- United States

- /

- Machinery

- /

- NYSE:FTV

Fortive (FTV): Assessing Valuation After Strong Quarterly Results and Automation-Driven Growth

Reviewed by Simply Wall St

Fortive (FTV) caught investors’ attention after its latest quarterly results, as both revenue and adjusted operating income topped expectations. The company’s focus on automation and connected equipment trends appears to be paying off in the professional tools segment.

See our latest analysis for Fortive.

Fortive’s stock has shown fresh signs of momentum, rallying over 11% in the past 90 days as investors responded positively to its results and renewed focus on automation trends. Despite weaker year-to-date share price returns, the one-year total shareholder return stands at -10.1%. The three-year total shareholder return is up 5.4%, showing the long-term story remains positive even as the company navigates industry shifts.

If you’re weighing what else is making waves beyond the industrial sector, this could be the perfect moment to broaden your approach and discover fast growing stocks with high insider ownership

With Fortive’s share price gaining momentum after a solid quarter, the key question now is whether the stock remains undervalued given its fundamentals or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 4.7% Undervalued

With Fortive’s fair value from the most followed narrative at $56.13 and a last close of $53.48, the company’s share price trades moderately below consensus expectations. This backdrop prompts further debate on whether Fortive’s current valuation reflects true future potential or merely recent headwinds.

The company is positioned to benefit from long-term infrastructure investment, smart city, and industrial automation trends. This is supported by robust demand for building automation, reliability solutions, and advanced measurement tools, which are anticipated to expand Fortive's addressable markets and accelerate revenue growth over the medium to long term.

Ready for the story behind the math? The real drivers of this valuation involve bold margin targets, shifting revenues, and a powerful multiple usually reserved for top-tier growth stocks. Want to see how these projections stack up in the full narrative?

Result: Fair Value of $56.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated exposure to healthcare headwinds and ongoing global trade tensions could undermine near-term revenue and put pressure on Fortive’s earnings visibility.

Find out about the key risks to this Fortive narrative.

Another View: What About Multiples?

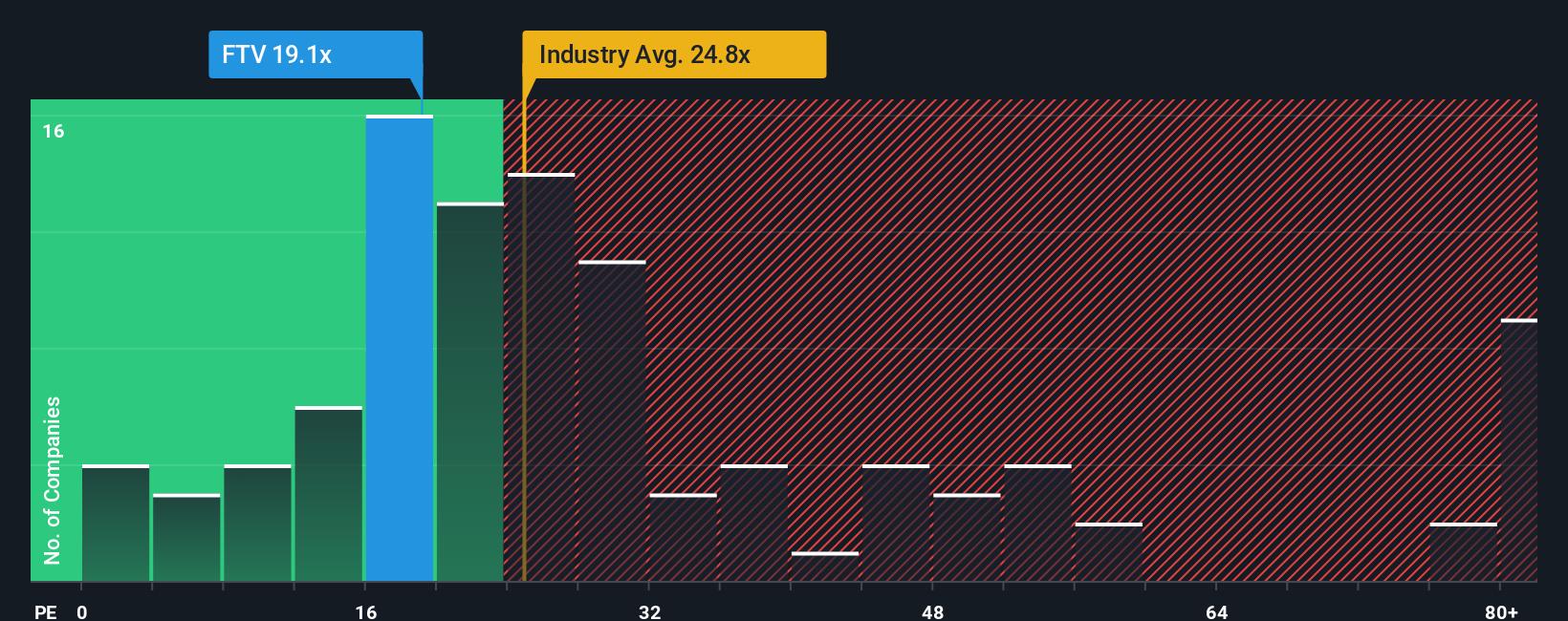

Looking through the lens of the market’s price-to-earnings ratio, Fortive’s stock trades at 19.2 times earnings, which is lower than both the US Machinery industry average at 24.9x and the average of key peers at 25.1x. While this points to relatively good value compared to competitors, the fair ratio estimate is 18.8x, suggesting only a slight margin of safety. As a result, investors face a balancing act between price risk and opportunity if the market realigns with the fair ratio.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortive Narrative

If you have your own ideas on Fortive or would rather dig into the numbers independently, you can put together a custom view in just a few minutes. Do it your way

A great starting point for your Fortive research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take a bold step toward building a smarter portfolio. Don’t miss out on these standout stock picks that could help accelerate your investment strategy today.

- Snap up income opportunities and secure your financial future with these 15 dividend stocks with yields > 3% offering high yields for steady returns beyond the ordinary.

- Catch early-mover advantages in transformational innovations by searching through these 28 quantum computing stocks working on breakthroughs in next-gen computing technologies.

- Tap into market mispricings by targeting these 913 undervalued stocks based on cash flows currently trading below their intrinsic value and primed for a turnaround.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTV

Fortive

Designs, develops, manufactures, and markets products, software, and services in the United States, China, and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026