- United States

- /

- Aerospace & Defense

- /

- NYSE:GD

General Dynamics (GD) Adds $642M Submarine Contract Is Long-Term Navy Demand the Real Story?

Reviewed by Sasha Jovanovic

- General Dynamics Electric Boat announced in late September that it was awarded a US$642 million contract modification to support Virginia-class submarine production, enhancing its work under a previous U.S. Navy contract.

- This award highlights the sustained demand for advanced naval capabilities and reinforces General Dynamics' critical role in the U.S. military-industrial base.

- We'll explore how this substantial submarine contract modification enhances General Dynamics' investment narrative and outlook for its Marine Systems segment.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

General Dynamics Investment Narrative Recap

To believe in General Dynamics as a shareholder, you need confidence in sustained global defense demand, strong government contracts, and the company’s ability to manage operational risks, particularly in its Marine Systems segment. The recent US$642 million contract modification for Virginia-class submarines further solidifies backlog visibility in the short term, but it does not eliminate concerns about supply chain delays, which remain the most important short-term risk to throughput and margins.

Among recent announcements, the upgrade in General Dynamics' contract pipeline, specifically the IT modernization contract for US Strategic Command, reflects management's ongoing efforts to diversify and secure large-scale government orders. This underpins one of the main catalysts for long-term growth: the expanding order book across both Marine Systems and Mission Technologies, helping to cushion the impact of episodic supply disruptions and margin pressures.

However, in contrast to the positive backlog news, investors should be aware that recent operational setbacks and supply chain delays in the Marine segment mean...

Read the full narrative on General Dynamics (it's free!)

General Dynamics' narrative projects $55.8 billion in revenue and $5.1 billion in earnings by 2028. This requires 3.6% yearly revenue growth and a $1.0 billion increase in earnings from $4.1 billion today.

Uncover how General Dynamics' forecasts yield a $337.94 fair value, in line with its current price.

Exploring Other Perspectives

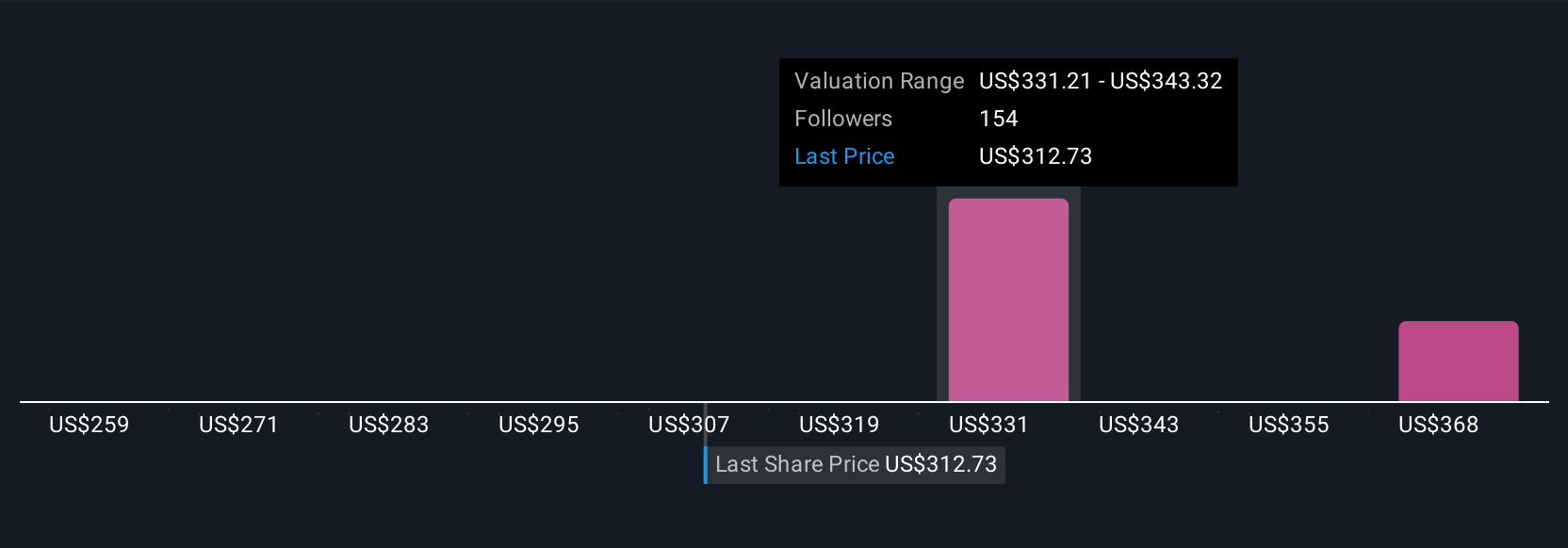

Eight individual fair value estimates from the Simply Wall St Community range from US$260 to US$378.90 per share. As you review differing views, consider how marine program delays could affect future earnings and sentiment.

Explore 8 other fair value estimates on General Dynamics - why the stock might be worth as much as 11% more than the current price!

Build Your Own General Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your General Dynamics research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free General Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate General Dynamics' overall financial health at a glance.

No Opportunity In General Dynamics?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GD

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives