- United States

- /

- Trade Distributors

- /

- NYSE:GATX

GATX (GATX) Margin Boost Reinforces Profit Narrative Despite Reliance on $125M One-Off Gain

Reviewed by Simply Wall St

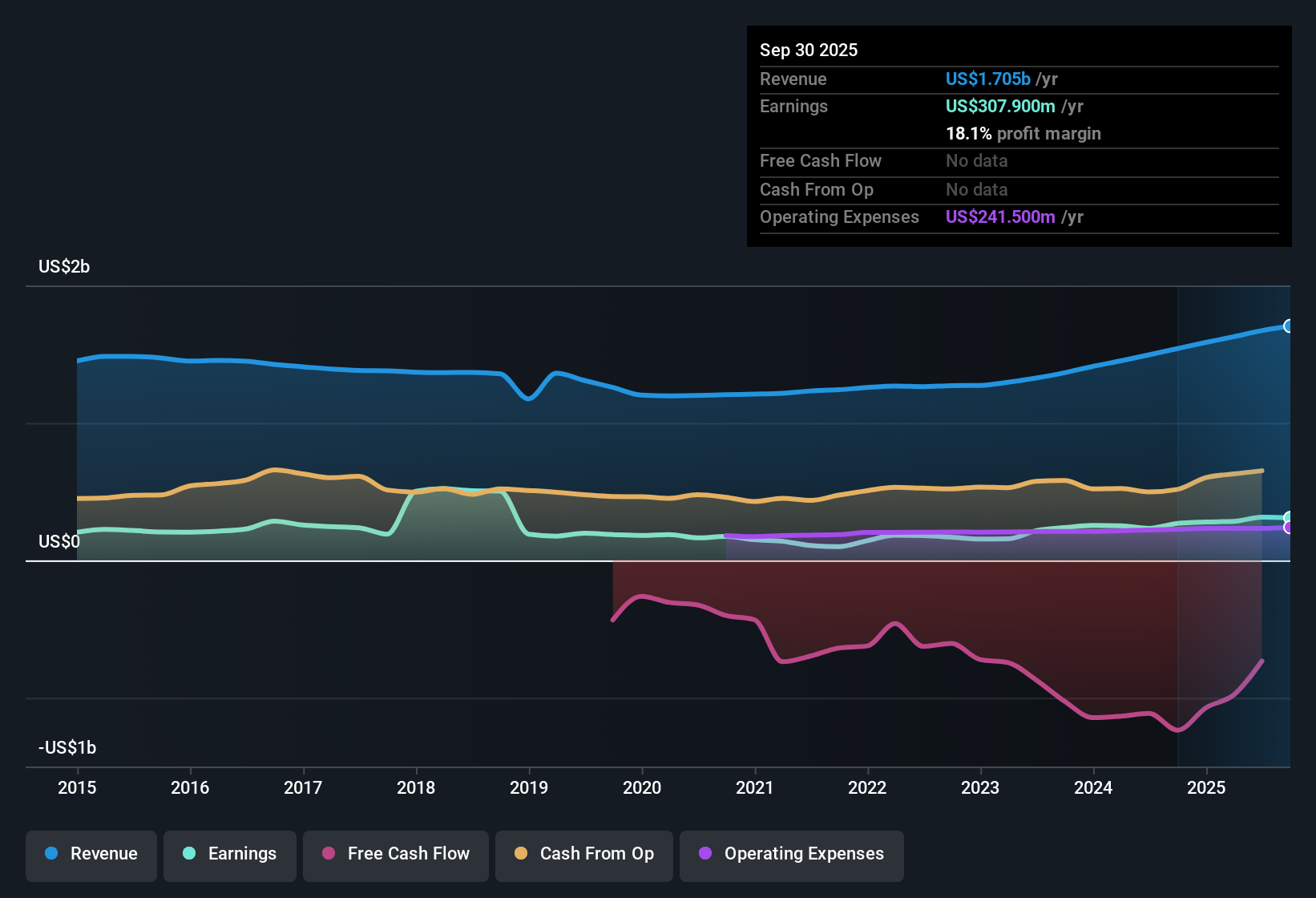

GATX (GATX) reported a net profit margin of 18.1%, edging above last year’s 17.4%. Earnings are forecasted to grow at 11.2% annually, with revenue set for 5.4% yearly growth. These figures trail the broader US market’s projected pace. Recent earnings were also boosted by a one-off gain of $125.0 million. With the company’s share price currently at $163.02, investors face a mix of decelerating growth and solid profitability. This dynamic is likely to shape sentiment as they weigh short-term gains against longer-term sustainability.

See our full analysis for GATX.Next, we will see how these headline figures measure up against the most commonly discussed narratives around GATX and analyze what the results reinforce, as well as where expectations might need a reality check.

See what the community is saying about GATX

Margin Trend Outpaces Peers

- GATX’s net profit margin improved slightly to 18.1%, rising above last year’s 17.4%, while still trailing analyst expectations for industry-leading expansion to 20.5% over the next three years.

- Analysts’ consensus view highlights that this margin momentum results from sustained high fleet utilization and longer lease terms in North America and India, which offset volatile secondary market gains.

- Persistent demand for rail transport and new asset deployments are identified as core drivers behind the margin increase.

- However, reliance on one-off gains, such as the recent $125.0 million positive item, adds unpredictability, limiting the durability of margin improvements over the longer term.

- Consensus narrative notes that ongoing shifts in the rail industry, such as broader supply chain investments and international agreements, are providing GATX with some tailwinds even as profit margins face industry pressures.

See if analysts' expectations on profitability and market momentum truly align with GATX’s results in the Consensus Narrative. 📊 Read the full GATX Consensus Narrative.

Growth Lags Broader Market

- Annual earnings growth is forecast at 11.2% and revenue at 5.4%, both falling short of the US market averages of 15.5% and 10.1% respectively, and indicating a slowdown from the company’s five-year average earnings growth of 18.6%.

- Consensus narrative cautions that while strategic asset deployments and international expansion aim to lift future growth, ongoing delays in Europe and muted lease renewal rates could restrict these ambitions.

- Recent annual growth of 14.5% is already below long-term trends, suggesting GATX may find it challenging to sustain its pace without further catalysts.

- Expected increases in profit margins may be offset if European utilization remains slow and engine portfolio investments do not recover.

Stock Trades Well Above DCF Value

- With a share price of $163.02 and a DCF fair value of $42.82, GATX stock is trading at a premium of nearly 280%, significantly above intrinsic estimates, despite its below-market growth profile.

- Consensus narrative points out that while GATX’s Price-To-Earnings Ratio (18.9x) appears favorable compared to the industry (21.6x) and peers (65.8x), the notable price premium above DCF fair value raises questions about how much optimism is already reflected in the stock.

- Analysts’ average price target is $189.25, indicating only a modest 16% upside from current levels if optimistic projections are realized.

- Consensus views the stock as fairly priced for now, but investors may need to revise expectations if earnings growth remains subdued and one-off gains diminish.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for GATX on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the data? Share your perspective by building a custom narrative in just a few minutes. Do it your way

A great starting point for your GATX research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

GATX’s premium valuation and slowing growth rate, especially compared to market averages, make its future returns less certain for value-focused investors.

If chasing lofty prices isn’t your style, check out these 877 undervalued stocks based on cash flows to find stocks trading well below their intrinsic value and offering greater upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GATX

GATX

Together its subsidiaries, operates as railcar leasing company in the United States, Canada, Mexico, Europe, and India.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives