- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics (GD) Announces US$1.50 Quarterly Dividend For Shareholders

Reviewed by Simply Wall St

General Dynamics (GD) recently affirmed a quarterly dividend of $1.50 per share, underscoring its commitment to rewarding shareholders. Over the last quarter, GD's stock price rose by 4%, in line with broader market trends. During this period, the company reported first-quarter earnings with a revenue increase to $12,223 million and a rise in net income to $994 million, which likely supported this upward move. The completion of a share repurchase tranche may have also added positive sentiment. In the context of a 13% market rise over the past year, General Dynamics' performance reflects steady growth.

We've spotted 1 possible red flag for General Dynamics you should be aware of.

The recent reaffirmation of General Dynamics' quarterly dividend of US$1.50 per share and its 4% stock price rise in the last quarter align with broader market trends, potentially reinforcing investor confidence. Over the past five years, the company's total return, including share price and dividends, increased by 95.69%. This longer-term gain can offer a more comprehensive perspective on its overall performance. In comparison to the previous year, the company's return underperformed both the US Aerospace & Defense industry, which returned 32.2%, and the broader US market, which returned 12.6%, indicating challenges in keeping pace with industry and market growth.

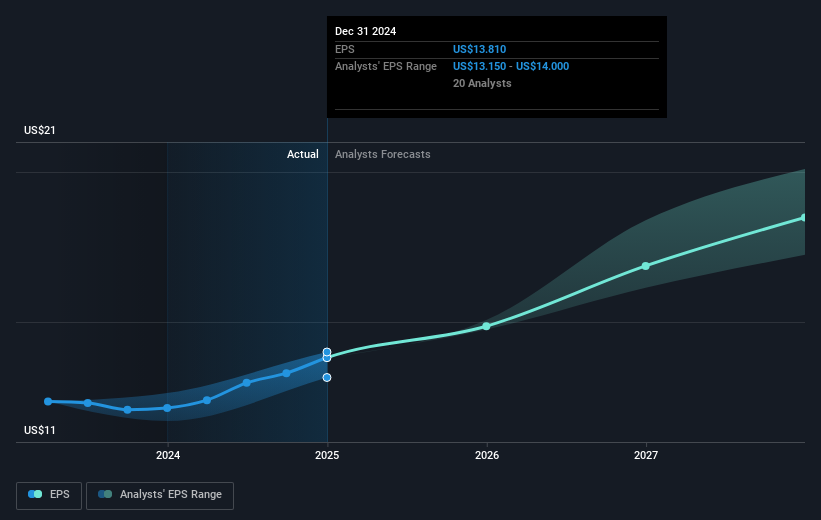

The certification of the G800 and strengthened order activity could positively affect future revenue and earnings forecasts. Analysts estimate an annual revenue growth of 3.4% over the next three years, supported by improvements in aerospace and marine efficiencies. However, challenges like supply chain issues and pressurized book-to-bill ratios could constrain growth. With a current share price of US$270.61, the analyst consensus price target of US$292.42 suggests a 7.5% higher market value, illustrating a fairly close alignment between current pricing and projected company value.

Evaluate General Dynamics' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives