spending could soon peak, tempering some of the exuberance that drove the stock’s powerful rally. This combination of robust long-term potential and new questions about the pace of future expansion is keeping momentum in flux as GE Vernova reshapes its grid and electrification footprint.

If you’re curious which other companies are showing high growth potential with insiders along for the ride, now’s a great time to discover fast growing stocks with high insider ownership

With analysts boosting their price targets and CEO guidance introducing new questions about future growth, the debate is intensifying. Is GE Vernova’s stock now reflecting all its promise, or could there be further upside for investors willing to look ahead?

Most Popular Narrative: 13.1% Undervalued

GE Vernova is trading below the most closely watched narrative's fair value, with the narrative suggesting a notable premium over the last close price. This valuation reflects strong confidence in the company’s future and is shaped by some potentially game-changing trends in its core markets.

Strategic investments in expanding capacity (e.g., Pennsylvania Electrification plant), robotics, automation, and AI, alongside ongoing productivity initiatives, position GE Vernova to capture accelerating demand and improve operating leverage. These factors may boost future net margins.

Want to know the formula powering this bullish price target? The heart of the narrative is aggressive margin expansion and a profit growth forecast that defies the skeptics. But what surprising set of financial leaps are analysts using to back up this valuation? Click to uncover the assumptions driving this eye-catching fair value.

Result: Fair Value of $672.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent losses in the Wind segment and weaker European demand could quickly undermine the bullish narrative if these trends continue in future quarters.

Find out about the key risks to this GE Vernova narrative.

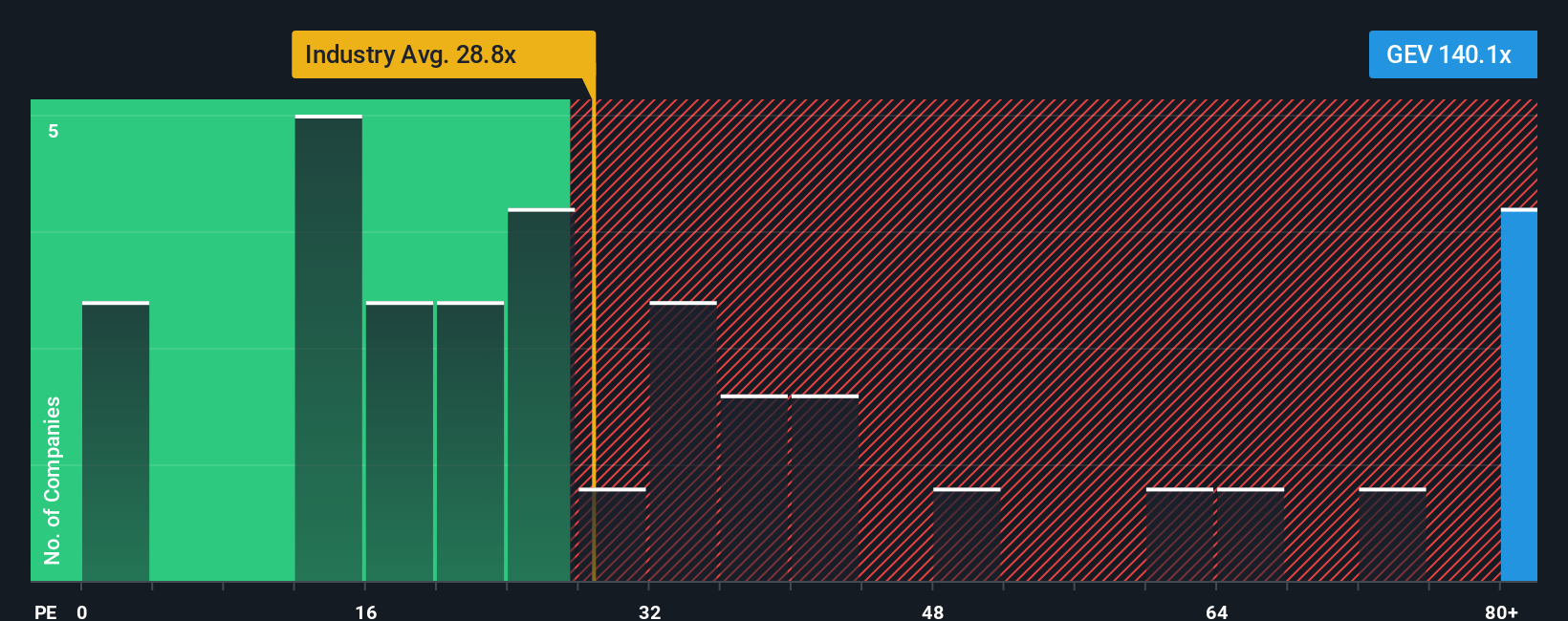

Another View: High Valuation Through Price-to-Earnings

On the other hand, GE Vernova looks expensive when using a traditional price-to-earnings approach. Its P/E ratio of 93.3x is well above both the US Electrical industry average (30.7x) and its peers (39.3x), and even outpaces the market’s own estimate of a fair ratio at 77.7x. This gap suggests investors are paying a hefty premium for future growth, but will those expectations hold in a changing market?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

If you have a different perspective or want to dig into the numbers on your own terms, it only takes a few minutes to shape your own forecast and interpretation, too. Do it your way

A great starting point for your GE Vernova research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Stock Ideas?

Seize your next big opportunity: the Simply Wall St Screener uncovers hand-picked stocks across groundbreaking sectors, high-growth frontiers, and powerful dividend plays. Don't risk missing your edge.

- Benefit from future-shaping artificial intelligence by exploring these 27 AI penny stocks packed with companies pioneering automation, smart data, and breakthrough AI applications.

- Generate income and stability by checking out these 17 dividend stocks with yields > 3% featuring stocks with yields above 3%, perfect for building lasting wealth.

- Supercharge your portfolio’s growth with these 877 undervalued stocks based on cash flows highlighting companies that could be trading below their intrinsic value and primed for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives