- United States

- /

- Electrical

- /

- NYSE:GEV

GE Vernova (GEV) Margin Acceleration Reinforces Growth Narratives Despite High Valuation

Reviewed by Simply Wall St

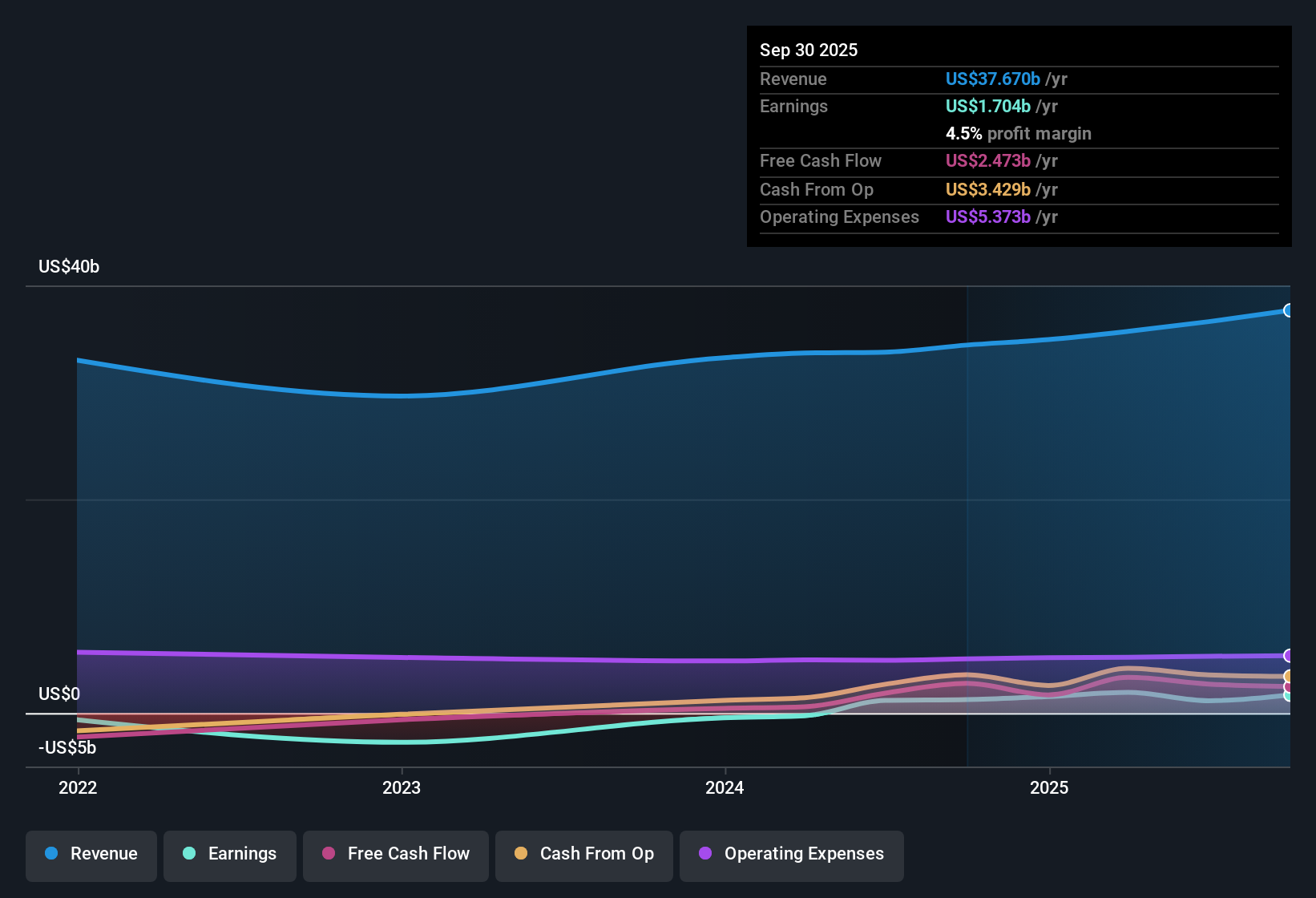

GE Vernova (GEV) reported earnings projected to grow 34.5% per year, outpacing the broader US market’s 15.5% annual forecast. Net profit margins reached 4.5%, higher than last year’s 3.7%, with five-year annual earnings growth averaging an impressive 78.6%. Investors are watching the continued acceleration in profits and margins, balanced against a high valuation multiple compared to industry peers, but with limited insider risk in sight.

See our full analysis for GE Vernova.Next, we will see how these key results compare to widely followed narratives and investor sentiment around GE Vernova, revealing which perspectives hold up and which are challenged.

See what the community is saying about GE Vernova

Margin Gains Propel Profit Targets

- Analysts expect GE Vernova’s net profit margin to climb from 3.2% currently to 12.1% within three years. If achieved, this would significantly outpace margin trends seen in similar industrial companies.

- Analysts' consensus view focuses on recurring, high-margin service revenues and strategic bets in grid and electrification, viewing these as the driver for future margin gains.

- The consensus narrative notes margin expansion is supported by a combination of growing electrification demand and long-term service contracts, which are steadily boosting the quality and predictability of profits.

- The move toward a higher-margin backlog and robust grid/software solutions is expected to drive this margin uplift, but regional risks and wind segment losses could limit progress.

What’s behind Wall Street’s optimism, and where could this substantial margin expansion face obstacles? Consensus says the shift toward high-value grid and software solutions is key, but uneven project wins and wind losses remain important watchpoints. 📊 Read the full GE Vernova Consensus Narrative.

Wind Losses Weigh on Diversification

- The Wind segment posted approximately $300 million in year-to-date losses, even as other divisions benefited from grid modernization and electrification demand.

- According to analysts' consensus view, wind’s drag on group profitability continues to temper the overall bullish margin outlook.

- Bears argue persistent wind losses and the risk of further cost overruns, including tariff headwinds of $300 to $400 million forecast in 2025, could undermine the expected uplift from other segments.

- Project-based volatility, such as delays or cancellations in transmission projects, makes future service revenue harder to predict, increasing the need for caution.

Valuation Premium Demands Growth Delivery

- GE Vernova trades at a 95x Price-to-Earnings multiple, a significant premium over the industry average of 30.8x, while sitting just below DCF fair value at $595.15 versus $600.71.

- Analysts' consensus suggests that justifying this steep valuation requires the company to reach ambitious profit and revenue targets. By 2028, that means $5.8 billion in earnings and a PE ratio that still exceeds sector averages.

- The consensus narrative points out that despite strong topline visibility and margin tailwinds, the modest 7.1% spread between the current share price and analyst target ($595.15 vs $676.04) leaves little room for underperformance.

- Even with limited insider selling and quality growth, execution on segment profitability and margin expansion becomes critical for maintaining investor confidence at today’s valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for GE Vernova on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Bring your perspective to the table and start your own narrative in just a few minutes. Do it your way.

A great starting point for your GE Vernova research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite GE Vernova’s robust growth and margin outlook, its lofty valuation leaves little margin for error if ambitious profit targets are missed.

If you want to avoid overpaying for growth stories, check out these 875 undervalued stocks based on cash flows to spot companies with solid fundamentals still trading at discounts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GEV

GE Vernova

An energy company, engages in the provision of various products and services that generate, transfer, orchestrate, convert, and store electricity in the United States, Europe, Asia, the Americas, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives