- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

General Electric (GE): Exploring Valuation After Strategic Aerospace Partnerships and Technology Breakthroughs

Reviewed by Kshitija Bhandaru

If you have been following General Electric (GE) lately, the company has been making waves, not just with its share price, but with a string of collaborations that are giving investors plenty to talk about. GE Aerospace’s recent alliances with Kratos Defense & Security Solutions on propulsion systems and with Merlin for AI-enabled autonomy solutions have thrust the company deeper into the next generation of defense and aerospace innovation. Add to that its successful supersonic ATLAS flight test and growing orders from the defense sector, and it is clear why GE is occupying a front-row seat in one of the hottest sectors right now.

All this momentum comes as GE’s stock has climbed an impressive 60% over the past year, far outpacing most industry peers. The company’s shares have picked up steam in recent months as excitement builds around its new technology platforms and recurring updates on business wins and product milestones. Long-term investors have also seen substantial returns over the past several years, even as the stock has faced intermittent pullbacks tied to broader market swings or sector sentiment.

With all these strategic catalysts in play and investor enthusiasm running high, the big question is whether the recent rally means GE is now fully valued, or if there is still room for those looking to catch the next leg up.

Most Popular Narrative: 2.4% Undervalued

The most widely followed narrative considers General Electric to be slightly undervalued, based on future earnings potential and margin expansion within its core aerospace business.

"Acceleration of next-generation engine programs (like CFM RISE with open fan technology and the GE9X) is driven by airline demand for significantly improved fuel efficiency and lower emissions. This positions GE to capture incremental orders and technology licensing revenue as decarbonization efforts intensify, positively impacting long-term revenue and earnings growth."

Want to know the ingredient in this fair value calculation? This narrative banks on some big growth numbers and margin optimism. Curious how next-gen tech, robust cash flows, and a premium valuation multiple get tied together as the spark for the price target? The details might surprise you.

Result: Fair Value of $302 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, mounting supply chain pressures or a prolonged downturn in global air travel could quickly undermine these bullish assumptions and reshape GE's outlook.

Find out about the key risks to this General Electric narrative.Another View: The Numbers Tell a Different Story

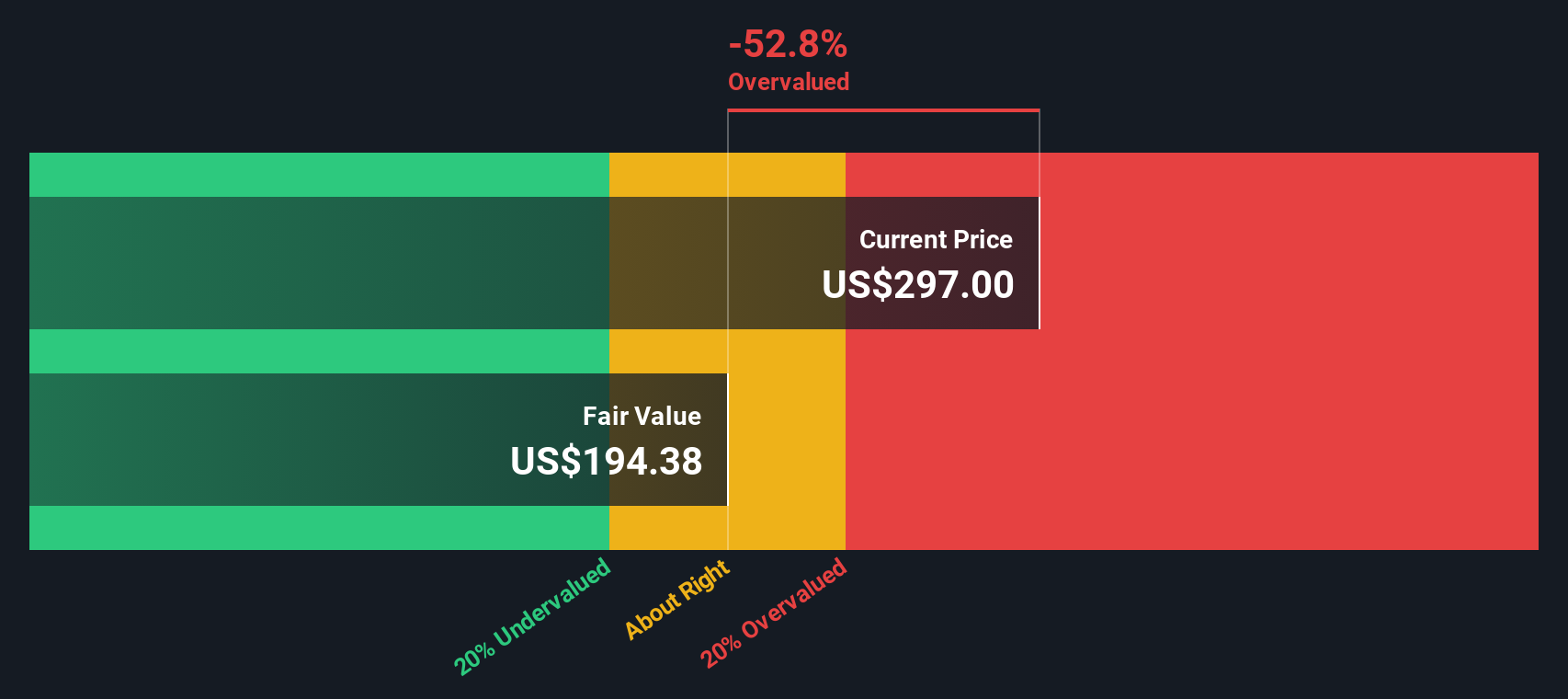

While the fair value narrative paints GE as slightly undervalued, our DCF model offers a less optimistic outlook and suggests the shares could actually be overvalued. Which set of assumptions will prove more accurate in the end?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own General Electric Narrative

If you see things differently, or would rather dive into the data on your own terms, you can easily build your own GE story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding General Electric.

Looking for More Winning Ideas?

Why settle for just one opportunity? These curated stock ideas could give your portfolio the edge. Make your next smart move before everyone else catches on.

- Uncover market gems by spotting companies with strong cash flows trading below their value using our handy undervalued stocks based on cash flows.

- Capture the booming potential of healthcare innovation with up-and-coming leaders in medical AI with our healthcare AI stocks.

- Ride the wave of global blockchain disruption by finding standout growth stories in digital assets by using our cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives