- United States

- /

- Construction

- /

- NYSE:FLR

Fluor (FLR) Is Down 7.3% After Class Action Lawsuit and $697 Million Q3 Loss—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In the past week, Fluor Corporation became the subject of a class action lawsuit alleging it misrepresented financial risks and cost overruns tied to its infrastructure projects, with claims that financial guidance for FY 2025 was unreliable and the impact of economic uncertainty understated.

- This legal challenge arrives as the company reported a net loss of US$697 million for the third quarter of 2025 and announced new contract wins and share repurchases.

- We’ll look at how the class action lawsuit and recent financial results reshape Fluor’s investment narrative and risk outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Fluor Investment Narrative Recap

To be comfortable as a shareholder in Fluor today, you'd need confidence in the company’s ability to deliver on its backlog and manage large, complex projects profitably, despite recent legal and earnings setbacks. The class action lawsuit, combined with the sizable Q3 net loss, brings short-term uncertainty to the forefront, especially regarding transparency around project costs, making management execution and reliability the most important catalyst and risk right now.

Among recent announcements, the sizable share repurchase program stands out, even as Fluor faces legal action and volatility, this move signals a continued focus on capital allocation and returning value to shareholders, linking directly to the company's push for improved margins and earnings per share as catalysts.

However, while Fluor’s new contracts are promising, investors should also be aware that negative operating cash flow and liquidity pressures could become more pronounced during periods of...

Read the full narrative on Fluor (it's free!)

Fluor's narrative projects $19.6 billion in revenue and $511.6 million in earnings by 2028. This requires 6.2% yearly revenue growth and a decrease in earnings of $3.6 billion from current earnings of $4.1 billion.

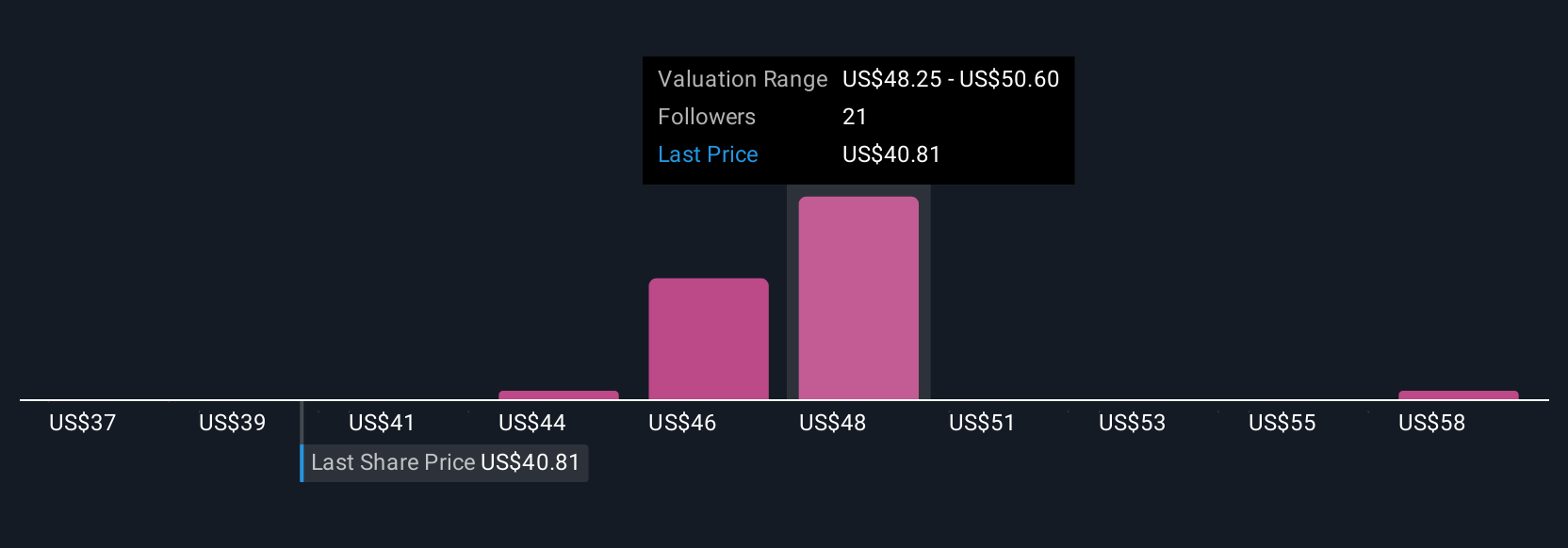

Uncover how Fluor's forecasts yield a $51.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range from US$45.14 to US$65.50 per share, reflecting wide differences in outlook. While opinions vary, ongoing legal challenges could affect profitability and influence sentiment around Fluor’s future performance, so it’s worth considering several perspectives.

Explore 8 other fair value estimates on Fluor - why the stock might be worth just $45.14!

Build Your Own Fluor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fluor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fluor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fluor's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLR

Fluor

Provides engineering, procurement, and construction (EPC); fabrication and modularization; and project management services worldwide.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives