- United States

- /

- Aerospace & Defense

- /

- NYSE:GE

GE (GE) Margin Surge Reinforces Bullish Narratives Despite Valuation Premium

Reviewed by Simply Wall St

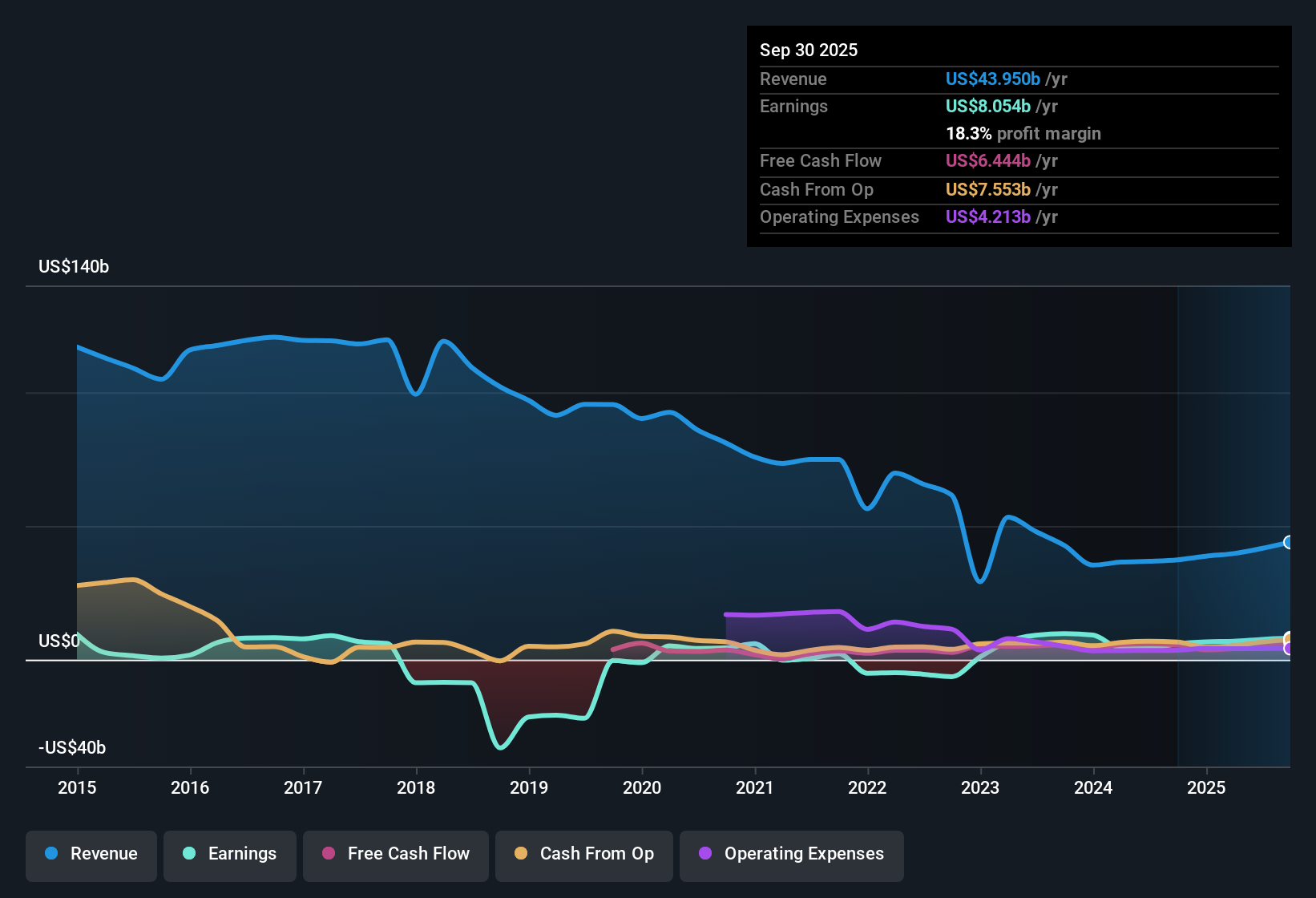

General Electric (GE) posted impressive numbers in its latest earnings, with net profit margins jumping to 18.3% from 15.8% the previous year. Earnings grew at 36.1% over the last year, outpacing the 5-year compound average of 32.5% per year, signaling an acceleration in performance. With continued profit and revenue growth and improving margins, investors are watching how these strong results balance against GE's current valuation premium and growth outlook.

See our full analysis for General Electric.The next section puts these headline numbers against the broader market narratives for GE, highlighting where the data supports the consensus and where surprises might emerge.

See what the community is saying about General Electric

Margins Widen as Efficiency Programs Take Hold

- Net profit margins reached 18.3%, up from 15.8% last year. Analysts anticipate modest further expansion to 18.8% within three years.

- Analysts' consensus view notes that advanced engine initiatives and digitalization across maintenance, repair, and operations are driving higher revenue and margin growth for GE.

- Programs such as CFM RISE and GE9X, with next-generation technologies and airline demand for fuel efficiency, are projected to support both order volume and technology licensing revenue. This reinforces expectations for longer-term gains.

- Rapid rollout of AI-enabled maintenance processes and increased shop visit activity is expected to support recurring aftermarket revenue and additional margin expansion in the coming years, helping to keep margins above historical averages.

See what’s behind GE’s margin strength and market outlook in the Consensus Narrative. 📊 Read the full General Electric Consensus Narrative.

Premium Valuation Outpaces Peers and Sector

- GE’s price-to-earnings ratio stands at 40.4x, higher than both the aerospace and defense sector average (39x) and the closest peer group (26.5x). The current share price of $306.63 remains below the analyst target of $327.29.

- Consensus narrative highlights how analyst expectations for high profit margin durability and revenue growth are built into the share price. However, the relatively tight 7.3% gap between the current price and analyst target suggests limited room for upside unless outperformance continues.

- To reach analyst targets, GE would need to sustain sector-leading revenue and earnings per share gains to justify a premium price-to-earnings multiple even as industry averages remain lower.

- The share price's proximity to consensus targets underlines the market’s confidence in GE’s growth outlook, but also signals increased sensitivity to any future missteps in execution or in market demand for new engine platforms.

Growth Leaning Heavily on Commercial Aviation

- Recent filings show that a major earnings driver remains GE’s concentration in commercial aviation and narrow-body engine programs, which increases exposure to airline industry cycles and competitive threats.

- Consensus narrative draws attention to the company’s reduced diversification following recent strategic shifts, making profits and cash flow more vulnerable to shocks in air travel demand, supply chain pressures, or slowdowns in retrofit and parts activity.

- If economic or regulatory headwinds affect global airlines, GE’s elevated dependency on commercial customers may cause earnings volatility, potentially magnified by ongoing supply chain challenges.

- Intensifying competition from engine makers and new technology entrants could squeeze pricing and margin potential if GE does not maintain an innovation advantage that aligns with global decarbonization and efficiency requirements.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for General Electric on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Does the data point you in a different direction? Share your take and shape your unique market narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding General Electric.

See What Else Is Out There

GE’s premium valuation and concentration in commercial aviation can expose investors to volatility when sector conditions change or if company execution does not meet expectations.

If you want companies with more attractive entry points and less valuation risk, check out these 879 undervalued stocks based on cash flows and discover which stocks the market may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GE

General Electric

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives