- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

Is It Time To Consider General Dynamics After Its Strong 2025 Share Price Run?

Reviewed by Bailey Pemberton

- If you are wondering whether General Dynamics is still worth considering after such a strong run, you are not alone. This stock now sits firmly on many value investors watchlists.

- After climbing 29.3% year to date and 29.9% over the last year, the share price has cooled slightly in the last month with a 2.0% pullback, which could be giving patient investors a fresh entry point.

- Recent headlines have focused on steadily growing defense budgets and renewed demand for combat systems and military technology, which helps explain why the stock has outpaced the broader market over the last few years. At the same time, investors are closely watching geopolitical tensions and long term government spending plans, both of which can quickly change the market mood around defense contractors like General Dynamics.

- On our framework, General Dynamics scores a 4 out of 6 for valuation, suggesting it screens as undervalued on most, but not all, of our checks. Next we will break down what different valuation methods are saying about the stock today and finish with a more holistic way to think about its true worth.

Find out why General Dynamics's 29.9% return over the last year is lagging behind its peers.

Approach 1: General Dynamics Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting its future cash flows and then discounting those amounts back into todays dollars. It is essentially asking what all of General Dynamics future cash generation is worth in $ right now.

General Dynamics generated about $4.65 billion of free cash flow over the last twelve months, and analysts expect this to climb gradually over time. Projections used in the model suggest free cash flow could reach roughly $5.01 billion by 2029, with further years extrapolated by Simply Wall St based on modest growth assumptions rather than explicit analyst forecasts.

When all these future cash flows are discounted back using a 2 Stage Free Cash Flow to Equity approach, the intrinsic value for General Dynamics comes out at about $372.80 per share. Compared with the current market price, this implies the stock is trading at roughly a 9.5% discount, which is close enough that it could just reflect normal market noise around a reasonable fair value range.

Result: ABOUT RIGHT

General Dynamics is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: General Dynamics Price vs Earnings

The price to earnings, or PE, ratio is a useful way to value consistently profitable companies because it compares what investors are paying today with the earnings the business is already producing. In general, faster growth and lower risk justify a higher PE, while slower growth or higher uncertainty usually call for a lower, more conservative multiple.

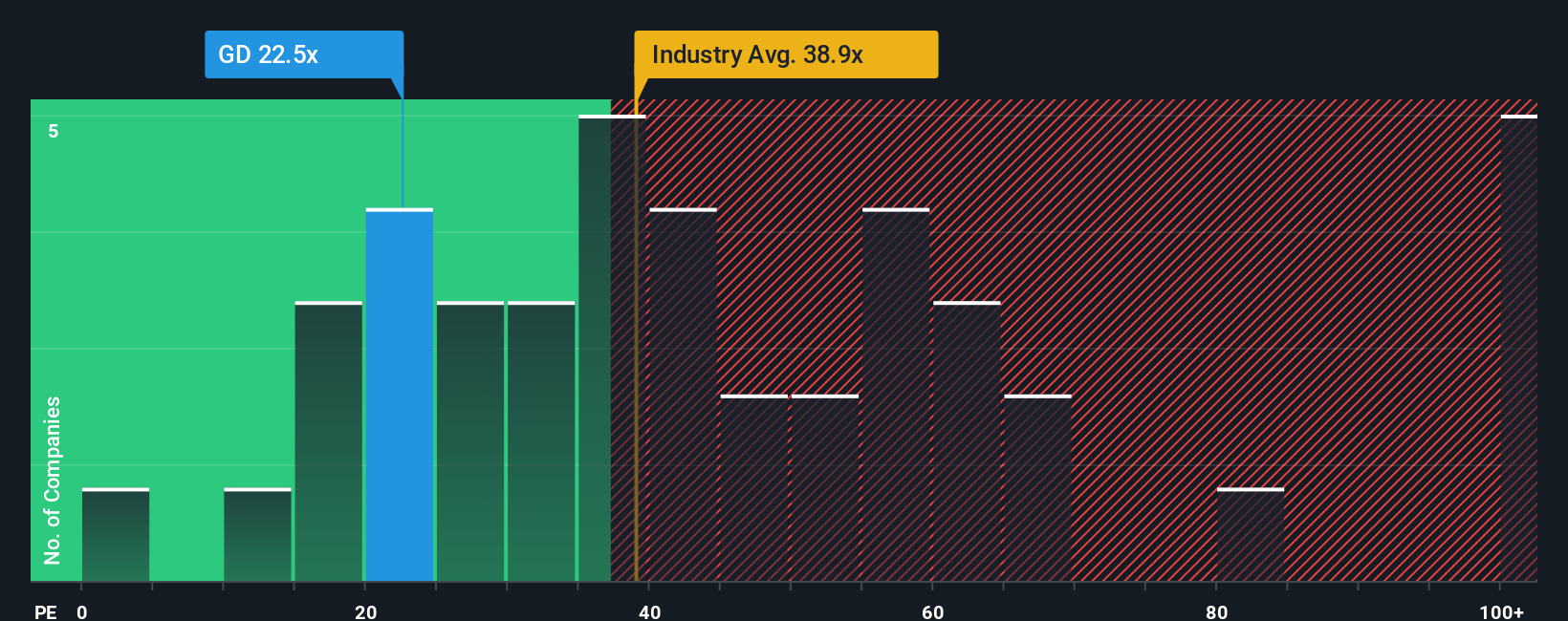

General Dynamics currently trades at about 21.6x earnings, which is well below the Aerospace and Defense industry average of roughly 37.4x and beneath the peer group average of about 34.8x. On the surface that discount might make the stock look obviously cheap, but simple comparisons can be misleading because they ignore differences in growth, profitability, size and risk profiles.

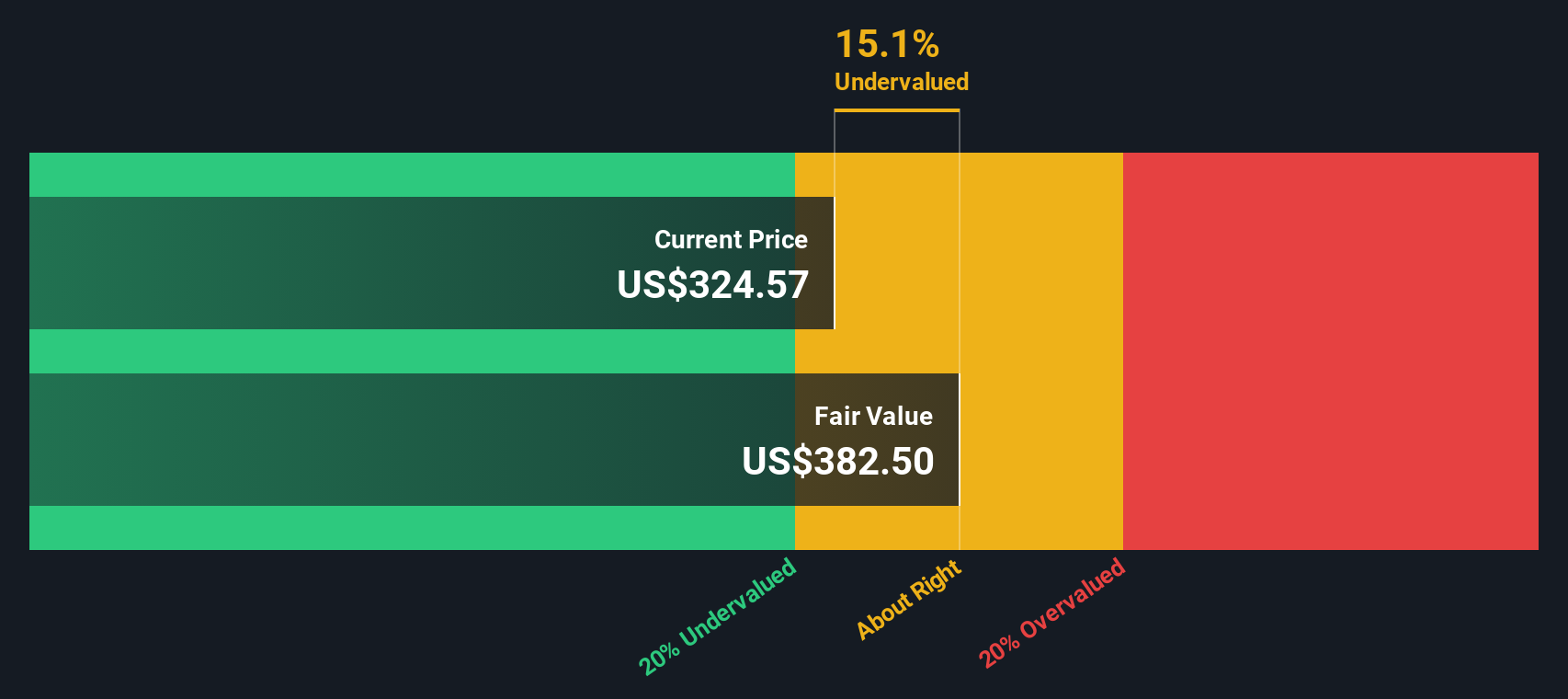

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio of around 27.5x represents the PE multiple that may reasonably be applied to General Dynamics, given its earnings growth outlook, margins, industry, market cap and risk factors. Because it is tailored to the company, it can provide a more nuanced benchmark than peer or industry averages. With the current PE sitting below this Fair Ratio, the shares appear modestly undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your General Dynamics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple way to attach your story about General Dynamics to the numbers you believe in, by linking your view of its future revenue, earnings and margins to a financial forecast, a fair value and a buy or sell decision that lives on Simply Wall St’s Community page, updates automatically as new news or earnings arrive, and can differ meaningfully from other investors. For example, one Narrative might assume marine and defense demand drives fair value toward the upper $380 to $400 range, while a more cautious Narrative leans closer to $280 based on execution and budget risks. This makes it clear when the current price looks attractive or stretched relative to your own fair value.

Do you think there's more to the story for General Dynamics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)