- United States

- /

- Construction

- /

- NYSE:FLR

Fluor (FLR) Valuation Spotlight: Starboard Stake and Strategic Pivot Spark Fresh Investor Debate

Reviewed by Simply Wall St

Fluor (FLR) shares have grabbed attention after Starboard Value revealed a near 5% stake and signaled plans to advocate for changes intended to boost shareholder value. This news comes as Fluor accelerates its shift toward clean energy and technology markets.

See our latest analysis for Fluor.

Fluor’s share price has jumped 18.6% over the past month, gaining momentum as news of Starboard Value’s activist stake and executive reshuffles made headlines. While there have been some bumps in recent years, reflected in a 1-year total return of -6%, long-term holders have still seen impressive gains, with total shareholder returns exceeding 278% over five years. This recent surge points to renewed optimism about Fluor’s ongoing transformation and growth potential in emerging markets.

If these moves in infrastructure and energy pique your curiosity, it’s a great moment to broaden your search and check out fast growing stocks with high insider ownership.

Yet with activist investors stepping in and the company making bold moves into high-growth markets, is there still hidden value left to unlock in Fluor shares? Or has the market already anticipated what is next?

Most Popular Narrative: 20% Overvalued

While Fluor's most popular narrative stakes the company's fair value at $49.89, recent trading above $50 hints at expectations already baked into the price. Investors now face a battle between transformative growth ambitions and market skepticism.

Fluor's shift from revitalizing the capital structure to focusing on generating cash and earnings under its new strategy could drive earnings growth and improve net margins. The strong backlog and significant new awards in life sciences, infrastructure, and key projects in Urban Solutions are expected to boost future revenue and earnings.

Want to know what’s really powering this bold valuation? The fair value rests on ambitious top-line growth, tighter margins, and a big question mark over profit multiples usually reserved for industry disruptors. Curious where analysts see the next twist in Fluor’s transformation story? Find out which forecasts push this figure sky-high.

Result: Fair Value of $49.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, project delays or unexpected costs in major ventures such as Dow's could quickly challenge analysts’ growth assumptions and shift the outlook for Fluor.

Find out about the key risks to this Fluor narrative.

Another View: Peer Valuation Ratios Tell a Different Story

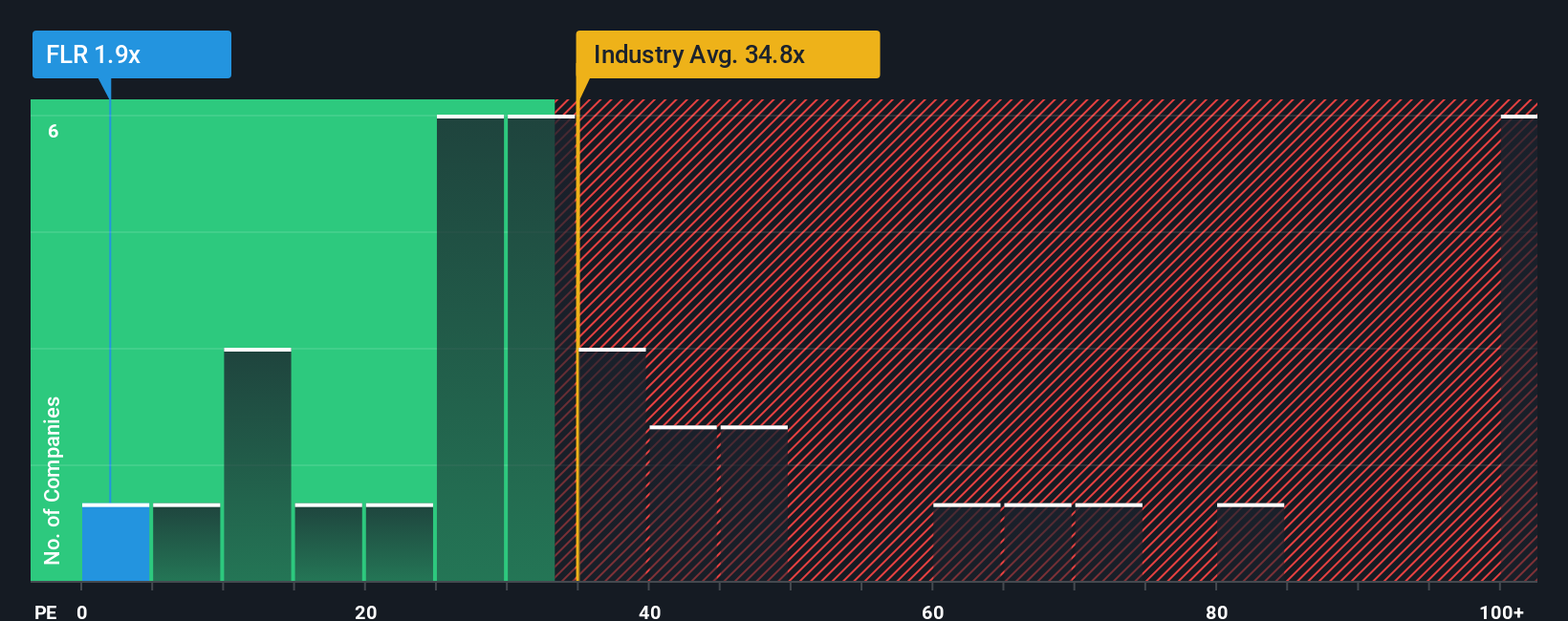

While analysts see Fluor as overvalued based on future earnings forecasts, its current price-to-earnings ratio of just 2x is strikingly lower than the industry average of 34.7x and the peer average of 32.3x. Even the fair ratio for Fluor is estimated at 5.6x. Such a wide gap could signal a hidden opportunity or simply reflect risks that others anticipate. Are investors overlooking real value, or does this low ratio warn of possible trouble ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluor Narrative

If you want to dig deeper or question these conclusions, you can quickly dive into the numbers and craft your own story in just a few minutes. Do it your way

A great starting point for your Fluor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Opportunity doesn’t wait, and neither should you. Expand your investing universe today with these powerful tools, so you never miss the next market winner.

- Start building a passive income stream by checking out these 21 dividend stocks with yields > 3% that consistently offer attractive yields above 3%.

- Catch the next wave in healthcare innovation by investigating these 34 healthcare AI stocks which are poised to transform patient care with groundbreaking AI advances.

- Spot bargains hiding in plain sight and tap into these 867 undervalued stocks based on cash flows which are primed for gains based on their robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives