- United States

- /

- Machinery

- /

- NYSE:GBX

Greenbrier Companies (GBX) Margin Jump Challenges Bearish Narratives on Profit Sustainability

Reviewed by Simply Wall St

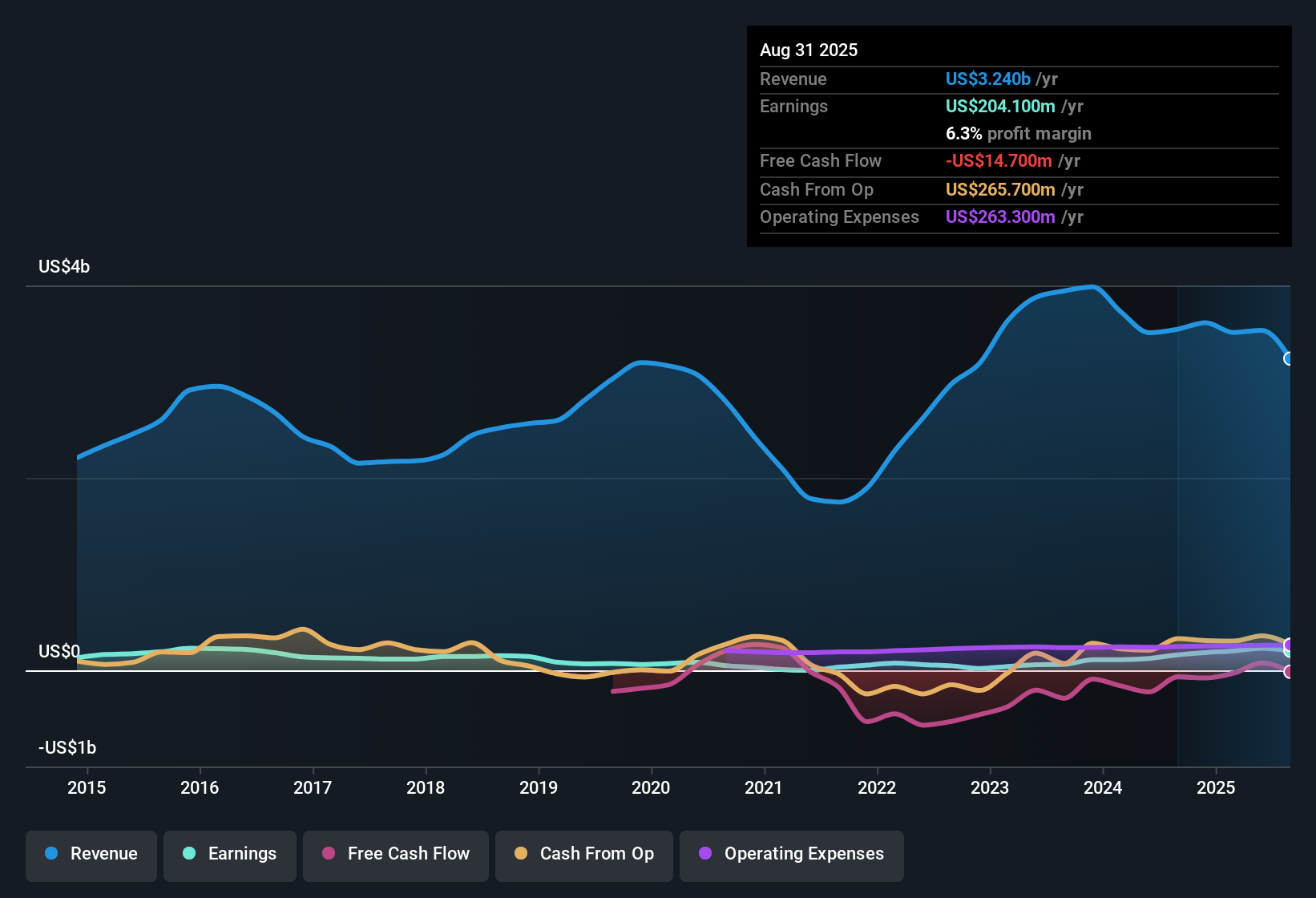

Greenbrier Companies (GBX) posted a net profit margin of 6.3%, up from 4.5% a year ago, underscoring a more profitable year for the railcar manufacturer. While earnings have grown at an impressive 44.9% annually over the last five years, the most recent year saw slower earnings growth of 27.5%, and Wall Street is eyeing a 6.2% annual revenue decline for the next three years. With shares trading at $41.29 and a P/E ratio of 6.3x, which is well below industry peers, investors are weighing attractive valuation signals against a higher financial risk profile and dividend concerns as fresh results come in.

See our full analysis for Greenbrier Companies.The next section puts Greenbrier’s headline numbers in direct context with the market’s narrative. This is where consensus gets confirmed or questioned.

See what the community is saying about Greenbrier Companies

Stable Backlog Anchors Near-Term Revenue

- Greenbrier’s global railcar backlog stands at $2.6 billion, creating a visible revenue runway that can help buffer declining sales forecasts in the broader railcar market.

- According to analysts’ consensus view, efficiency improvements and strong leasing demand are seen as crucial levers supporting revenue in a tough industry environment.

- With leasing revenue climbing 39% over the last two years and a limited supply of equipment, consensus analysts point to recurring revenue as an offset against short-term headwinds.

- However, the predicted 6.2% annual revenue decline over the next three years still challenges this story, especially as a slower pace of new orders in Europe and potential production cuts could limit how much of the backlog actually translates into cash flows.

- To see how these numbers contribute to the bigger narrative and where analysts are divided, check out the latest consensus insights for Greenbrier Companies. 📊 Read the full Greenbrier Companies Consensus Narrative.

Margin Gains Face Shrinking Forecasts

- The net profit margin has risen to 6.3% from 4.5% a year ago, demonstrating effective cost actions and margin resilience despite revenue pressures.

- Consensus narrative notes this margin lift supports optimism that strategic efficiency steps can help Greenbrier weather a challenging demand landscape.

- Facility rationalization and operating improvements are credited for recent margin gains, signaling better profitability even as the top line falls.

- On the flip side, analysts now expect profit margins to compress back down to 2.2% by 2028, a marked reversal that suggests current margin strength may not be sustainable over the long run.

PE and Price Signal Value Trap Risk

- Greenbrier trades at a price-to-earnings ratio of 6.3x, well below the US Machinery industry average of 24.6x and the peer average of 30.4x. However, its $41.29 share price remains significantly higher than its DCF fair value of $23.05.

- According to the analysts' consensus view, the relative discount to peers flags a possible value opportunity, but any bullish case is complicated by a fair value gap and looming profit declines.

- The analyst price target of $49.00 offers just a modest upside from today, meaning Greenbrier’s low PE may reflect justified caution about shrinking margins and revenue, not just a market mispricing.

- For the consensus narrative to pan out, the company would need to sustain elevated trading multiples (PE of 32.9x in 2028) on much lower earnings. This scenario demands a high degree of investor confidence in a turnaround that has yet to materialize.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Greenbrier Companies on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the numbers lead you to another conclusion? In just a few minutes, you can chart your own course and share your outlook. Do it your way

A great starting point for your Greenbrier Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Greenbrier faces shrinking earnings forecasts and profit margin pressures. These challenges affect both its near-term returns and its longer-term value story.

If you want to focus on companies trading below their fair value with lower downside risk, check out these 848 undervalued stocks based on cash flows that could offer a more attractive entry point right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GBX

Greenbrier Companies

Designs, manufactures, and markets railroad freight car equipment in North America, Europe, and South America.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives